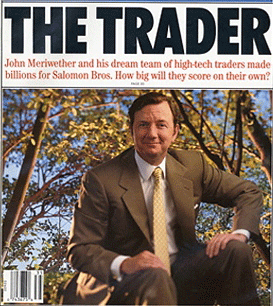

John Meriwether. Fateful Fall

John Meriwether was considered simply a master of hedging risks and building positions on a neutral positioning, making a profit from the so-called spread.

By the way, John Meriwether was one of the largest investors in Russian securities, namely debt bonds, which actually led to his collapse after the world-famous default in 1998.

He managed billions of dollars, and his team included the best mathematicians and economists, which allowed John to remain at the top of Olympus for a very long time.

The initial path of the future Wall Street star

John was born in 1947 in Chicago.

From childhood, John was an unusually capable young man, because no matter what he undertook he could always complete it. So, John was one of the best students in the class, had achievements in golf and loved science very much.

It is worth noting that John Meriwether was a gambler from childhood, which in the future played an important role in his development as a trader.

Drastic changes

John Meriwether was a very ambitious young man, and life on the salary of an ordinary teacher did not suit him at all.

Having received an MBA degree, his range of opportunities has significantly expanded, so he makes a fundamental decision to give up teaching and gets a job at Salomon Brothers.

John Meriwether's career at Salomon Brothers progressed so rapidly that by the age of 30 he was a general manager and head of the hedging department.

The unique approach that John and his team developed was to buy undervalued assets and sell overvalued ones, with a high degree of correlations and the position had minimal risk, but there were high interest rates.

Over the years, John and his team earned more than $100 million for the company, while achieving the highest commissions for himself and his team - 15 percent of the team's profits.

The team and the pursuit of percentage

The 15 percent annual bonus for each trader encouraged some team members to take extremely high-risk freelance trades.

John, having learned about the tricks of some traders, informed his management, however, due to the fact that the information was leaked to the media, journalists simply inflated a huge scandal, the basis of which was manipulation of auctions for treasury bonds.

Public pressure forced Salomon Brothers to get rid of the goose that laid the golden eggs, so John Meriwether and his team were fired.

John Meriwether and the first hedge fund

John took the blow with pride and subsequently created his own fund, Long-Term Capital Management. Meriwether was a very talented manager and organizer, so in a short time the entire progressive team from Salomon Brothers moved to his company.

As at his previous place of work, the strategy of hedging and neutral positioning was taken as a basis, which was constantly improved by the scientists on his team.

Starting in 1994, the fund began to actively trade and in the first year brought a simply phenomenal return of 43 percent, when the risk on operations did not reach five percent.

The high profitability caused very great popularity, and after two years of its activity and stable profitability in the region of 40 percent for three years, it led to the fact that in management

the fund was over 7 billion dollars, and by the beginning of 1998 the amount of assets was 120 billion.

Wake-up call

The company's rapid growth, constant investment and retention of positions led to the fact that the company began to own a twentieth of the world market. John Meriwether actively invested in the Russian economy and purchased debt obligations.

Having accumulated simply huge positions, the unexpected happened - a default in Russia and, as a consequence, a moratorium on payments on debt obligations. This was the first, however, not the strongest blow.

A loss of 300 million is not a problem for a huge company, however, due to low liquidity and falling demand, LTCM could not get rid of unnecessary assets, and its neutral positioning and sudden change in payments on open positions simply ate up investor money.

The end of the Meriwether era

A huge turnover of open positions during the collapse of a company could not only harm investors, but also bring down the entire financial system of the world. To prevent this, the US Federal Reserve System and the largest banks bought 90 percent of LTCM shares and used the proceeds as working capital, which made it possible to maintain open positions and close them with minimal losses.

In 2000, having paid off all creditors and investors, LTCM ceased to exist, and John Meriwether 10 years later opened a new fund with assets of $30 million, which allows it to exist comfortably to this day.