Setting up 3 screens in the MT4 platform

Trading according to the well-known strategy of the American trader of Soviet origin, Alexander Elder, involves the simultaneous use of 3 charts with different time periods of the same asset.

According to the strategy developer, working with multiple timeframes allows you to effectively filter false signals for opening trading positions.

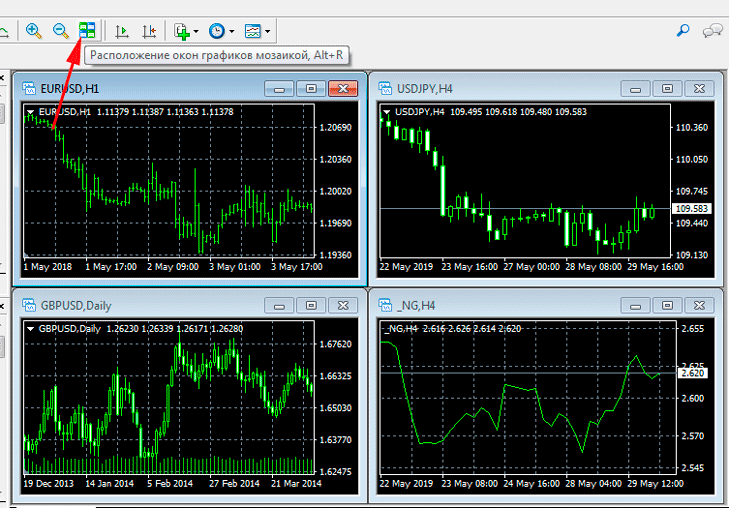

For a comfortable visual perception of charts, it is recommended to configure the platform in such a way that all 3 timeframes are displayed in one terminal window.

However, many novice traders have difficulty setting up charts, although there are many options for how to do this simply and quickly.

How to add three charts for one currency?

After this, all currently open charts will be displayed in the terminal window at once. It is important to close all windows that do not display the pricing dynamics of the desired instrument.

After this, all currently open charts will be displayed in the terminal window at once. It is important to close all windows that do not display the pricing dynamics of the desired instrument. For example, if the EUR/USD pair is being analyzed, then the charts of other assets should be closed.

Next, you will need to open 2 more charts of the desired currency pair by selecting EUR/USD in the “Market Watch” window and right-clicking, then select the chart window from the submenu.

After the graphs appear, you should adjust their size by setting the following parameters:

• Timeframe;

• Display type – Japanese candlesticks;

• Transfer to the chart the indicators needed for analytical work.

The result should look something like this:

Please note that for comfortable work, traders recommend displaying charts in ascending time period from left to right.

Please note that for comfortable work, traders recommend displaying charts in ascending time period from left to right.

The logic of such a filter is obvious: entry into the market is carried out only if the indicator signal is confirmed on all 3 timeframes.

Important! Using Alexander Elder's 3-screen method, it is possible to significantly improve trading results even when working with chart or candlestick patterns.

To stretch the schedule to the full screen, just click the corresponding button.

Experienced traders use the 3 screens of A. Elder with the integrated use of several trading systems. In addition, this arrangement of graphs makes it possible to analyze several financial instruments at once.

This is especially true when opening medium -term and long -term trade positions based on fundamental analysis . The 3 screens method also allows us to evaluate the market reaction to the publication of economic news.

An alternative may be the use of three monitors or three simultaneously launched trading terminals, but this is a more difficult solution to the task.

Three screens strategy- //time-forex.com/strategi/strategiya-tri-ecrana-eldra step-by-step description with recommendations

The three screen indicator - http://time-forex.com/indikators/tri-ekrana allows you to do everything automatically, the best assistant in this strategy.