Basic reversal patterns.

Reversal patterns are a basic element of graphical analysis; they give signals about an imminent trend change, which makes it possible to close transactions that were opened according to the current trend in a timely manner.

The search for reversal patterns should be preceded by an understanding that the previous trend not only existed, but was also clearly expressed. The first signal that says that the pattern has been detected correctly is a breakthrough of important trend lines.

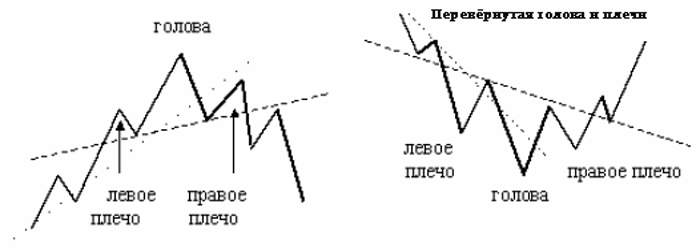

The most famous reversal pattern for a bull trend is called the Head and Shoulders. It is characterized by the presence of two shoulders and one head. An additional check for the correctness of its identification is a comparison of the ideal and real trading volumes.

The appearance of "Head and Shoulders" indicates a turn towards the downward trend.

If we analyze the downward movement on the left side, then there should be an increase in trading volume. If we check the upward movement, then the volume should decrease. Where the head ends, the amount of assets traded (when the price moves up) should be significantly less than during a bearish movement.

It is quite simple to verify the end of the figure in question. This is indicated by the breakdown of the “neck”. This event will indicate that the entire pattern has ended, therefore, a downward trend .

The next figure is the Inverted Head and Shoulders.

It may appear at the bottom of a bear market. If this happens, then we can talk about the beginning of a bullish trend. In general, the same as the previous figure, only exactly the opposite. The “Triple Bottom” (a subsequent price rise is possible) and “Triple Top” (a subsequent price decline is possible) patterns are weaker. They are similar to Head and Shoulders, only here all the movements are in an area limited by 2 parallel lines.

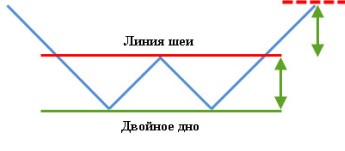

The figures “Double Top” (a reversal of an upward trend is possible) and “Double Bottom” (a reversal of a downward trend is possible) are very similar to them. Only in this case the signal is even weaker.

Advice from experienced traders: if you use reversal patterns to open new trades, then you first need to confirm the correctness of the version you have put forward, and only then make decisions regarding subsequent actions (opening a sell/buy trade, etc.). The easiest way to confirm is to use Forex technical indicators .