Automatic calculation of trading parameters

This is not the first time I have talked on my blog about various tools that help make trading more comfortable.

Today we will talk about such an important thing as planning trade transactions in stock trading.

It can be quite difficult for a novice trader to determine the volume of upcoming transactions and establish the level of risk and profitability for future positions.

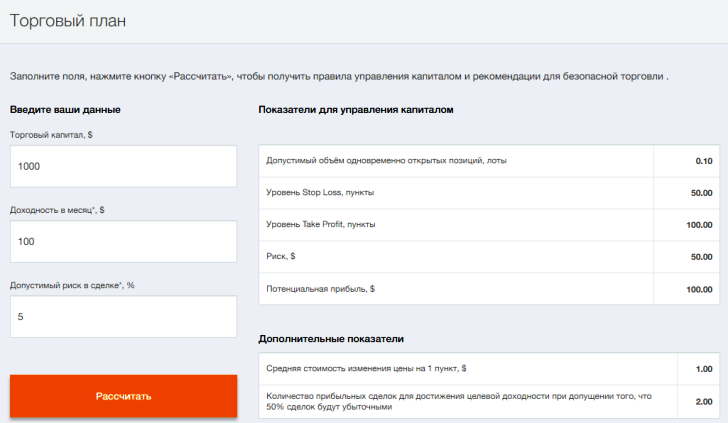

In order to calculate all the necessary parameters of transactions, taking into account the desired profit and acceptable risk, the “Trading Plan” tool was invented.

It is clear that one should not expect anything supernatural from such a simple instrument, but still the data obtained can serve as a kind of guideline when starting trading.

It is clear that one should not expect anything supernatural from such a simple instrument, but still the data obtained can serve as a kind of guideline when starting trading.

For example, in our case it is clear that if you do not want to risk more than 5% of the deposit, then with a capital of $1000, the maximum volume of all open orders should not exceed 0.1 lot. Most likely, it is assumed that the calculation base is the EUR/USD currency pair, since the size of 1 point with such a volume is 1 dollar.

The approximate sizes of stop loss and take profit orders are also determined, which you can focus on by setting these stops taking into account the market situation.

Options for setting stop orders - https://time-forex.com/praktika/kak-vystavit-stop-loss

The trading plan calculation tool can be used online and absolutely free of charge, after registering with the Amarkets broker in the trader’s account. There you will also find many more useful tools and free advisors for automated trading.