MACD combo indicator

It is no secret that the visual perception of certain processes in the market greatly influences a trader’s ability to work and productivity.

Often, everyone’s favorite indicators, especially standard ones, have a rather complex signal recognition system.

That is why on various sites you can find dozens or even hundreds of different modifications of standard indicators.

For example, traders don’t want to watch moving averages , so they ask programmers to implement an indicator that will display the moment of crossover with an arrow on the chart.

Actually, there are hundreds of such modifications and alterations floating around on various Forex forums, and believe me, visualization really affects the trader, helping to find the necessary signal much faster and easier.

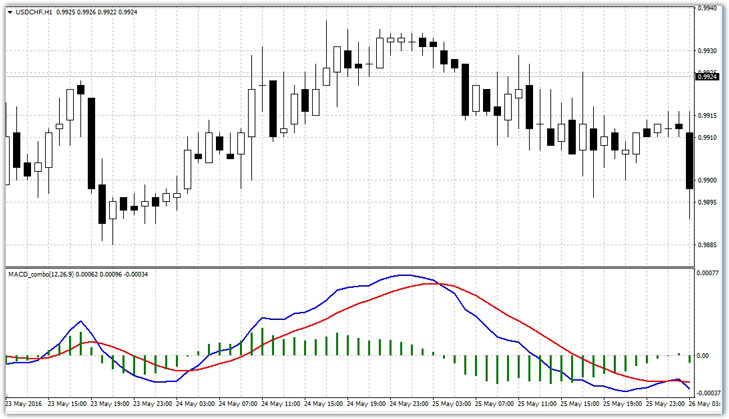

The MACD combo indicator, unlike its main analogue, uses lines to display the moment the histogram crosses level 0 and also displays the difference between the signal line and the MACD indicator line.

Thanks to a simple modification of the instrument, MACD combo has become an active part of various scalping strategies, and some traders use it themselves.

Installing the MACD combo indicator

MACD combo, unlike its predecessor, is not installed by default in MT4, so you will have to download it at the end of the article and do the installation yourself.

To do this, after downloading you must have access to your platform's data directory. To do this, launch the Meta Trader 4 trading terminal and in the file menu, find the line called “Data Directory”.

Having launched the directory, you will see a number of folders, among which you need to find a folder called indicators and drop the downloaded MACD combo file into it.

Next, close the directory with terminal folders and make updates in the navigator panel. After the update, the MACD combo will appear in the list of custom indicators, so you can drag it onto the chart of any currency pair .

MACD combo settings

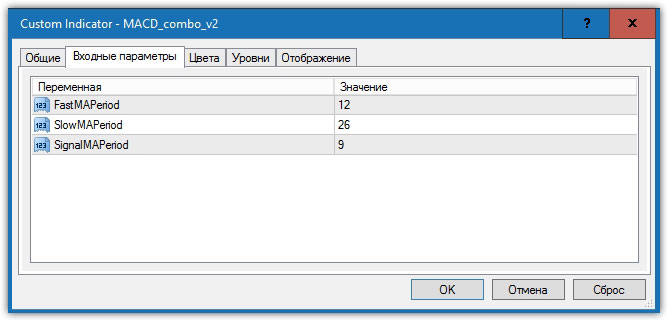

The MACD combo indicator, like its original analogue, has the same settings, since the basic basis of this instrument is a moving average with different periods, and the histogram that we are used to seeing is the difference between certain moving averages.

There are only three lines in the settings, namely FastMAperiod, SlowMAperiod, SignalMAperiod.

So in the FastMAperiod line you can specify a fast moving average, in the SlowMAperiod line you can specify a slow moving average, and in the SignalMAperiod line you can specify the period of the signal moving average. It is also worth adding that SignalMAperiod is shown as a red line on the chart.

The actual settings are no different from the standard MACD, so optimizing the indicator for a specific trading style should not cause any difficulties. Signals and options for using MACD combo

The first option for using the indicator is based on the intersection of two lines of the indicator or a histogram of level 0. This signal is the main one, since MACD has been modified for better perception of this particular signal.

It is also worth noting that the intersection of these two lines, as a rule, occurs when there is a significant change in the trend, and mainly when there is a reversal in the market.

So, entering the market to buy occurs when the blue line crosses the red line from bottom to top, and entering to sell occurs when the blue line crosses the red line from top to bottom. Similar to this signal, you can buy when the histogram has crossed level 0 from bottom to top or sell if the histogram has crossed level 0 from top to bottom.

Both of these signals appear simultaneously, and see an example below:

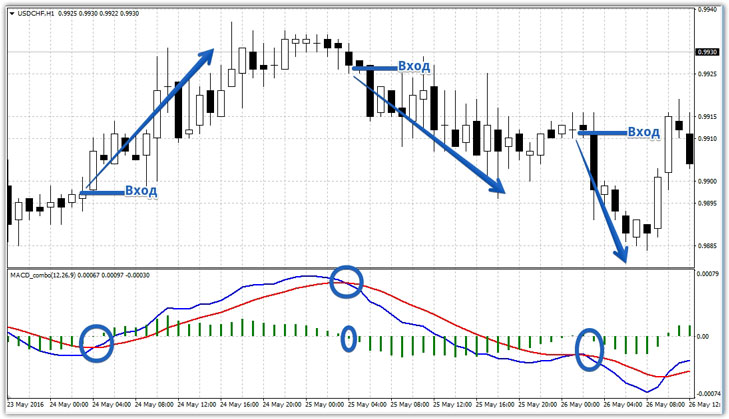

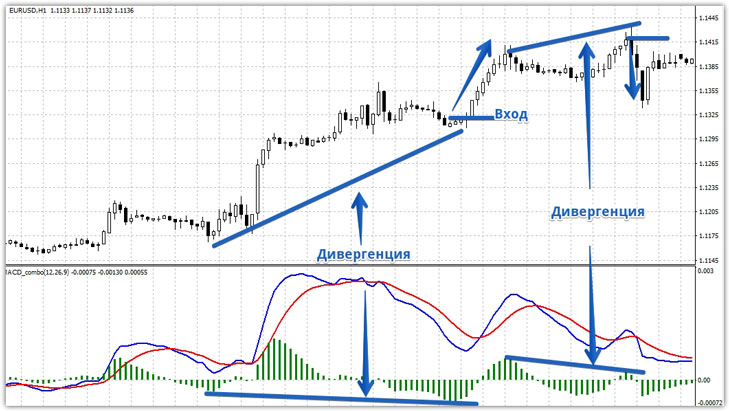

The second type of signal is based on the ability of the MACD combo to predict a possible price reversal using a phenomenon such as divergence.

Divergence in Forex occurs when price readings diverge from the actual market situation. As an example, imagine that you see a new high that the price has formed over the week, but at the same moment the histogram shows that this high is lower the day before.

Such a consumption in the readings marks a strong reversal in the market. As a rule, after detecting divergence, you should enter a position after a decrease or increase in the next bar of the MACD combo histogram, which will confirm the emergence of a reversal.

An example of divergence by MACD combo is shown below:

The tool can serve not only as a signal indicator, but also as a filter for the trend and direction of the transaction, filtering signals from other indicators from entering the market against the main trend.

Thus, finding the histogram above level 0 indicates an upward trend, and finding the histogram below level 0 indicates a downward trend.

In conclusion, I would like to note that MACD combo, like its main analogue MACD, is a multifunctional technical analysis tool. However, it is better to avoid using the script alone, and combine it with some kind of trend indicator .

Download MACD combo indicator