Elliott Waves.

Crowd behavior is subject to certain laws and changes according to certain rules. Any freely traded asset is inextricably linked to the will of a large number of people, a kind of crowd. It would be logical to find patterns here as well and try to develop methods for successful trading.

traded asset is inextricably linked to the will of a large number of people, a kind of crowd. It would be logical to find patterns here as well and try to develop methods for successful trading.

This is precisely what accountant Ralph Nelson Elliott did at the beginning of the last century. Studying the bizarre movements of market prices, he concluded that the market, as a product of crowd psychology, has a unique, constantly repeating wave structure. Having established that the wave relationships in this structure obey Fibonacci proportions, Elliott created a subtle and timeless tool for analyzing commodity and financial markets.

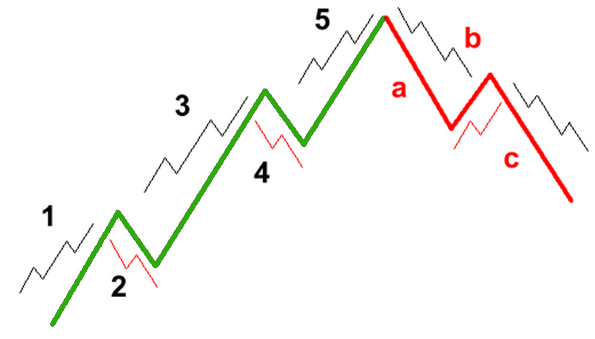

What is the essence of this work? Elliott's basic patterns consist of impulse and corrective waves. An impulse wave has five smaller waves and moves in the same direction as the higher-order trend. A corrective wave ( forex pullback ) contains three subwaves and is directed against the trend. By connecting with each other, these structures form larger formations of the same figures, which, by combining, create even larger specimens... And this process is endless.

Thus, in Elliott Wave Theory, any wave can be considered part of a larger wave, itself dividing into smaller waves. To accurately identify each wave, the theory places particular emphasis on their individual characteristics and construction proportions. However, identifying waves is the main difficulty with wave theory. Individual waves are clearly visible on established charts, but predicting the future is often problematic and requires certain skills.

In its pure form, the Elliott Wave Principle does not claim to be a complete forex trading system ; it is more accurately described as an analytical method for forecasting the currency market. The practical purpose of this method is to identify market reversal moments that are most suitable for trading. The wave concept is particularly well suited for this purpose, as by identifying the first impulse wave, you recognize the trend direction and, by waiting for the second corrective wave to complete, you can successfully enter the market.

Market analysis using Elliott Wave Theory offers the opportunity to understand changes in the psychology of currency traders, identify emerging sentiment, and make the right decisions.

The Elliott Wave Principle lifts the veil on the mysterious mechanism that drives exchange rates and is a powerful tool in a trader's arsenal.