How to write an advisor for metatrader 4

The dynamic development of the market and constant computer progress simply forces the trader to keep up with the times. If earlier writing advisors for your trading strategy was considered as a trader’s whim to make his life easier, now it is more of a necessary measure in order to be competitive in a given market.

with the times. If earlier writing advisors for your trading strategy was considered as a trader’s whim to make his life easier, now it is more of a necessary measure in order to be competitive in a given market.

Yes, precisely competitive, because it was robots that completely flooded the exchange, and if earlier pipsing and scalping strategies were easy to apply manually, now it is quite difficult to remain effective against the backdrop of high-speed robots.

Therefore, sooner or later, each of us asks ourselves a completely logical question: “How to write an advisor for MetaTrader 4?”

In order to write an advisor for MetaTrader 4 or any other platform, you must first of all have knowledge of programming, and as our practice shows, each platform has its own language, which can be easily learned from the textbook for this program.

Negligent brokers and advisor protection.

Recently, the industry for providing brokerage services has expanded greatly and every day we see the emergence of more and more different brokers. Dealing centers and their subsidiaries also began to actively develop.

the emergence of more and more different brokers. Dealing centers and their subsidiaries also began to actively develop.

The emergence of such competition in this area has given traders maximum deposit bonuses, promotions and all sorts of delights without which it is very difficult to imagine trading. What is it worth to provide leverage of 1 to 1000, when a couple of years ago it was difficult to get 1 to 500.

The number of bonuses and advantages of some brokers over others can make your head spin. However, among all the advantages that came with the development of this area, it is worth noting that the number of dishonest brokers has also increased significantly.

Which account to choose for Forex.

Typically, the beginning of Forex trading is characterized by the choice of a broker; novice traders devote a lot of time and effort to this issue, but an equally important point is the choice of account option.

effort to this issue, but an equally important point is the choice of account option.

In practice, there are about ten options for trader accounts, each of which is designed to solve specific problems.

The choice is made immediately, but there may be several accounts, so it’s not scary if you make a mistake at first. The size of the spread and the requirements for the minimum deposit that must be made to start trading depend on the type of account.

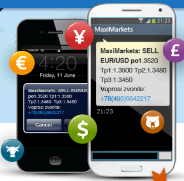

Free Forex Signals

Not everyone manages to understand by what principles the exchange rate on the Forex market moves, but this is not at all a reason to despair; free signals for opening positions will come to your aid.

free signals for opening positions will come to your aid.

Forex signals are a message that contains recommendations that indicate the time of the transaction, currency pair, direction and some other parameters, such as completion time and size of stop orders.

There are several options for how to receive such recommendations completely or relatively free of charge (you need to top up your account with a broker), we will talk about them further.

Forex trading without indicators.

It turns out that you can trade Forex without using technical analysis indicators, which novice traders often don’t like.

The main reason for this dislike is that most indicators deliver their signals with some delay, which causes trouble when trading on short time periods.

In addition, most scripts require additional configuration and optimization, which a Forex beginner cannot always cope with.

But, fortunately, there are a lot of options when you can trade without using indicators. 1. Based on candlestick analysis, Japanese candlesticks signal a continuation of the trend or an upcoming reversal. There are about a hundred candlestick combinations that can be used to determine the market mood.

Promotions carried out by brokers.

In modern conditions, when working on the stock exchange, there are many ways to increase the profit you receive; you just need to monitor the promotions that your broker carries out, and sometimes, when particularly profitable offers appear, you can change the broker.

need to monitor the promotions that your broker carries out, and sometimes, when particularly profitable offers appear, you can change the broker.

Some traders do not want to get involved with bonus programs, but promotions are not always bonuses; there are other safer and more profitable offers.

Let's look at what Forex brokerage companies offer today in order to attract clients:

Where to get money on Forex.

Most beginners who dream of becoming a trader think that in stock trading the main thing is to find a certain amount of money, and the larger it is, the faster the path to wealth will be.

a certain amount of money, and the larger it is, the faster the path to wealth will be.

This statement is not too far from the truth, so initial capital in Forex is one of the components of successful trading.

The larger its size, the less risky trading option you can use to make a profit. Therefore, the question immediately arises - where to get money for Forex trading? And most importantly, how much is needed for tangible earnings.

The smallest spread, brokers and currency pairs

The size of the spread plays a huge role when trading using high leverage; many scalpers have to pay amounts several times higher than their own deposit.

several times higher than their own deposit.

The size of the spread is influenced by three factors - the trading instrument (currency pair), the broker you trade with, the type of account and the time of trading.

Each of these points can increase a small spread to huge sizes, which will negatively affect the financial result of your transaction.

And now everything is in order:

Who should not trade Forex.

There is a category of people who should not even start trading on the currency exchange; the result of their attempts is quite predictable - loss of money and another disappointment.

money and another disappointment.

Typically, such applicants for the profession of a trader are united by a number of common qualities that will interfere with achieving success.

So, what qualities can prevent you from becoming a trader and lead to loss of money?

• Greed - remember how often you lend money or treat someone at your own expense, how much you love money and how difficult it is for you to part with your own money.

If you recognize yourself as a greedy person for profit, it is better for you to refuse to play on the stock exchange, since it is this quality of character that will force you to take excessive risks, which always leads to losses.

Forex account replenishment.

It would seem that such a simple moment as replenishing an account when trading forex sometimes raises a lot of questions for novice traders, but in reality, if you do not take into account some of the nuances of this process, you may encounter certain difficulties.

but in reality, if you do not take into account some of the nuances of this process, you may encounter certain difficulties.

Go to the website of any broker and compare the number of payment systems with which you can top up your account and the number through which you can withdraw funds.

The latter are usually at least two times smaller; the situation that has arisen is explained quite easily - by purely technical issues.

Forex deposit interest.

Most Forex traders do not pay attention to such a trifle as interest on a deposit, or rather interest on free funds not used in transactions on the foreign exchange market.

free funds not used in transactions on the foreign exchange market.

Almost all brokers offer their clients a similar bonus, and the amount of accruals is an order of magnitude higher than in banks; usually the interest rate ranges from 10 to 15% per annum, depending on the broker.

Yes, for those who trade scalping, this amount of earnings may seem ridiculous, but there are a lot of other strategies that bring only a couple of percent per month, and additional charges will allow you to increase your earnings quite significantly.

There is one truth in this matter, but, as a rule, you cannot simply deposit money into a trader’s account and receive interest; a prerequisite is the execution of transactions. That is, you must open at least a couple of orders per month.

Pros and cons of a demo account

Free Forex demo accounts are a tool that some people love and others hate. Why is this happening? How can a training account be harmful?

Why is this happening? How can a training account be harmful?

Of course, a demo account has its advantages, but there are also pitfalls that can negatively affect future trading.

Let's look at demo accounts from different angles. A demo account allows you to practice playing Forex for free.

For beginners this is just a godsend. And experienced investors use it to test their new methods and systems.

Signals for a trend reversal.

Most traders suffer losses and lose profits due to a trend reversal, so one of the main tasks in Forex is the timely detection of this very reversal.

Forex is the timely detection of this very reversal.

There is no need to explain what a change in trend is fraught with, it is, at a minimum, triggering a stop loss or trailing stop, and at worst, draining the deposit.

There are several options for receiving trend reversal signals:

Risk of choosing a broker

There are a lot of recommendations on the Internet on how to choose the right broker for Forex trading, but they all mainly come down to an overview of trading conditions and the quality of dealing services.

trading conditions and the quality of dealing services.

In fact, there is a very real way to distinguish a broker from the so-called kitchen, working against its clients.

Everything is quite simple, the verification will only take you a couple of minutes, but after that you will know exactly who you are dealing with and how high the risk of losing your deposit is by type of brokerage company.

Leverage risk.

Lately, brokers have been increasing the maximum leverage more and more; for some companies it has already reached a ratio of 1:2000.

a ratio of 1:2000.

It would seem that this is only to the benefit of the trader, top up your account with $100 and trade with a volume of 200,000 and only manage to take the profit.

But in practice the situation does not work out quite as expected. A trend rarely moves in one direction for more than 15-20 points; even on short time frames there are constant fluctuations in the opposite direction. What do they mean for a trader using large leverage?

Dealing center for a beginner.

Choosing the first DC is quite important when starting Forex trading. What basic properties and characteristics should a brokerage company have in order to meet all the requirements of a novice trader?

should a brokerage company have in order to meet all the requirements of a novice trader?

It turns out there are quite a few such requirements, and some of them are quite specific and not so important for an already experienced professional.

Below I will not only list the necessary characteristics, but also give examples of some suitable DCs.

No losses on Forex.

The Forex market is perceived as one of the riskiest trading platforms, a reputation it has earned due to the large number of traders suffering losses.

number of traders suffering losses.

It is simply not realistic to trade completely without losses, but you cannot allow their amount to exceed profits; the result of such trading will always be a complete loss of your deposit.

You should try to minimize possible losses and minimize the likelihood of losing your deposit; this is not as difficult as it seems at first glance.

How to overcome emotions in Forex.

The reasons for the biggest failures in stock trading are emotions that provoke rash actions.

At first glance, it seems that it is not possible to completely eliminate emotions when trading, but in fact this is not the case; if you wish, you can significantly reduce the influence of the emotional component on decision-making.

There are several ways to do this - pending orders, stop orders, automatic trading methods or binary options trading.

How to make money on Forex with a small deposit.

Trading on any of the exchanges requires quite a substantial amount of capital, but you can try to make money without having a substantial amount at your disposal.

having a substantial amount at your disposal.

Of course, we are not talking about a couple of dollars, we are talking about a deposit of several hundred. Beginners are usually interested in the question – How to make money on Forex with a small deposit?

To be completely frank, you can answer it this way: to make money, no, but to win, yes. That is, everything will depend on many factors that are quite difficult to calculate and take into account.

To make money with a small deposit you will need to use a solid leverage , usually its size in this case is from 1:100 or more.

Also, you will not be able to use most of the popular trading strategies, because the open position will have weak support.

How not to lose money on Forex.

The stories of losses on the Forex exchange are mainly similar as two drops of water, so there are a lot of standard recommendations on how to reduce the likelihood of critical losses.

standard recommendations on how to reduce the likelihood of critical losses.

Following several, not difficult rules, you will be almost one hundred percent insured from the drain of the deposit and large drawdowns.

In fact, this is a whole range of measures, including trading recommendations, capital management and risk insurance.

The reason for the flow of money on Forex usually becomes - technical malfunctions of trading equipment, incorrect distribution of capital, lack of stops and attempts to earn a lot at once. Based on this, the main components of the anti -loss complex are:

Forex by day of the week.

When working on the currency exchange, you should know not only how to trade, but also when, because trading differs significantly depending on the day of the week when it is carried out.

differs significantly depending on the day of the week when it is carried out.

An incorrectly chosen time to enter the market can result in a lost deposit, and even a stop loss will not help prevent troubles.

Forex by day of the week allows you to make the right decision regarding the duration of the transaction and its other parameters, and so when you should trade and when it is better to refrain from opening new positions.

Auxiliary Forex tools.

Trading on any of the exchanges is quite a complex task, so why not make it a little easier by using various Forex tools for these purposes.

easier by using various Forex tools for these purposes.

Forex tools are special programs, scripts, informers, techniques and other ways to obtain additional information that will increase the chances of success.

Technical analysis indicators - there is rarely a trader who does not use this tool; it is the indicators that allow for more effective analysis of the Forex market. There are several groups of indicators, some study the trend, others construct lines and levels, and others assess the state of the market.

Trading the ruble on Forex.

Recently, the use of the Russian ruble as one of the currencies in the foreign exchange quotation has become increasingly popular.

the Russian ruble as one of the currencies in the foreign exchange quotation has become increasingly popular.

The ruble is used in Forex in combination with the US dollar or euro; these two currency pairs allow you to make good money, despite the rather small size of the spread.

The main advantages of working with the ruble are the availability of fundamental data (economic and financial news, analyst reviews), high volatility, and ease of exchange rate forecasting.

How to choose the best dealing center (DC) for Forex.

Making money on Forex is not easy, so choosing a dealing center becomes even more important. In my practice, I have had to work with quite a large number of DCs and it is very disappointing when a broker, for some reason, tries to cut profits or refuses to give them away at all. In this article I will tell you how to

In my practice, I have had to work with quite a large number of DCs and it is very disappointing when a broker, for some reason, tries to cut profits or refuses to give them away at all. In this article I will tell you how to

avoid such annoying misunderstandings and save your profits, and with it your nerves , spent on proceedings.

Moreover, trade conditions and other advantages play not the first role in this matter. Let's return to the question - How to choose a dealing center for Forex trading.

The main selection criteria are the following indicators:

Currency trading rules for a beginner.

Statistics show that no more than 15% of all participants in this free financial market receive stable profits on retail Forex.

this free financial market receive stable profits on retail Forex.

And yet some currency traders earn more than a million dollars a year. In this regard, the appropriate question is: “What do these “some” lucky people know and do so special?”

Nothing special. They just strictly follow the set of internal trading rules. Moreover, they observe it not from time to time, but constantly, that is, every minute they spend behind the display of their own trading system. Below are some rules from this code. It makes sense for novice traders to adhere to them, which will allow them to develop their own trading settings over time.

How a beginner can make money on Forex.

I would like to immediately upset novice traders; it is almost impossible for a beginner to make money on Forex. To be more precise, “earn money consistently.”

To be more precise, “earn money consistently.”

It is quite possible to make a profit from one or two transactions, but it is quite difficult for such success to become the rule. Usually everything happens according to the standard scheme: you earn a couple of points on profitable trades and lose everything on one unsuccessful one.

How can a beginner make money on Forex? – there is no standard recipe, but there are a couple of nuances that will allow you to save your money.

Which does not matter when trading forex.

Any newbie who has opened an account and installed a trader’s trading terminal is concerned with the question of what is most important when trading Forex.

most important when trading Forex.

There are quite a few important points, but they all have different effects on trading performance. And sometimes the parameters that are called basic are not at all important when using certain strategies or trading options.

So what and in what situations can you ignore when trading Forex?

Why do you need a Cent Account and its main differences?

For the last two or three years, you have literally come across advertisements for Forex trading; on the Internet there are a lot of offers to open an account and start trading on Forex with a deposit of “only” $300-500, and this is offered to novice traders, who in 99% will lose their first deposit.

a lot of offers to open an account and start trading on Forex with a deposit of “only” $300-500, and this is offered to novice traders, who in 99% will lose their first deposit.

If you want to try your hand at trading on the currency exchange, it is better to open a cent account; you can trade on it with just a few dollars, the loss of which will not cause much damage to your budget.

A cent account is used for the following purposes: training in real trading, testing Forex strategies, checking the operation of indicators and trading advisors, and rarely for making money.

Forex trading for beginners.

Many people have heard about huge earnings on the Forex market, but they have absolutely no idea how to start independent trading. At first glance, it seems to a beginner that everything is so complicated that it is simply impossible to figure it out, but this is only at first glance, in reality, in order to start trading you will only need one day, but in order to earn much more. These two questions will be discussed in this article.

they have absolutely no idea how to start independent trading. At first glance, it seems to a beginner that everything is so complicated that it is simply impossible to figure it out, but this is only at first glance, in reality, in order to start trading you will only need one day, but in order to earn much more. These two questions will be discussed in this article.

Forex trading for beginners is divided into two stages - preparatory and trading itself. If the first steps usually do not raise questions, then in the second part there are a lot of them.

Which broker to choose, recommendations and error analysis.

Mistakes made when choosing a Forex broker are usually very costly for any of the traders; in addition to the fact that you can simply lose some money as a result of an order that doesn’t work, there is also a high probability of completely losing your entire deposit.

the traders; in addition to the fact that you can simply lose some money as a result of an order that doesn’t work, there is also a high probability of completely losing your entire deposit.

Which broker should you choose to insure yourself against such troubles?

This is one of the main questions that any trader faces. At the same time, there are a lot of nuances that are not always paid attention to, but they may indicate the reliability of the dealing center, or, on the contrary, characterize it from the best side. What should you pay attention to when studying the contract and trading conditions?

When to close positions in Forex.

There are a lot of methods based on which positions are closed on Forex, but as a rule, this action is based on two reasons - achieving the required level of profitability and exceeding the limit losses.

this action is based on two reasons - achieving the required level of profitability and exceeding the limit losses.

As a result, closing positions on Forex occurs as a result of triggering stop orders (take profit, stop loss, trailing stop), or manually at the trader’s decision.

It has been said more than once about how to close unprofitable positions, so we will only dwell briefly on this point, clarifying the main points.

Closing unprofitable positions.

The most acceptable option, from the point of view of risk management in Forex , is that the loss as a result of one unsuccessful transaction should not exceed 2-3%, but this option is suitable for fairly large deposits and when using a small leverage.

Page 3 of 4