ZULUTRADE – the first steps towards selecting real managers

Greetings dear visitors. SETUP ZULUTRADE, ” I touched on

Today, in practice, together with you, I would like to select several managers, look at their statistics, and also share the first results, and how funny it was the first mistakes.

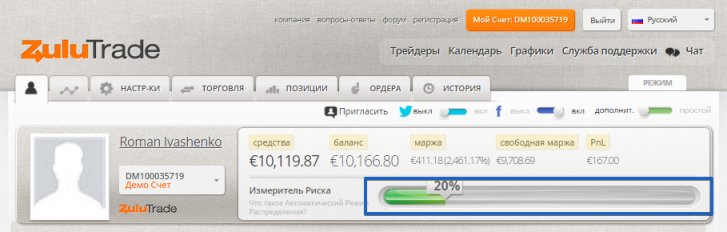

And so, to begin with, I decided to open a demo account with a company of $10,000 size to select the first traders and consider their trading in practice, and not according to the promises of the site.

For me, 20 percent of the risk is acceptable, so I set it to this value. Moreover, I would like to note that having established the risks, the system will open transactions, automatically reducing or increasing lots relative to the managing traders whose signals you are copying. You can see the slider itself with setting risks in the picture below:

The second step for me was the selection of the first managers. To be honest, I did not break down the risk percentage for each manager. My task was to find 5-7 candidates and simply evaluate their results, find weak links in this chain and simulate results acceptable to me. In selecting managers, I tried to rely on their drawdown, as well as profitability, and I tried to take into account that the trader would give out signals for at least 3 months.

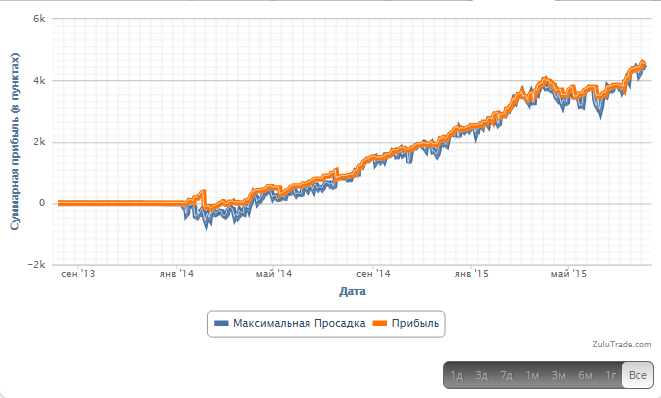

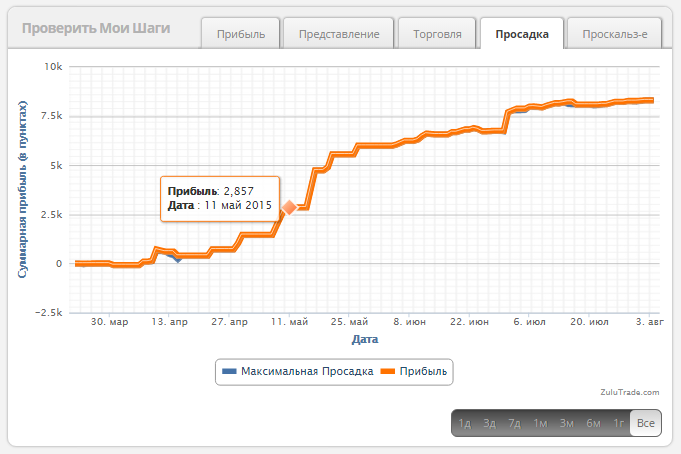

Of course, many people chase experienced ones, choosing a manager with an account of at least half a year, but as for me, a person who sticks to his strategy for three months is also not green. Therefore, the first trader I chose for my portfolio was Pminvestcap. The trader has been successfully distributing signals for 81 weeks, and his drawdown percentage did not exceed 14 percent with a fairly high profitability. You can see the graph of its growth and drawdown below:

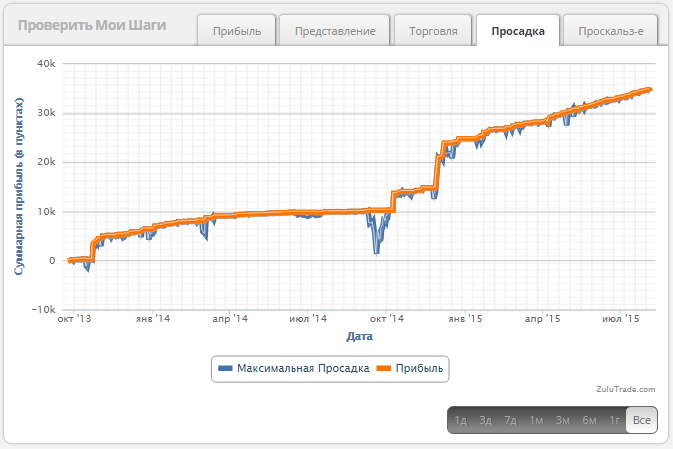

The second candidate for my portfolio was trader uuicc1. In the market, the trader successfully distributes signals for 96 weeks, and his drawdown percentage is 18 percent (the maximum recorded) and his profit percentage is approximately 120 percent per year. The drawdown is, of course, a little large, but the growth over such a long period cannot but surprise. You can see the graph of the manager’s balance growth and drawdown below:

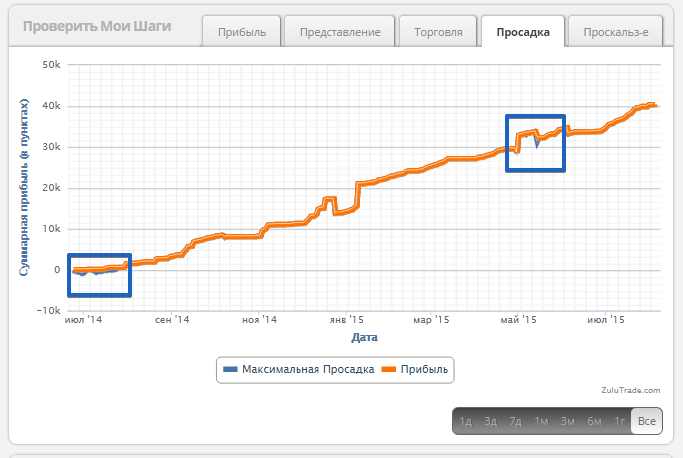

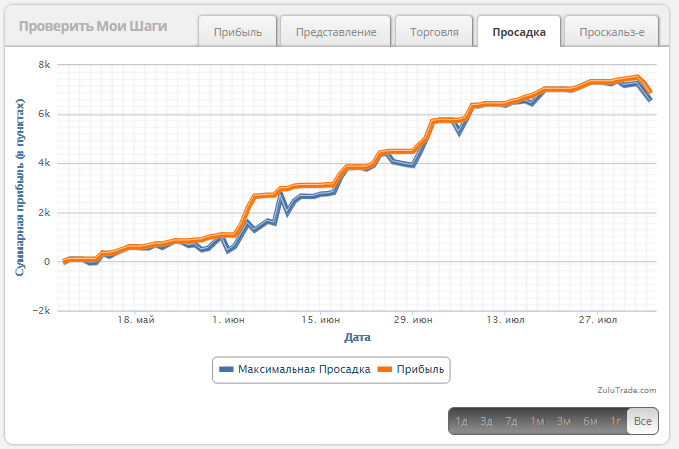

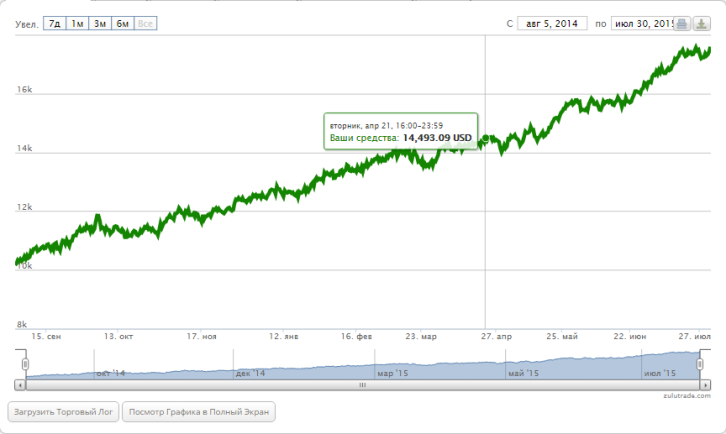

The third candidate for portfolio formation was the TraderVic trader. If I'm not mistaken, he is the first in the top ranking of managers. The trader has been in the market for 57 weeks, and his profit is calculated at 1000% per annum, and the maximum drawdown reached as much as three percent.

According to all the rules of investing and trading, here is a chicken that lays golden eggs. The drawdown chart is almost impossible to see behind the balance chart, which indicates strict adherence to all the rules of the trading strategy. See the chart of growth and drawdown in the picture below:

The fourth candidate became relative to the previous newcomers, who is only 18 weeks in the market. The trader is hiding under the nickname Mwtechtransilvania. Over this period of time, the trader managed to take more than 8 thousand points from the market for 76 transactions. The average position time is 6 days, and the minimum profit of the transaction with a size of 100 points.

Simply put, you have a medium -sized medium with a good strategy, because the percentage of the drawdown did not exceed 2 percent of the deposit. According to the increase schedule, you can notice that the trader is not averaged and not scalp, but clearly takes profit on large movements. You can see the growth and subsidence schedule in the picture below:

And finally, the fifth candidate Ferifgip. In the market, the trader is still relative to the newcomer, because in total in the system he tracked for 12 weeks. However, for such a short period of time, the trader managed to take 6500 points when drawing 21 percent. Of course, the drawdown is high, but I was hooked by the percentage of winning positions, which amounted to 88 percent. You can familiarize yourself below:

After the selection of all the managers I needed, I decided to simulate a portfolio in one year. Such a function is available to you in the personal account of Zulu under the list of traders. You can see the result of the counting with the risks I have given in the picture below:

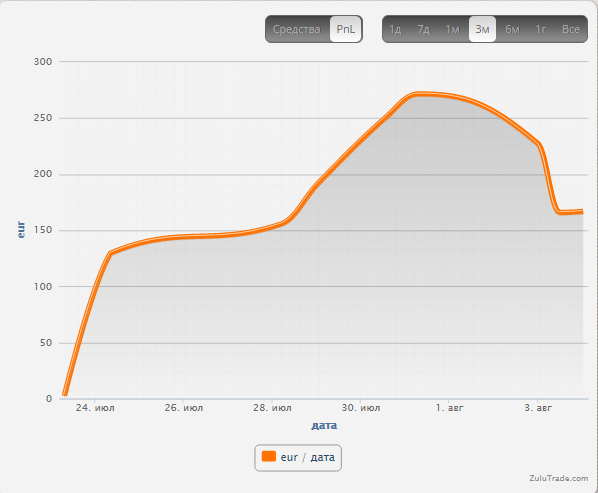

As a result of the counting, if all traders will adhere to their trade tactics, I can make a profit by copying their signals with a size of 73.4 percent of the deposit. In one year, I think this good investment. And now I am sharing the result of trading traders from July 27, 2015 to August 4, 2015:

In the future, I will monitor the situation on the account and share my observations and impressions. But as you can see from the profitability graph, not everything is as smooth and beautiful as it looks on the managers’ accounts. But, despite this, the portfolio was able to bring me 1.6% profit in such a short period of time. In the following articles we will try to find the flaws in the portfolio and perhaps change someone or, conversely, practice with risks.