Hedge fund - investment features.

Anyone who has had an account with a foreign bank probably knows how low the interest rates offered on deposits are. On average, it's only 1% per year, and often the amount is even less. Therefore, foreign investors have no choice but to look for alternative investment options.

only 1% per year, and often the amount is even less. Therefore, foreign investors have no choice but to look for alternative investment options.

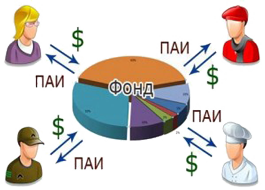

A hedge fund is an investment company that accepts clients' money and invests it in various types of highly profitable assets (stocks, bonds, currencies, precious metals, futures contracts, etc.).

An example of such a fund is Soros Fund Management LLC, founded by George Soros, who until recently actively engaged in stock market speculation and accumulated billions of investors' funds. Someone who has learned to make money on the stock market attracts investors' money to increase working capital, because it makes no difference whether trading millions or billions. The trading strategy remains the same.

The operating scheme of such companies is quite simple:

• The client selects the investment portfolio .

• Deposits money.

• The fund buys or sells assets included in this portfolio and makes a profit from these transactions.

• At the end of the reporting period (month), the client receives the agreed percentage of the profit.

The profitability of a hedge fund usually ranges from 10 to 60 percent per year, which is much more profitable compared to a bank deposit of 1%. But this is mainly abroad, while in our country the situation is completely different.

Studying the offers of companies proudly calling themselves hedge funds on the Russian market, I was unpleasantly surprised, since most of them turned out to be simply financial pyramids.

The main signs of such pyramids are a confusing system that involves building a ladder on which the investor's profit depends, intrusive and aggressive behavior of employees, and sometimes investors like you who want to make you their referral.

Safer at the moment are investment programs offered by well-known brokerage companies such as Alpari or Aforex . Investments are made according to the classic Western model. It's clear that there are some risks involved, but they are usually limited to a decrease in profitability over the reporting period.