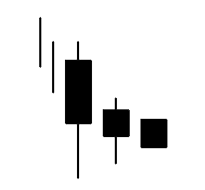

Candlestick combination "Three Southern Stars".

On a candlestick chart, the distance between the opening and closing prices of a time frame is of no small importance.

Acceleration has always been considered a confirmation of an existing trend, while a slowing trend always indicates a weakening trend.

Candlestick patterns often form during such weakening periods, one such pattern being the "Three Southern Stars."

This candlestick pattern consists of three bearish Japanese candlesticks, each smaller than the previous one.

The development scenario is as follows:

In a downtrend, the first candle to appear is a long bearish candle with a long lower shadow, while the upper shadow is absent, which indicates that the price never exceeded the opening price during the formation of the Japanese candle.

The third candle also opens with a price gap against the body of the second candle, it is even smaller and has no shadows at all.

The appearance of this candlestick pattern significantly increases the likelihood of an uptrend; the signal is confirmed if the Three Southern Stars are followed by spinning tops or other patterns indicating an even greater slowdown in the trend.

After this, you can place pending buy orders slightly above the current price.

A narrowing price channel in most cases leads to a trend reversal. By following this principle, you can independently track probable reversal points.