Top traders

The world of trading would not be so bright and attractive if it were not for the success stories of hundreds of traders in different parts of the world who were able to earn millions, or even billions of dollars.

It is these idols that show us all that it makes no difference who you were in the past, what kind of family you are from and what connections you have.

Professional education also does not always play a decisive role in making a profit.

And most importantly, there is no ceiling on profitability, because on the stock exchange absolutely everyone can realize themselves to one degree or another.

And the exchange allows you to achieve all this, and real success stories of top traders are the most important confirmation of this.

Top 5 most famous and successful traders in the world.

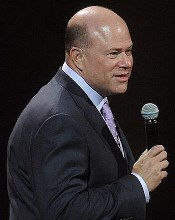

David Tepper

David Tepper is one of the most prominent personalities in the investment world, as he managed to amass a personal fortune of $11 billion through his trading.

This trader was born in 1957 in the most ordinary family of an accountant.

As a child, he showed excellent mathematical abilities, but he was more interested in sports than in studies.

But after school he wanted to become an economist, and for this he entered the University of Pittsburgh. Problems immediately arose with his studies, since he did not have a scholarship.

Therefore, he had to work part-time at various jobs, and in his third year he began his successful scalping with options. By the way, thanks to profits from options, he managed to graduate from university and get an internship at Equibank.

He started from the very bottom, and before founding his fund he rose to the rank of chief executive officer at Goldman Sachs.

He made his billions by buying up debt and shares of companies during the mortgage crisis.

Read more

Nicholas Darvas

The biography of this trader and the story of his success simply cannot but touch the soul of any person who has finally decided to gain financial independence.

The fact is that this now famous millionaire trader was completely far from the stock exchange; moreover, together with his sister, they toured US cities and earned huge fees as dancers.

Everything was turned upside down by a banal accident, because for the first time he was paid for the concert not with real money, but with shares.

Since then, Darvas became so interested in investing in stocks that he began to buy everything he could get his hands on.

Naturally, this approach promised nothing but losses, so after analyzing himself and his actions, Nicholas was able to turn 35 thousand dollars into 2 million.

He conveyed his experience in books, which are also recommended reading for novice traders and investors.

Read more

Warren Buffett is a leader of top traders.

Many people learned about investing not from a textbook, but from numerous publications and television programs about such a famous investor as Warren Buffett.

It was this man who introduced the concept of lifelong investing, when shares of a company were held for decades and sold only on rare occasions.

In addition, Buffett always despised speculators, since he blamed them for the collapse of many companies and the emergence of instability in his own assets.

The most interesting thing is that Warren formed his portfolio only from stocks whose products he personally uses.

However, despite the beautiful stories about buying shares of Coca-Cola and the vest company, he became a real billionaire only after he became almost a monopolist in the US insurance market.

However, this is the man who raised many hedge fund managers, and his investment philosophy teaches you to look a little further than tomorrow.

His fortune is currently estimated at $84 billion.

Read more

Gary Smith

Gary Smith's success story is one of the most atypical, because it would seem that the simple boy he was when he first became interested in the stock exchange showed such a love for easy money that there was no clear discipline necessary for trading. speech.

Since childhood, Gary Smith earned money by deceiving casinos at roulette, finding patterns in the displacement of the reel axis, and also by exchanging and reselling coins to collectors.

However, when he was only 14 years old, he happened to get acquainted with the textbook of Nicholas Darvas, where he, in turn, shared approaches to buying shares.

The book was so impressive that Smith re-read dozens of books and stormed the market, trying to win for 19 years.

Only after 19 years of marking time in one place did he manage to overcome himself and earn his first million.

You can also get acquainted with one of his books - http://time-forex.com/knigi/kak-y-igrau

Mary Erdoes

In the minds of most people, the average trader is a man of about forty in a suit and tie, but not a woman.

But in vain, because women are no less effective in stock trading than men, and the success story of Mary Erdoes is the most striking confirmation of this.

Thanks to her grandmother, Mary was instilled with a love of finance from childhood; moreover, it was thanks to her that she got her first internship at an investment company.

It’s not for nothing that this woman entered the top traders, starting from an ordinary messenger, Mary Erdoes rose to the CEO of such an investment company as JPMorgan Chase & CO.

Today, she manages and controls more than $3 trillion, and she is called one of the most powerful women in the world.