Volumes in exchange trading and their impact on the trend

Exchange trading volumes play a huge role in trading, helping traders determine trends and interest in a particular asset.

What is exchange volume?

In the market, volume is a measure of how much an asset (currency, stock, commodity) is bought or sold in a given period of time.

Today, there are many indicators that can help you analyze the market situation and determine the strength of the existing trend.

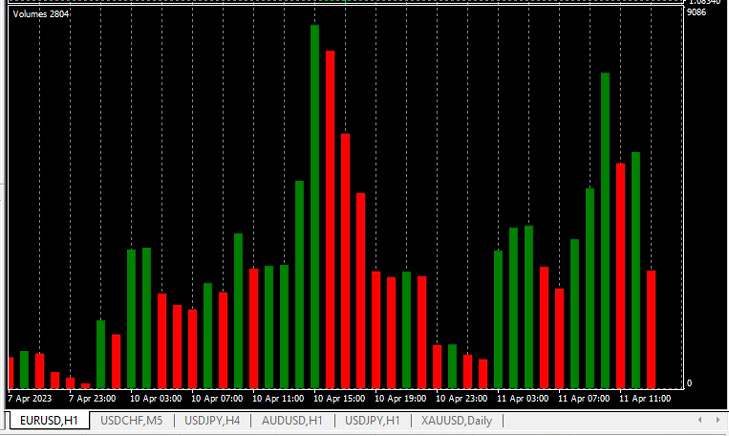

Volume indicators show the total amount of trades executed on the exchange over a specific time period. These scripts are one of the most popular tools on the trading platform.

Traders are used to trusting volumes

In most cases, professional traders participate in stronger movements and do not participate in movements that indicate market weakness; this approach does not always give a 100% result and requires additional entry signals.

In a rapidly rising, bullish market, there will be increasing volume and an influx of money into the market for further trading, pushing the price even higher. However, as soon as volume declines, this will indicate a decline in interest, warning of a high probability of a reversal.

A similar situation can be observed in a bear market, only in this case there is a sharp increase in the number of short trades.

It should be noted that an increase or decrease in price with a small volume is not a strong signal; only an increase or decrease in price combined with an increase in trading volume indicates a new trend.

Using the volume indicator in practice

In practice, volume is typically used to solve problems such as determining trends, price reversals, and confirming price breakouts.

Confirm the new trend

As mentioned above, volume can be a secondary indicator, providing information to confirm price trends, but it does not, by itself, generate trading signals. On charts, you can often see a drop in volume during a strong trend:

Stochastic indicator can also be used for this purpose .

The trading strategy is extremely simple

An increase in volume with a rising price confirms an upward trend; a trade can be opened if the established trend indicators also give buy signals.

When trading volumes decrease, be prepared to close your existing buy position and move your stop loss closer to the current price. Exiting occurs as soon as the price stops rising and begins to decline.

Confirmed trend reversal

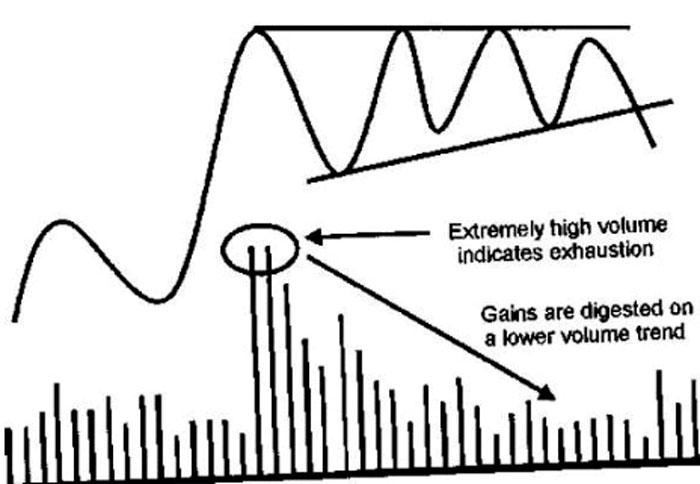

Another property of volume is that when volume peaks, the selling pressure on the market begins to weaken.

In this case, there may be two possible scenarios:

When volume peaks and price growth slows, it can be concluded that buyers are exhausted and the price will soon begin to fall.

Conversely, during a downtrend, when volume is at its maximum and the price stops falling, one should expect a reversal and the beginning of an upward trend soon.

If there is a sharp increase in volume and a price recovery, followed by a drop in volume again, this behavior may indicate a weakening trend.

Confirmation of a breakout through an increase in volumes

There are often important price levels on the chart, which are used to build support and resistance lines , and volume is an important indicator in confirming price breakouts.

If a sharp increase in volume occurs during a breakout, this may serve as confirmation that the breakout is not false. When volume does not increase after breaking through an important price level, this indicates that the price failed to break out of the price range and the breakout is false.

In conclusion, we can conclude that exchange volumes are excellent indicators for confirming a trend, determining the minimum or maximum price, and checking for a breakout level.

By skillfully combining volumes with other trend indicators, it is entirely possible to take the effectiveness of your trades to a new level.

Another advantage of using indicators such as Volumes is their ease of use, which makes them easy to incorporate into your strategies even for novice traders.