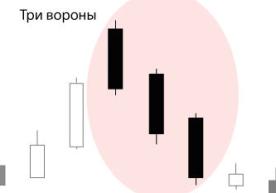

Candles “Three Black Crows”

The Three Black Crows pattern is a set of three descending Japanese candlesticks. This combination is a sign of a strong downtrend and price decline.

This combination is a sign of a strong downtrend and price decline.

Interpretation of the model

The explanation of the model is that after an increasing trend, three black patterns appear; they open at or near the degree of completion of the previous day.

In reality, the model in its classical form is extremely rare, so some deviations from the rules are provided.

The form allows us to understand that this construction shows the start of extraordinary sales that have begun in the market.

Market participants close long positions, and the main trend changes its direction.

If the opening prices of each next candle are lower than the previous one, then the signal grows.

It is clear that after the appearance of this combination, purchase transactions are recommended, since the emerging trend is expected to continue in the future.

It’s even better to enter the market before the candles appear, but in this case you should use other signals, and the candlestick pattern will only serve as confirmation of the correctness of the entry. There are rules for determining the “Three Black Crows” candle:

Three black candles are formed, the prices at the close of which exceed the previous price;

The opening price of each candle is in the middle of the last candle;

Candles have short lower shadows.

Also, this Forex candlestick combination is sometimes referred to as “Three identical crows”. When opening positions, be careful, since after the appearance of the Crow, a correction of 20-30% of the total distance that the trend has traveled during the candlestick pattern often occurs.