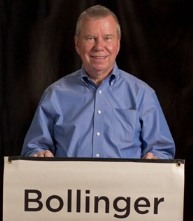

Analyst John Bollinger. The path from cinematographer to financial markets

Every trader associates the name Bollinger with the bands of the same name, which are used in technical analysis.

A multitasking tool that made it possible to solve the problem of interpreting the current trend in conjunction with determining volatility in the market, it became simply an indispensable part of many trading strategies for different categories of traders.

The most interesting thing is that the tool does not lose its relevance to this day and is used by the widest mass of traders.

However, few people know that John Bollinger himself, before entering stock exchange history, was very far from financial markets; moreover, he did not even like mathematics, but preferred art.

John Bollinger was born in France in 1950. From childhood, he showed an unusual interest in art, namely, he was fascinated by photography, paintings, but he had the greatest love for cinematography.

First career

After successfully graduating from the School of Visual Arts, John becomes a sought-after specialist as he received a diploma in lighting photography.

In order to realize himself, John makes one of the most important decisions in his adult life - he moves to Hollywood and begins an active search for work.

His first place of work was the news channel Financial News Network, where he actually began working as a cameraman.

It is worth noting that working at FNN made it possible to find a number of excellent part-time jobs, so John was repeatedly involved in the filming of various TV series and films.

Getting to know the exchange

Even in early childhood, John’s father brought a book by a famous trader, which Bollinger himself tried to get acquainted with, but due to the lack of a certain level of knowledge, he was never able to master it.

Being a successful careerist and having achieved some success as an operator, one fine day his mother asked him to sort out her investment portfolio, which included shares of large companies, the dividends of which were supposed to be an additional source of income in retirement.

At the moment when John dealt with the return on assets, he was able to realize how promising the activity of a stock trader and investor is.

After investments and the stock exchange aroused very high interest in John, he approached the editor of FNN and offered to launch a program where he would act as an analyst. To ensure that John’s words were not unfounded, he was sent to analyst school, where he plunged headlong into technical and fundamental analysis.

The program launched on FNN with John in the leading role of an analyst aroused enormous interest among the audience, and after the channel was bought out and completely reformatted by CNBC, its weekly program was left as one of the most popular and in demand.

Trader career. First development

Working on the TV channel allowed him to expand his huge circle of communication with professionals in the field of developing technical analysis tools, and after purchasing a personal computer, John was able to implement his own ideas and developments.

Actually famous Bollinger Bands were the first indicator invented, and after John was able to prove the effectiveness of his theory and tool in practice, the popularity of the show on CNBC skyrocketed.

Unlike other theorists and analysts, John became a fairly successful practicing trader, and the next step in his growth was the founding of his own hedge fund, Bollinger Capital Management, which was engaged in investments in the stock market, as well as scientific research activities in the field of technical analysis.

Today, John Bollinger continues to host a weekly analytical show on CNBC, and also became the founder of a number of analytical companies, where he holds senior positions.