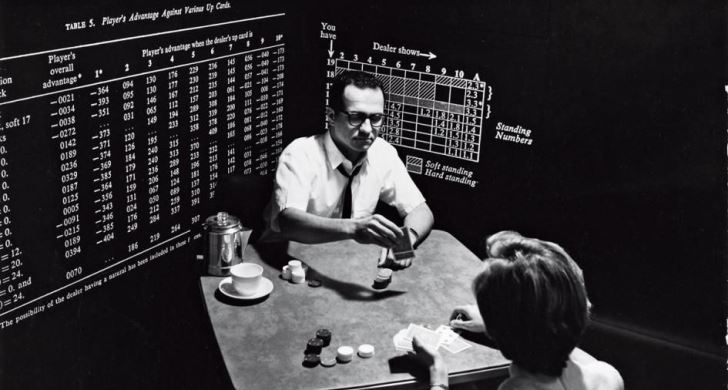

Edward Thorpe, mathematician who managed to beat casinos and the stock exchange

There are many mathematical strategies that allow you to beat the casino or make money on the stock exchange.

But a fairly small number of people can use them effectively. Edward Thorpe is one of those people who not only successfully used mathematical strategies for making money, but was also their direct author.

It is especially famous among players trying to beat the casino. At the same time, Thorpe is quite a legendary person who has managed to prove himself in various fields of activity, and especially in those related to making money.

The result of his work was a capital approaching a billion dollars, while the bulk of the money was earned on stock trading.

In addition, Edward is not only one of the famous traders, but also the author of several quite popular books on the use of mathematical approaches in gambling and one of the first to come up with a portable computer for playing in a casino.

The difficult path to success of Edward Thorpe

The future genius was born in 1932 in a family of immigrants from Sweden, the father worked as a guard, and the mother was engaged in households. His outstanding mathematical abilities were manifested in early childhood.

Thanks to the phenomenal memory and efforts of his father, Edward, by 5 years, learned the basics of mathematics and knew how to perform actions with three -digit numbers in his mind. In addition, he easily managed to memorize large passages of the text.

At that time, there were no specialized schools for gifted children in Chicago, so Torp went to a regular secondary school.

While still a child, he understood that his family would not be able to pay for training at the university and was forced to start making money on his own, declining money received for future studies.

But unfortunately, the work on caring for lawns, cleaning snow and newspapers did not give much earnings and in high school the guy realized that it would not be possible to collect money for college. Then it was decided to go the other way - to become the winner of the city Olympiads in school subjects, which will make it possible to get the right to free education in one of the selected educational institutions.

Stubborn studies gave its results, and Edward took first place at the physics Olympics, and this allowed him to enter the prestigious University of California. There, in order to ensure his accommodation and nutrition, he again had to earn extra money.

Is it impossible to beat the casino?

After receiving his diploma, Edward found himself in a casino for the first time, and surprisingly even won a small amount of money.

That evening, a dispute arose among his friends: “Is it possible to beat the casino?” and he decided to try to test this statement in practice. First, he began with experiments with homemade roulette, and then moved on to card games and settled on Black Jack, a game more familiar to us as 21 or points.

After a series of experiments and trips to the casino, he developed a strategy that consisted of counting the remaining combinations in the deck, or rather their combinations.

After a series of experiments and trips to the casino, he developed a strategy that consisted of counting the remaining combinations in the deck, or rather their combinations.

The strategy gave good results, but was very labor-intensive and required a lot of calculations. For these calculations, Thorpe created a portable computer. The strategy he came up with really allowed him to beat more than one casino and even accumulate a good fortune from it.

The path of the future investor

The casino did not become Edward's only occupation; in addition, he taught mathematics at a number of American universities.

At the age of 32, he became fascinated by stock trading and investment, and began to independently study the theory of finance and the basics of working on the stock exchange.

The result of this passion was the development of a system for trading shares of companies, which used hedging and made it possible to receive up to 25% profit per annum.

Five years after becoming familiar with the exchange, Thorpe and his partner created an investment hedge fund called Convertible Hedge Associates.

The initial capital of the fund was only $1,400,000. After ten years of the fund’s existence, it already managed 28 million, and the average annual profit was close to 18%. Which was a pretty good result at that time, since the fund successfully survived several stock market crashes.

After a scandal in 1987 in which some of the fund's employees were accused of fraud, its activities were suspended.

After a scandal in 1987 in which some of the fund's employees were accused of fraud, its activities were suspended.

And in 1992, Edward Thorpe opened a new fund, which existed for 8 years with an average annual profitability of 21%. After 2002, at the age of 70, Edward retired from fund management and moved into private investment.

Edward Thorpe considers the secret of his success to be a good education and the ability to correctly use existing advantages.

In his opinion, all people have the same chances of success, but not everyone can take advantage of them. You can read more about the strategies invented by the brilliant mathematician in his book - http://time-forex.com/knigi/chelowek-na-wse-rynki