Setting up ZuluTrade

Recently, I began to increasingly come across various miracle courses on automatic trading on many sites, after purchasing which you will immediately become a super investor and start earning big money.

purchasing which you will immediately become a super investor and start earning big money.

As a rule, these courses talk about copying the signals of successful traders through the ZuluTrade platform and how to choose your own manager.

Since I have come across more than one such course, I can immediately tell you in advance that you should under no circumstances buy these courses, since after reading this article, most of the questions related to copying and choosing a manager will disappear for you.

ZuluTrade is a universal platform where successful traders gather to distribute trading signals for the commissions that the system pays.

Moreover, the number of such traders is simply huge, which will allow you to find a truly worthy candidate and increase your profits many times over, without knowing how to trade.

Registering with Zulu should not cause you any difficulties, since in addition to the usual registration form, you can log in through a social network (I did it through Facebook). The system will immediately prompt you to open demo account, in order to try to copy transactions and see what can be achieved without investment.

Simply put, you and I will form a portfolio of managers on a demo account, and then if everything suits us, then you can fund the account. This approach helps you monitor the trading of managers and see all the pitfalls without damaging your own pocket.

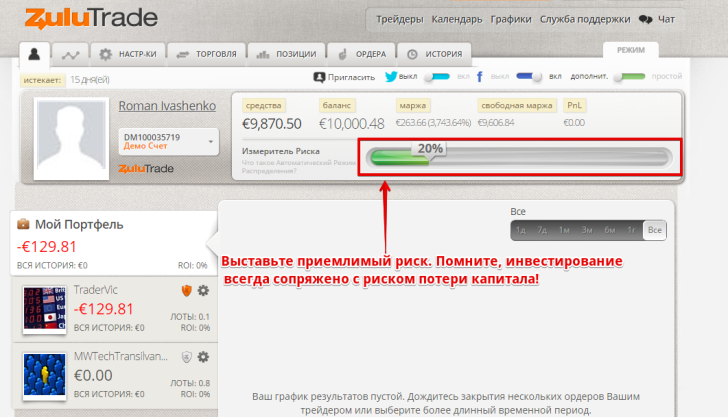

Before starting work on choosing a manager, I advise you to set up a risk line. In front of you in your personal account it is displayed as a percentage bar. This is necessary in order to limit your losses, and the system itself, after selecting this percentage, will calculate with what lot to open positions relative to the manager. Personally, I decided to start with 20 percent, since this is the amount that, in the event of its loss, will not greatly affect my capital.

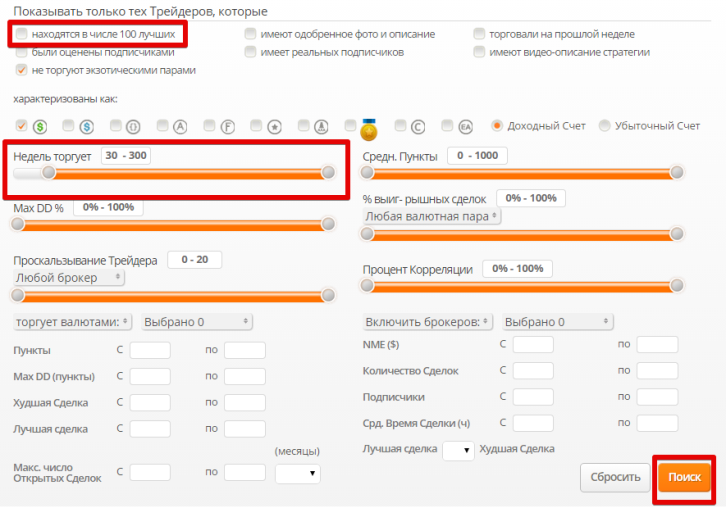

In order to select a manager, at the very top of the menu, click on the traders option. A large rating will appear in front of you, in which there are hundreds of managers. However, the rating also includes traders who issue signals from a demo account.

Personally, I recommend that you do not deal with them, because such managers do not feel the ground under their feet, since for them it is candy wrappers, but for you it is real money. Therefore, I recommend immediately switching the tab to $ LIVE Traders.

Also, to weed out novice managers, you can enter the filter (the icon next to the search bar) and set additional parameters such as account age, profitability, and the like. This filter calculates the age of the set in weeks, so I recommend filtering traders by account age of at least 20 weeks.

After you filter by the manager parameters you need, a list of accounts with the specified criteria will appear in front of you. Next, to get acquainted with the manager’s tactics and his main indicators, just click on the account number. You will be redirected to a page where you can get acquainted with his main indicators, see the drawdown on his account, see the currencies he trades, and also see the transactions he has previously made.

On the “Profit” chart, you can see with what intensity the trader’s profit grew by date, and also use the bottom tab to enable the display of critical events. A point that marks a critical event may tell you that the account was on the brink at that moment or there was a strong deviation from the trading strategy.

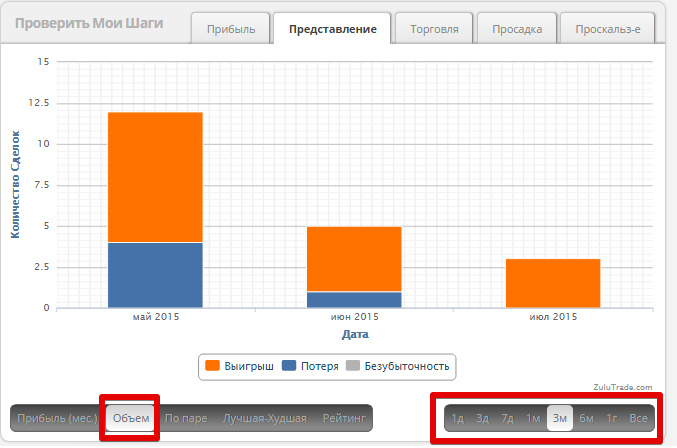

In the “View” column you can see the number of winning points, as well as the number of points that were lost due to the triggering of the stop order.

Also in the same column you can see information on the volume of profitable and unprofitable positions on the trading account for a certain period.

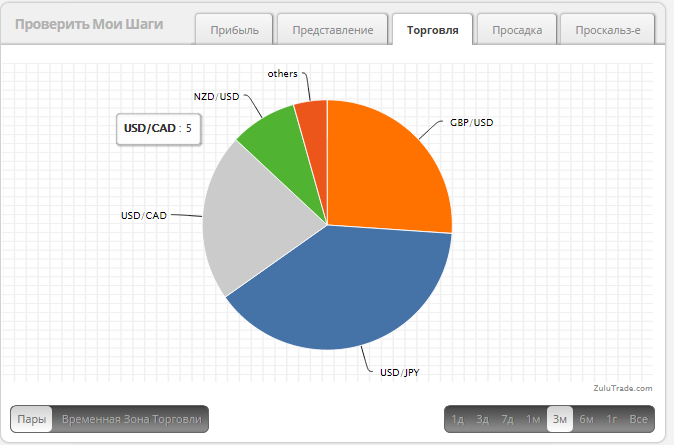

In the “Trade” column you can see what currency pairs the trader trades and their percentages.

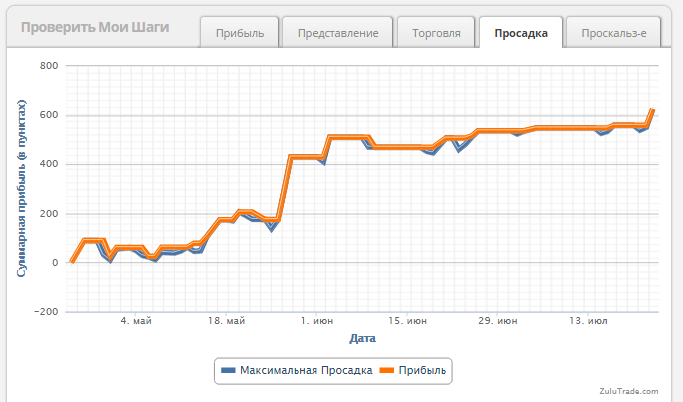

One of the most important indicators for you when choosing a manager is drawdown. If a trader uses risky money management methods, the drawdown line will be very far from the profit line. So, if you see such a large distance, it may tell us that the trader is using a martingale. In the example you can see the ideal ratio of drawdown to profit:

If all the trader’s indicators suit you, then simply click subscribe under his photo (nickname)!

If all the trader’s indicators suit you, then simply click subscribe under his photo (nickname)!

Considering that we set up risks at the very beginning of work, the system itself will select which lot to open for you relative to the manager’s transactions. Next, the system will open transactions in a fully automatic mode without your intervention, and your task is to monitor the situation on the account. Thank you for your attention, and I hope that you yourself will be able to choose a good manager for yourself without any purchased courses, especially since you have all the tools for this at your fingertips!