Lamm or Pamm account?

Today, not only a trader can make money on the Forex exchange, but also anyone who positions himself as an investor. And you don’t have to be a billionaire like Buffett or Bill Gates, because nowadays the brokerage industry has developed so much that by investing even 1 dollar, you can feel like an investor.

And you don’t have to be a billionaire like Buffett or Bill Gates, because nowadays the brokerage industry has developed so much that by investing even 1 dollar, you can feel like an investor.

This became possible thanks to the emergence of Pamm and Lamm accounts, where you can, like investing in the account of a specific trader, simply copy the trading signals of a good manager.

Today there are quite a few brokers that have both PAMM and LAMM accounts, this makes it possible to either invest your money in a manager or simply copy his operations proportionally on your account.

For those who have come across it for the first time, I will try to explain the difference between pamm and lamm accounts, as well as the pitfalls that are hidden behind them.

A PAMM account is a special type of account on which a trader works in public mode and accepts investments from various clients. In essence, through the system you directly invest in a trader who can manage the total capital of investors and his own, but he cannot withdraw the investor’s money.

The profit is basically divided in half, but the management percentage of the profit can go either to you or to the manager. Undoubtedly, PAMM accounts are very attractive to investors because you can invest and take profits without doing anything. But under a good cover there are a lot of pitfalls.

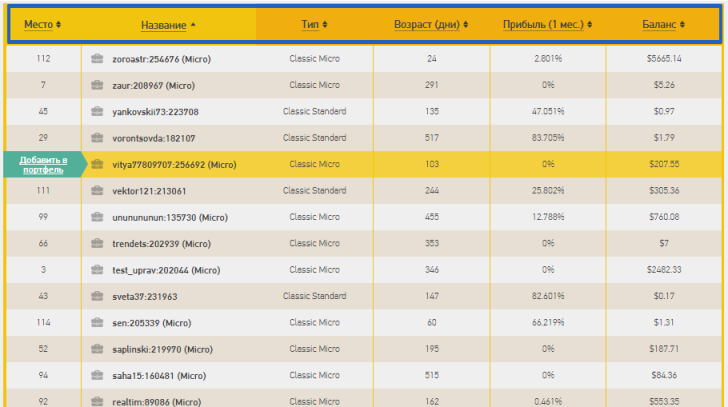

For example, a lot of beginners open a PAMM account in order to recruit a large pool of investors, and in the end, simply because of their stupidity, they destroy both the investor’s money and their own. To avoid such troubles, you should look at the trader’s profitability and his work experience. For example, with the Grand Capital company you can filter accounts by age, profitability and balance. The longer a trader works and the smoother his growth chart, the better for you.

Unlike a PAMM account, a LAMM account is designed to copy a specific trader that you choose from the list that the broker offers you. The peculiarity of this type of investment is that the system will automatically open transactions the same as the trader, but this will happen on your account, in the trading of which you can either interfere or conduct it in parallel with copying signals.

Essentially, this type of investment is suitable for people who have had experience with trading, but even a complete beginner can cope with it. There are also pitfalls hidden under this type of investment. For example, it very often happens that the trader’s balance does not coincide with the investor’s balance, and when the trader opens a series of orders and for him it will be a tolerable drawdown, then, unfortunately, it can be fatal for your deposit.

In order to choose a trader from whom you want to copy signals, enter the LAMM rating of managers. You will see a list of accounts that you can filter by profitability, age, account type (micro or classic), place in the rating or balance.

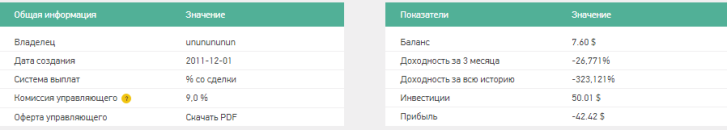

After you like one of the traders, you should familiarize yourself with the information on his account. To do this, click the name of the account that you like. A graph will appear in front of you with three lines.

The blue line is responsible for the account profit, the red line for deposits and withdrawals, and the yellow line for the balance. Also, if you go below, you can see summary information on the account:

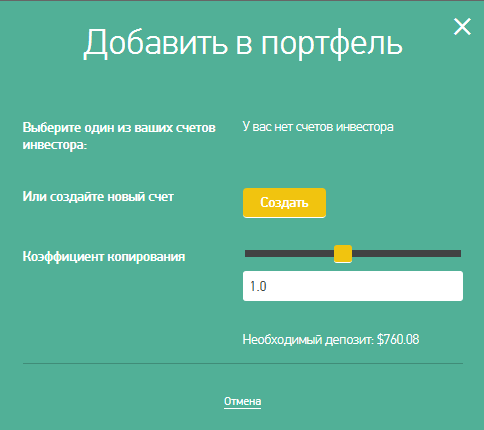

You also have the opportunity to communicate with the manager through the form to ask a question, which will redirect you to the forum thread maintained by the manager. This thread is assigned to each LAMM account owner, so you can ask any of the managers any questions you may have. If you are satisfied with any account and you want to copy its transactions, then simply click invest in this account. A window will appear in front of you in which you can set the copy ratio.

This is necessary so that you can regulate risks. By decreasing the coefficient, the system will open transactions with a lot less by this coefficient, and increasing it will lead to an increase in the lot relative to the transaction performed by the manager. If you leave 1, then you will open a deal with the same lot as the manager.

In general, both PAMM and LAMM accounts can be profitable if you choose the right manager. Since the broker introduced this service quite recently, you may find that you do not have enough tools to analyze the manager’s trading system. If LAMM accounts are still actively developing and you have some choice of managers, then you won’t look at the list of PAMM accounts of this company without a smile.

Of course, communicating with a trader on a forum is convenient, but where is the guarantee that he is telling the truth? Therefore, I think that it is better to refrain from investing until the broker adds new tools for analysis, especially since you can choose another broker for PAMM investments http://time-forex.com/vsebrokery/pamm-brokery