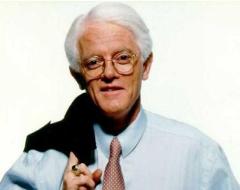

Peter Lynch

Peter Lynch is the manager of one of the largest hedge funds, who, thanks to his unique approach, was able to maintain the fund's profitability for 13 years, and the growth of his assets through stock purchases made his fund the largest in the world.

Peter Lynch is a star in the world of investing, and the books he wrote ( OVERWALL STREET ) reveal all the cards on stock selection and proper investing.

It is also worth noting that Peter Lynch is the cleanest investor who has not been involved in any major scandals with regulators, so there is simply no doubt about his success story.

However, before rising to extraordinary heights, he had to go through a rather difficult school of life, which will be discussed in this article.

Seeing the complexity of life while still a schoolboy, Peter gets a job at a local golf club as a bearer of balls and clubs.

At that time, golf clubs were, and still are, gathering places for the American elite, stock traders and owners of the largest hedge funds. Therefore, from a very young age, the world of shares and the stock exchange was a priority for Lynch. Already at the age of ten, Peter outlined a goal for himself that he was going to go to no matter what.

First experience on the stock exchange

After graduating from school, young Lynch clearly knew that he wanted to major in finance. However, the savings earned from the time he spent carrying clubs were not enough to pay for his education, so Peter decided for the first time to apply the knowledge he had gained from eavesdropping on the conversations of stock exchange players.

Peter believed that air cargo had a huge future, so he decided to buy shares of Flying Tigers Airlines for the first time, which were not only promising, but also inexpensive, namely $7 per share.

When the US war with Vietnam began at that moment, almost all shares fell in price, but precisely because during the war the US had to deliver cargo by air, the company's shares rose to $30. This gradual increase in shares over several years allowed Peter to pay for his education at the University of Pennsylvania.

Career growth.

Upon graduation, Peter decided to join Fidelity as a regular trainee. By the way, 75 people applied for the position of analyst, but Peter reminded the head of the fund that he had carried his clubs for seven years and knew exactly as much about the world of shares as the director of the company himself.

Actually, Peter’s courage bribed the head of the company, so Lynch quickly took up his duties.

Peter had simply enormous acumen, so after three years of work in 1974 he was promoted to director of the research department at Fidelity, and a couple of years later Lynch became head of the Magellan fund, which specialized in stocks.

Having taken over the management of the fund, the head of the company gave clear instructions to reduce the portfolio of shares from 40 different companies to 25, which he has not succeeded to this day. Lynch loved stocks so much that he saw benefits just everywhere and actively purchased various assets against the will of his superiors.

By the way, the number of different companies was so high that Lynch’s colleagues began to tease him that he was trouble-free and was buying everything in a row. However, no matter what anyone says, Lynch actively increased the fund’s profitability, so from an initial capital of 18 million, the fund grew to investments of $14 billion in investor funds.

Features of choosing an investment object.

When choosing stocks, Peter was always guided by logic, not by dry numbers. As his office workers recall, Lynch once brought twenty pairs of tights from different manufacturers and forced his female staff to wear them for two weeks.

At the end of the term, Peter collected all the reviews from the employees and, based on them, purchased shares of the best company and believe me, he was right. Peter always tried to choose companies that had a narrow specialization and that other large investors did not look at.

At the age of 45, Peter Lynch retired, becoming one of the CEOs of Fidelity and devoted himself to charity.