Cayman indicator – trading against the crowd

There are various forex strategies and indicators designed to trade against the crowd in the Forex market.

This is not surprising, because this strategy allows you to make good money.

But at the same time, it has increased risks. Therefore, in order to truly make a profit trading against the crowd, it is necessary to have reliable forex indicators.

One of these is the unique Cayman indicator.

What is this script for, what principles are embedded in it and how it can help traders, further in our article. What does it mean to trade against the crowd?

Despite all the variety of strategies and tools for technical or fundamental analysis, most traders move in one direction. Accordingly, they all get the same, disappointing result.

According to statistics, 95% of traders lose their money.

At the same time, the remaining 5%, who saw changes in the market in a timely manner, receive the money of all the losers. The strategy of trading against the crowd is based on the assertion that in the market it is impossible for everyone to be right.

That is, there cannot be 100% buyers or sellers. Therefore, when there are more bulls in the market, that is, the majority of traders are buying, proponents of this strategy will open short positions.

Accordingly, when the majority sells, that is, become bears, those who trade against the crowd will buy.

Moreover, to open a transaction on the foreign exchange market, there must be at least 60% of traders in the role of bulls or bears.

Moreover, to open a transaction on the foreign exchange market, there must be at least 60% of traders in the role of bulls or bears.

It is at such moments that a key change in the current trend can occur. Therefore, when the number of buyers or sellers crosses this mark, traders trading against the crowd close existing positions to preserve the profits they have already made.

After which, depending on the market situation, they wait for a favorable opportunity, for example, until the consolidation ends, or immediately open new transactions against the trend.

In order to understand where to open trades, you need to be able to determine the general state of the market for a particular asset. Simply put, to have a tool that will show how many traders are selling or buying an asset and, accordingly, who is more in the market.

There is no universal tool that would show the state of the entire market. Since Forex is a decentralized market. But if you use the indicators of a large broker with at least 100 thousand traders trading, you can get an overall picture that is close to the actual state of the entire market. After all, as we said at the beginning, most traders act the same way.

One such broker is AMarkets .

Tens of thousands of traders trade here, which makes it possible to obtain objective information about the situation on the market as a whole. It is not surprising that it was this company that developed the unique Cayman trading indicator, which allows you to be on the opposite side and make money when the majority loses.

Characteristics and operating principle

The Cayman indicator does not just show the ratio of sellers and buyers, it shows the potential highs and lows of the market, that is, it makes it possible to determine the most likely location of a key turning point, and this, in turn, allows traders to enter the market against the crowd at the very beginning of a new trend and take the high movements.

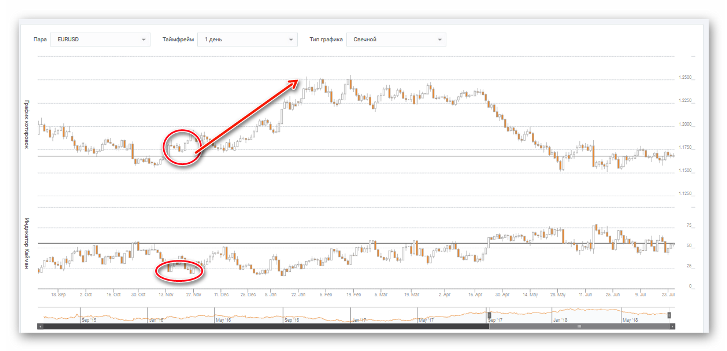

The screenshot shows a chart of the EURUSD currency pair at the top and an indicator chart at the bottom.

The screenshot shows a chart of the EURUSD currency pair at the top and an indicator chart at the bottom.

At first glance, it is a little unclear, but in fact everything is very simple.

Technical characteristics:

The indicator supports the following pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, USDCAD, USDCHF, EURJPY, EURGBP, XAUUSD and XAGUSD.

The indicator has a fixed range from 0 to 100.

The price moves within these values and never reaches them.

There are internal levels that can be set in the range from 1 to 99.

The indicator indicators are most effective on daily and weekly charts.

Operating principle:

The indicator has its own extreme values.

We can say that these are the maximum levels of market sentiment, but it should be taken into account that different currency pairs have different levels. For example, if the euro/yen pair previously reversed when the purchase level reached 75%, then with a high degree of probability this level is critical for it.

Accordingly, you need to monitor this level. Most likely, the next time the indicator approaches this level, the price will reverse.

At the same time, if, for example, the US dollar/Australian dollar pair turned around the sales level of 25%, then for it this level will be extreme.

As a result, for this pair it is necessary to set exactly this level and monitor it in the future. Ranges from 0 to the critical level of 25% indicate that the market is oversold.

If the Cayman indicator enters this zone, you can expect the currency pair to reverse upward. Accordingly, the range from 75% to 100 indicates overbought. When the indicator enters this zone, it is time to prepare to sell. Let's take the EURUSD daily chart as an example. For her, the critical levels are 30 and 70:

The screenshot shows how on November 13 and 27 the indicator indicators enter the overbought zone and reach a level of 25 and below, which is a critical indicator for this pair.

The screenshot shows how on November 13 and 27 the indicator indicators enter the overbought zone and reach a level of 25 and below, which is a critical indicator for this pair.

Accordingly, this could be regarded as a strong signal for a correction or change in trend if it was a downward trend, but since it was a correction in an uptrend, we received a signal to continue the trend when everyone already believed in its reversal or deep correction.

As a result of such an entry, it was possible to earn 750 points in 3 months.

If the trader closed at the first strong candlestick signal for a reversal. Where to find the Cayman indicator

Since the indicator was developed by specialists from AMarkets, it can only be found in the trader’s personal account with this broker. There are several versions of the indicator:

Online version -

https://www.amarkets.org/ . The indicator is available in the trader’s personal account after registration. Indicator for the MT4 trading platform.

In addition, the company even developed the Cayman advisor.

After installing the indicator in the terminal, it becomes even more convenient to use than on the website. But to do this, you need to open a real account and make a deposit. Please note that it is recommended to use this indicator in conjunction with other analysis methods or as an auxiliary one. Combined use of the Cayman indicator with other methods will allow traders to significantly improve their trading.