ZULUTRADE – the first damn thing is lumpy

Greetings dear visitors. Previously, together with you, we selected a trial portfolio of managers, which you can read about in the article entitled “ ZULUTRADE – FIRST STEPS TO SELECTING REAL MANAGERS .”

Previously, together with you, we selected a trial portfolio of managers, which you can read about in the article entitled “ ZULUTRADE – FIRST STEPS TO SELECTING REAL MANAGERS .”

Five managers were selected to trade on an account of $10,000, who, at first glance, seemed to me to have good trading statistics.

Almost all five traders are leaders in the Zulu rating, however, during real testing, pitfalls were identified, which I would like to tell you about today.

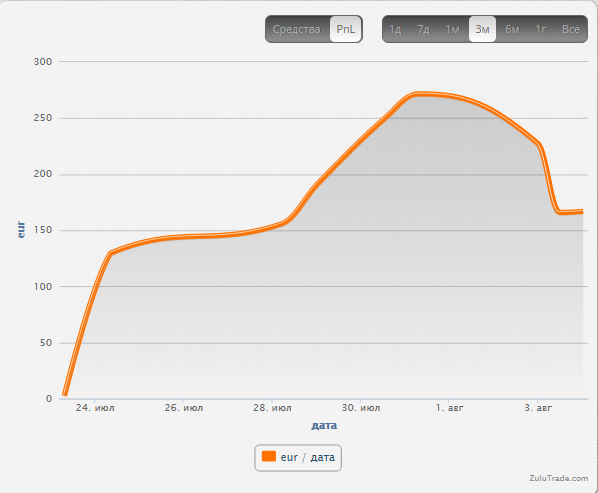

Initially, the results of two weeks of testing resulted in wonderful impressions, since almost all managers maintained their high top bar. At the time of writing this article about selecting managers, traders successfully brought in $300.

And you can see the growth graph in the picture:

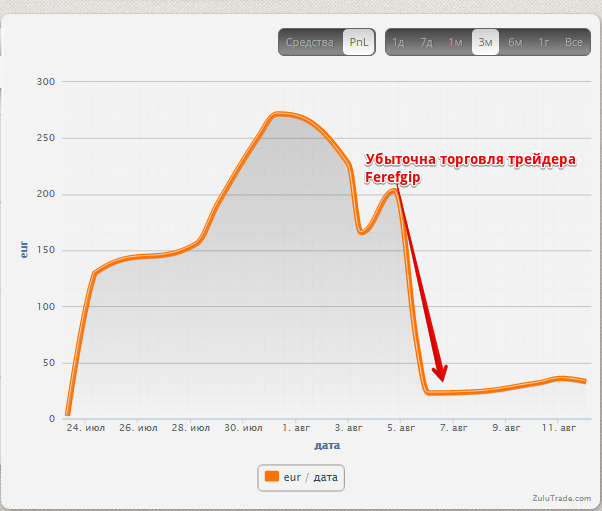

Waking up early in the morning, I decided to check the status of the account on which the pool of managers was so actively working and do you know what I discovered? First problems. The income curve changed very sharply and from excellent growth it began to fall rapidly. After analyzing which manager, to put it mildly, messed up, it turned out that this was a trader under the pseudonym ferifgip. He was fifth on the list of traders whose signals I decided to copy. The trader was relatively new, but he had fairly positive profit statistics relative to drawdown.

The manager managed to ruin all the results and lost $180 of earned profit literally overnight. And then for the first time I saw the strict dependence of profit on each of the managers, and you can notice that it is enough not to notice one unprofitable manager in order to lose all the money earned, which is exactly what happened to me. The reaction to this kind of manager’s behavior was not long in coming, so I removed him from my portfolio. However, removing the manager will not return our money, despite the fact that it is not real. You can see the result of one trader’s mistake in the picture below:

Next, I decided to analyze in more detail the work of my managers. So, for example, the most profitable trader TraderVic, who is the first in the ranking and brought me a profit on my account of $165, but that would have been fine, but at the moment he managed to make a drawdown of $250, which is much higher than all the money he earned. After analyzing the transactions of the TraderVic trader, it turned out that he is a grid operator and actively uses averaging.

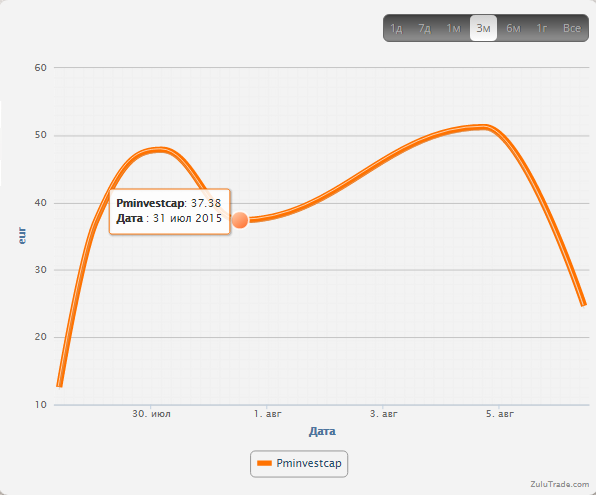

As you understand, this is a rather risky approach, so after it comes out of the drawdown, I will immediately remove it from the portfolio. A trader under the pseudonym Pminvestcap had a very similar trading system. However, unlike the previous one, his profitability chart shows that the trader uses a stop order, but for some reason today he managed to use a martingale and simply allowed a drawdown, which is twice the profit he gave. Naturally, the drawdown is small, but this suggests that it is worth taking a closer look at it. You can see the result of copying trades of the Pminvestcap trader in the picture below:

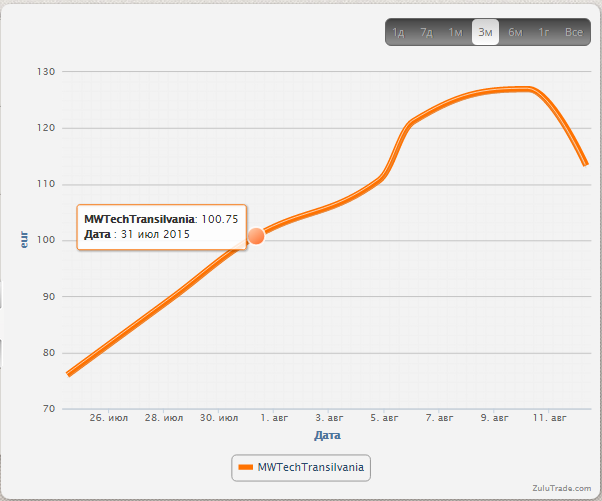

During the analysis of managers, the trader MWTechTransilvania was especially able to stand out. During the copying period, the manager brought me a profit of $113 to my account, and the drawdown from his open positions did not reach more than two percent. This may tell me that the trader is sticking to his trading strategy and I have stumbled upon a truly worthwhile candidate for managing real money. You can see the result of copying trades from the MWTechTransilvania trader in the picture below:

The trader under the pseudonym uuicc1 did not make a single trade during the month of copying. Therefore, it is too early to talk about its effectiveness. In the next article, together with you, I will select new candidates for copying transactions and make fundamental changes in the portfolio of managers. You can try independent investing at the broker Amarkets .

Thanks for your attention, good luck!