What is a “reversal candle” and how to spot candlestick patterns?

Japanese candlesticks are one of the most popular types of chart displays. They allow traders to assess the situation on the market, conduct an analysis and understand how to proceed.

This is why without the ability to “read” candles it is very difficult to succeed in Forex.

Today, with the support of the dynamic broker NPBFX, we will figure out what a “reversal” candle is and how to detect reversal candlestick patterns on charts.

Reversal candles are those candles after which the market trend reverses in the opposite direction. In order to be sure that a candle is a reversal, you need to make sure that it necessarily follows an upward or downward trend.

At the same time, a single candle itself cannot be a signal of a reversal, since it is not a model. Only after receiving confirmation on the chart can you evaluate the resulting figure as a model and, accordingly, a signal.

Before we look at what reversal candlestick patterns exist in the market, let's look at a specific type of candlestick that is often called an "indecision candle". These Dojis are some of the most visually special types of candles. The fact is that they have disproportionately huge shadows. “Doji” are formed when the opening and closing prices are close to each other (or completely coincident). Dojis can become reversal if there are candles with large bodies nearby.

For example, if the Doji candle is short, but has a long shadow below, we are talking about a bearish play, as a result of which demand has exceeded supply, which may indicate an imminent reversal. If the long shadow is above the short candle, the trend is opposite.

Reversal candlestick patterns

The number of different figures by which the price movement can be determined in the future exceeds several dozen. Therefore, there is no opportunity to cover everything at once in a short period of time. In this article, we will look at several of the most popular combinations that indicate an imminent trend reversal on the chart.

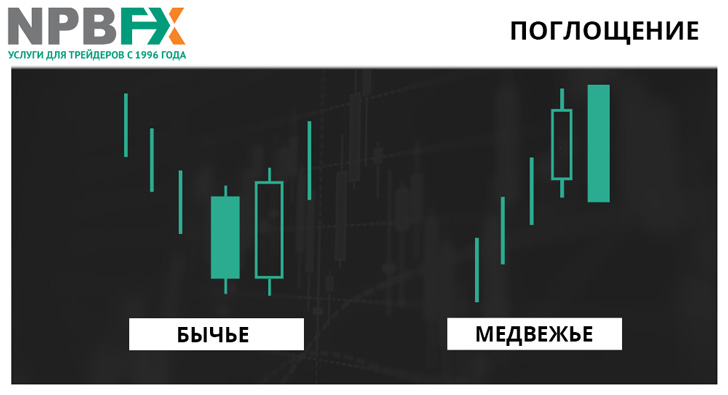

absorption :

- Bullish engulfing is considered one of the most common reversal patterns in the market. It looks like this: first there is a strong decline, the last candle in which is completely covered by the light one. This suggests that the initiative was seized by the bulls, who absorbed the sellers.

Note! When this pattern is formed, the closing price of the final falling candle and the opening price of the rising candle may coincide. But the closing price of the bullish candle will necessarily be at a level higher than the opening price of the falling candle. In an ideal situation, the body of the rising candle covers the range of the bearish one.

- Bearish engulfing. The figure is the opposite of bullish. That is, everything works in a mirror image, arising on a previously growing trend. Otherwise, the rules for forming such a model are absolutely the same.

- Lost baby. Remember how we talked about Doji candles a little higher? This figure is one example in which this type of candle plays the main role. The model itself is very rare, but also has a fairly strong signal. It usually means the end of a trend and occurs most often on fairly high time frames - for example, on the daily one.

On the chart, a so-called gap gap appears behind the bearish candle, after which a doji with a long shadow is formed, and immediately behind it is a bullish candle with an upward gap.

- Harami or "pregnant candle". A candlestick pattern that includes two components. One candle is completely in the range of the first (see picture below), while it is colored in a different color. If the first candle is bearish, then the smaller one is bullish, and vice versa. Typically, such a pattern is formed after a sharp drop and rise on the chart.

Note! A “nested” candle, that is, a candle that is in the range of the previous one, can also be a doji. In this case, the model gets another name - bullish/bearish harami cross .

So what is the point of the model? At some point the market stops, as if it’s procrastinating. Moreover, such a model is quite rare, which is why traders especially value it.

- Hammer/Hanged Man . Candles of this type - having a very small body and a long shadow (it can be upper or lower) - are especially valued by traders. The difference in names is due to a trend. When a bullish pattern is formed, the figure is called a “hammer”; when a bearish pattern is formed, it is called a “hanging man.”

Note! The appearance of such figures in itself only preliminary signals a possible further market reversal. The real signal is the breaking of the maximum - for a hammer, the minimum - for a hanging man.

- A gap in the clouds, a dark veil. A model with relatively low signal strength, but it still deserves traders’ attention. Such models show that forces have temporarily “crossed” to the opposite side of the trend.

In the case of a clearing in the clouds, the combination includes a candle with a long black body and a candle with a long white body that opens below the low of the black candle, closing above its middle. The greater the “penetration” of the second body into the first, the more likely a trend reversal is.

With a dark curtain, a combination of two candles with long bodies is preserved, only the first is white, the second is dark. The black light, opening below the low price of the white candle, closes above its middle. In general, everything is traditionally the other way around.

- Stars . This is the name given to candles that have both a small body and shadows. In this case, they are formed with a gap between the previous and subsequent candles. In order for a reversal pattern to form, it is important to have a strong movement before the “star” appears and to form a candle after it in the opposite direction from the trend. Most often, this pattern is formed at the end of a growing trend.

- Tweezers . The formation of such a pattern involves a double “bounce” from the same level. In this case, the price can bounce back twice during any trend. The model is used on all timeframes, including minute ones.

The presence of a reversal pattern on the chart does not mean a 100% change in trend. It is quite possible that the signal will turn out to be false, so before making trading decisions you should always check them, reinforcing the signal with additional tools. The NPBFX broker has developed a professional Analytical Portal specifically for this purpose. Access to it is free, and there are a lot of useful resources.

Analytical portal NPBFX : confidence in trading decisions

- Accurate trading signals. The portal has a separate section dedicated to trading signals, which are updated every minute, which ensures their maximum relevance. In addition, signals from NPBFX are particularly effective due to the fact that they are built on the basis of a dozen popular and frequently used indicators - this has a positive effect on their accuracy, since one indicator can compensate for another.

- Regular analytical reviews. Comprehensive reviews of individual instruments and the market as a whole are published on the portal regularly, throughout the day on weekdays. Each review contains information that is strictly “to the point” and without fluff, as well as visual charts and trading recommendations. For convenience, a filtering system has been thought out; you can select specific tools, receiving analytics only for them. This section will work well in market analysis together with the economic calendar , which is also available on the portal.

- A selection of trading strategies. Training on the portal is presented in the form of information for novice traders and for more advanced traders with experience. For example, there is a full-fledged collection of more than 60 trading strategies. You can choose something to suit every taste - for example, filter the TS by the specific indicator it uses, or by timeframe.

These are not all the useful features that the NPBFX portal offers. You can learn more about them on the portal itself immediately after registering on the broker’s website. Please note that access is absolutely free, no additional fees are required.

Broker NPBFX : comfortable conditions and deposit insurance

The history of NPBFX is divided into two stages. Banking period - from 1996 to 2016 - when Nefteprombank JSC was a service provider providing clients with access to markets. At this time, a stable base was formed, the basis of which was a high level of reliability and safety. The second stage – from 2016 – began with rebranding, without which further development “in step” with the modern Forex market would have been difficult.

Immediately after the rebranding, NPBFX became a member of the Financial Commission, an independent international body whose task is to resolve controversial issues between the broker and his clients. At the same time, category A membership, which NPBFX has, guarantees insurance of the deposit of each client - by decision of the commission, compensation in the amount of up to 20,000 euros can be paid.

- Access to five markets (over 130 instruments) from one account.

- STP/NDD technology.

- Exiting transactions to the interbank market.

- A variety of accounts: from standard to zero and swap-free.

- Unlimited number of accounts of any type.

- Start trading from $10.

- There are no restrictions on the use of trading strategies. Working with advisors and robots, hedging and locking, and scalping is allowed and encouraged.

- A large number of promotions and bonus offers, an affiliate program with several levels.

- Regular competition on the demo account “Battle of Traders” with monthly drawings of $2500 and the opportunity to win a new iPhone.

You can open an account and start trading using candlestick patterns in just a few minutes: to register, follow the link to the official website of the recommended broker NPBFX.