Setting up opening orders in metatrader

The most popular trading platform in which most traders open transactions is MetaTrader, version 4 or 5.

Everything in its operation is intuitive, many settings are installed by default and they are quite sufficient for most strategies.

But there are also trading options, the implementation of which requires more fine-tuning, which will make trading more comfortable and efficient.

For example, the same setting for opening new orders slightly expands the standard settings.

When setting up orders, you can set parameters such as one-click trading, the volume of opened transactions, the asset for which the position will be opened, the size of the deviation, etc.

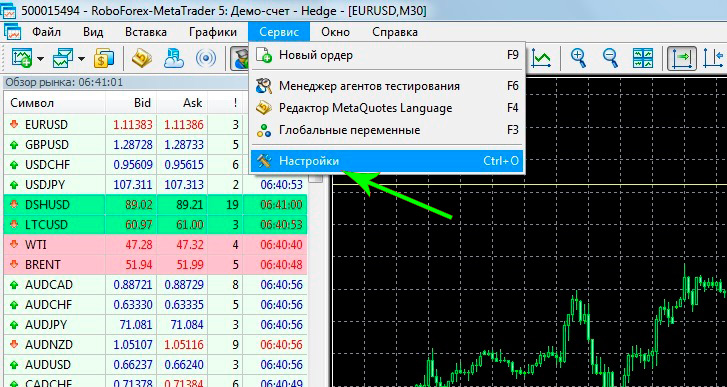

Then in the window that opens, select the “trade” tab, where you will see everything that can be changed.

Then in the window that opens, select the “trade” tab, where you will see everything that can be changed.

There is nothing complicated in the settings themselves, but in order to save your time, I will tell you in a nutshell about customizable indicators:

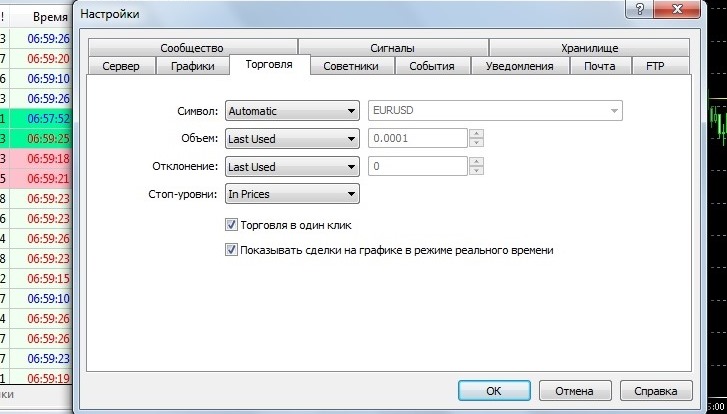

And now let’s take a closer look at what you see in the picture above:

And now let’s take a closer look at what you see in the picture above:

Symbol – we select the asset that will be traded, here we are offered three options:

Automatically (automatik) – that is, the asset whose chart you have open right now.

Last used – the currency pair for which the previous order was opened.

By default – you need to select which asset will be specified in the new order by default.

Volume – allows you to set the volume of new transactions.

There are only two options - the specified volume or the last used one. Deviation is a parameter that is designed to combat requotes when the trend moves quickly.

By indicating the size of the deviation, you agree to open an order even if the price does not correspond to the one at which you opened the position. For example, you open an order to buy euros for dollars at a price of 1.11500, and while the order reached the server the price became 1.11505 and you received a refusal.

By default, we set the size of the deviation to which we agree in points, preferably no more than a few dozen.

The last one used is if we want orders to be opened only at the price that we saw when opening.

Stop levels are a rather interesting opportunity to choose how your stop loss and take profit .

In points or in the price of the asset. One-click trading – permission to close orders in one click.

We put a bird on Allow, we remove it from Deny. Show trades on the chart in real time – if you check this box, your orders will be displayed on the chart in the form of arrows.

Fine-tuning is especially useful when trading strategies that require quick action, such as scalping and pipsing .

Setting parameters in advance saves valuable time and increases trading efficiency.