Reversal candlestick combinations

The vast majority of traders never pay attention to candlestick patterns when trading. For them, Japanese candlesticks are nothing more than a representation of the price movement over a certain period of time.

patterns when trading. For them, Japanese candlesticks are nothing more than a representation of the price movement over a certain period of time.

However, more experienced players know that patterns can carry a lot of information about an impending storm, about the weakness of bulls and bears at a certain moment, and, strangely enough, about a possible price reversal.

There are a very large number of candlestick combinations; if my memory serves me right, there are more than thirty of them, and the information on how to use them does not fit even in a two-hundred-page textbook.

However, despite the wide variety of candlestick patterns, no more than ten are actively used by traders, and if we talk about reversal patterns, then if five are in use, that's good.

The fact is, some of them are extremely rare, and recognizing most of them in time proves very difficult for most traders. Therefore, today I'd like to introduce you to the reversal candlestick patterns you see on your chart day after day, but due to ignorance, simply ignore their signals.

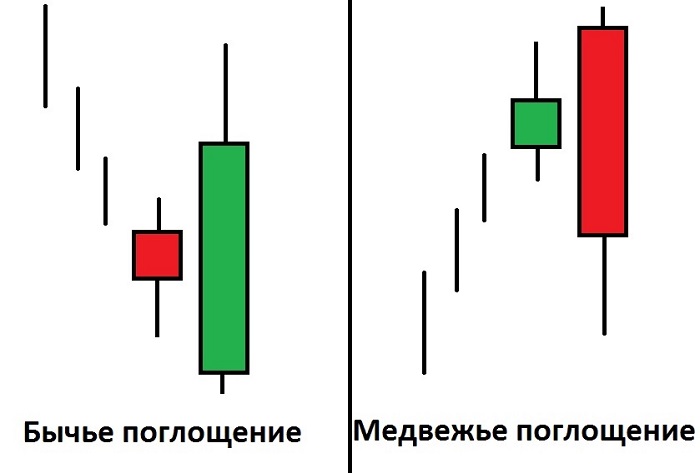

To make it easier to remember the names of candlestick patterns, the Japanese always visualized them with some kind of image. So, behind these seemingly funny names lies a truly sound approach to learning. The most popular reversal pattern, which you encounter every day, is the "Engulfing" pattern.

Its essence lies in the fact that when the price moves in a certain direction, a candle appears that is directed in the opposite direction, and it is of such a size that it seems to absorb the previous one along with its shadows.

There are bullish and bearish engulfing patterns, and the difference between them is the candlestick that engulfs the previous one. In a bullish engulfing, a bearish candlestick is engulfed by a bullish one, and in a bearish engulfing, a bullish candlestick is engulfed by a bearish one. This candlestick reversal pattern is very common and works on any time frame.

Scalpers especially love this reversal combination, as it always serves as a signal for a timely exit or a trend reversal. You can take a closer look at this pattern in the image below:

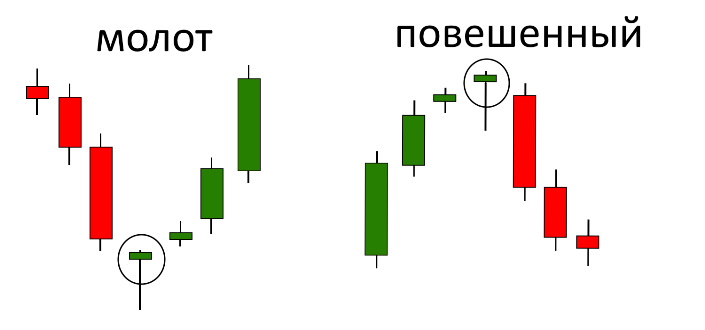

The second, equally common, reversal candlestick pattern is the "Hammer and Hanging Man." The names of these combinations do indeed evoke images; for example, the "Hammer" has a small body and a large lower shadow, with the upper shadow being very small or absent altogether. Therefore, the candlestick resembles a hammer, no matter which way we look at it.

This combination occurs at the peak of a trend and suggests that the trend is currently running out of steam and will soon be recaptured by the opposing side, leading to a trend reversal. The hammer is a very popular pattern and works very well on four-hour and daily charts. It's also noteworthy that the hammer most often appears near support and resistance levels, which may indicate that players simply lack the strength to break through this price level, and the price will roll back to the previous level.

However, after the price pulls back and strengthens, another breakout attempt may occur. Therefore, you should understand that the Hammer indicates an imminent reversal. Whether this is a pullback or a global trend shift, you should focus on fundamental indicators. The difference between a hammer and a hanging man is only in the trend in which it originates.

So, in a bullish trend, a candlestick resembling a hammer is called a hanging man, while in a bearish trend, it's called a hammer. You can see an example of a hammer and a hanging man in the image below:

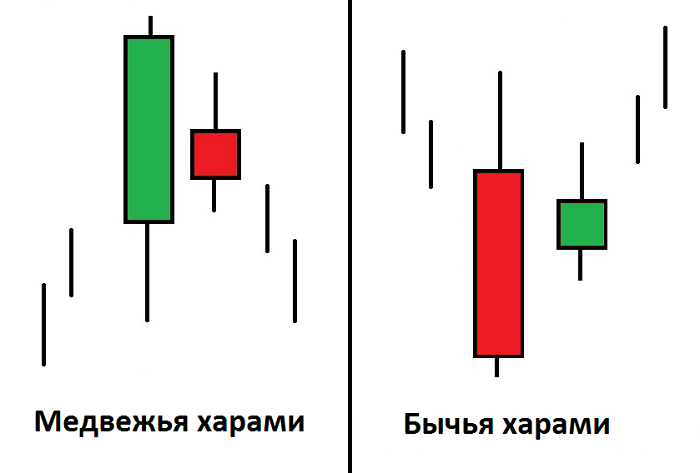

The third candlestick pattern, most often seen at the end of a trend, is the Harami. This interesting Japanese name conceals a surprising Russian translation, which means "Pregnant.".

The pattern consists of two candlesticks, the first of which should be long (either bullish or bearish), and the second one that appears should be in the middle of the previous one, reminiscent of a mother with a child in her womb. Despite this abstraction, the pattern is considered very strong, so when it appears, you should understand that the trend has simply run out of steam and a pullback is about to begin.

Many traders stumble over this pattern, believing it's the ideal entry point for a trend continuation, as it doesn't occur at the peak. However, this is a profound misconception, leading to stop orders being triggered. Remember, when you see a Harami, prepare for the trend to end! You can see an example of a Harami in the image below:

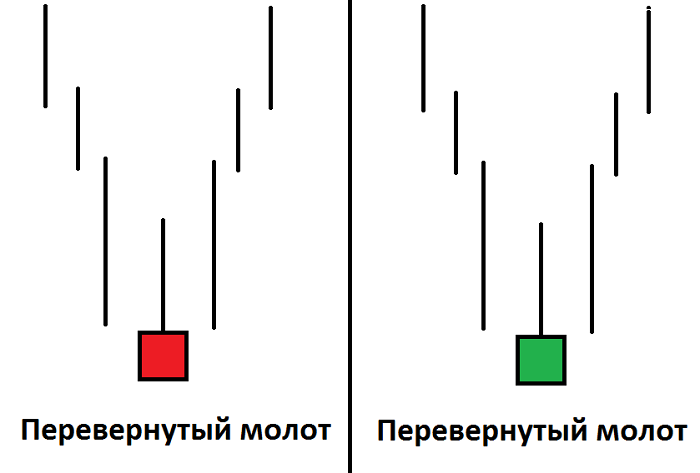

The fourth reversal candlestick pattern you may often see on your charts is the Inverted Hammer. This combination is no different from the Hammer pattern, but the difference is that the shadow points upward instead of downward as in the Hammer. It is considered a strong bullish signal, occurring at the bottom of a bearish trend.

To confidently enter a position, you need to wait for the second candlestick, which should also be bullish. If this doesn't happen, I recommend simply ignoring this signal, considering it unconfirmed. You can see an example of an "Inverted Hammer" in the image below:

Many who have ever encountered information on candlestick patterns have probably wondered, "What about the Doji?" Indeed, the Doji pattern is the most common, but it doesn't show a clear reversal point, as is often assumed. For those unfamiliar, the Doji consists of two or one long shadow, with no actual candlestick body.

The appearance of a Doji may indicate a creeping doubt among the bulls or bears driving the price. However, this doesn't necessarily mean a reversal will occur, as after a brief pause, the movement may resume with renewed vigor. If you're buying or selling and a Doji appears, it's probably the best time to consider your exit point and be prepared for new reversals. You can see an example of the pattern in the image below:

In conclusion, I'd like to point out that reversal candlestick patterns typically occur before news releases or important announcements. Therefore, you'll always be forewarned that a reversal is imminent, unlike the typical trader who enters a position near the end of a trend or exits with a lost profit because an unexpected reversal simply wipes out all their profits.

In conclusion, I'd like to point out that reversal candlestick patterns typically occur before news releases or important announcements. Therefore, you'll always be forewarned that a reversal is imminent, unlike the typical trader who enters a position near the end of a trend or exits with a lost profit because an unexpected reversal simply wipes out all their profits.

Thank you for your attention, and I hope you, too, will actively monitor the price chart and avoid the mistakes many make. Good luck.