Forex Profit Boost indicator

It is no secret that in order to achieve stable profits, traders have to abandon intuitive trading and give preference to systematic trading, using various trading strategies .

With the advent of a huge number of strategies, traders, in order to achieve the uniqueness of their approach, go to the most desperate and unreasonable measures, increasing the number of indicators in the strategy, creating the most complex algorithms.

Unfortunately, in practice, this kind of strategy always becomes unprofitable, because the more complex the rules and conditions, the less often you will receive signals, which significantly affects the trader’s efficiency.

The Forex Profit Boost indicator is a complex trend tool that combines two trend indicators.

Indicators like Forex Profit Boost are a classic example of how one tool can be a great trading strategy without the overload of indicators, and the trading rules are so simple that even a beginner can handle them.

Installing Forex Profit Boost

Forex Profit Boost is developed for trading in the MT4 trading terminal, so in order to use the indicator, you must first install it on your platform.

To do this, download from the link at the end of the article and place the indicator in the indicators folder of your terminal.

To find this folder, in an open trading terminal, go to the file menu and open the root directory. After installation, it is very important to update the Navigator panel so that the Forex Profit Boost indicator appears in the list of custom indicators.

After updating, drag Forex Profit Boost onto the chart with the price: How the indicator works.

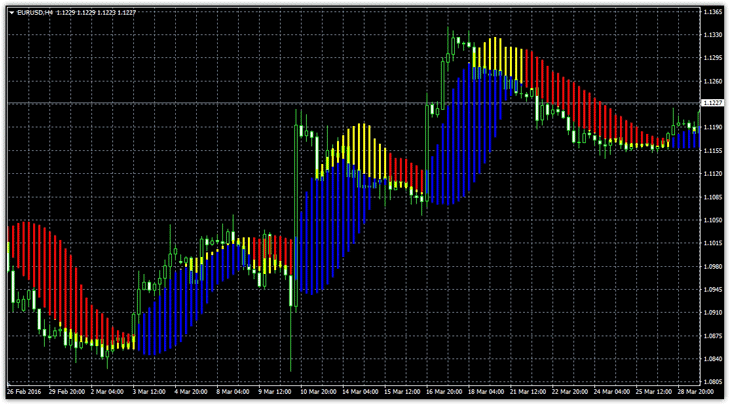

Forex Profit Boost Settings Forex Profit Boost is an indicator that combines a moving average as well as Bollinger Bands.

The principle of operation and display of information is quite simple, namely, if the price is above the moving average, the indicator draws a blue color; if it is below, the indicator draws a red color.

You can also see the yellow color on the chart, which symbolizes a weakening trend. Yellow coloring appears if the price moves away from the Bollinger band and moves towards the center.

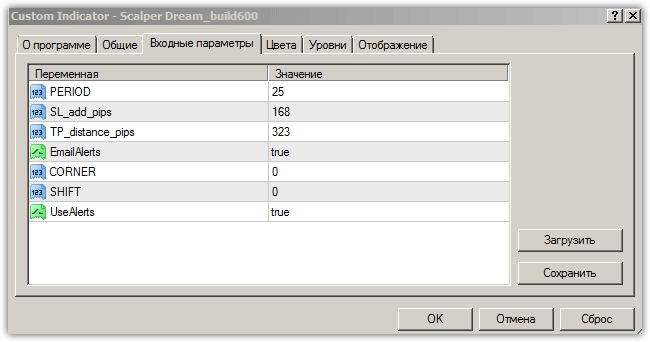

If we talk about settings, the indicator contains only five lines, which in one way or another can affect the operation of the instrument.

So, in the MAPeriod line you can set the period of the moving average, and in the MAMethod line you can change the type of moving average to exponential, linear, and so on. In the BBPeriod line you can change the period of the bollinger bands, and in the BBDeviation line you set the deviation, and in the BBShift line the shift of the indicator by a certain number of bars.

It is worth noting that the developers claim that the tool can be easily used on five-minute and fifteen-minute charts.

However, as our historical study has shown, in order to do this you will have to optimize the tool according to the main parameters. Signals.

Application options When using the Forex Profit Boost indicator, signals can be divided into aggressive and more conservative.

Aggressive signals include entering the market when the trend changes, namely the indicator color changes from blue to red for sales and changes from red to blue for purchases. Exit from such transactions occurs when the trend changes, and a stop order is set at local levels.

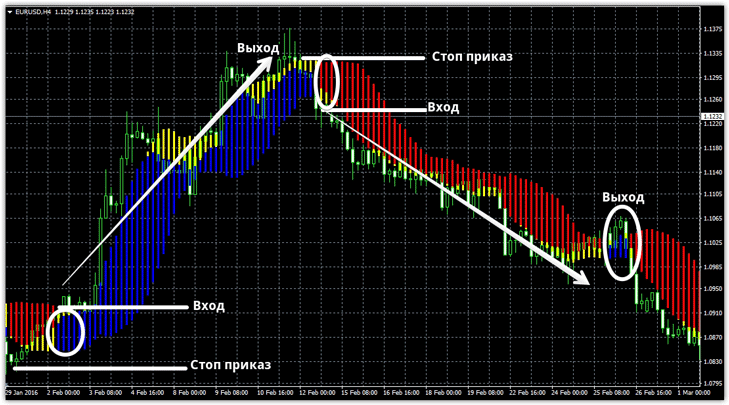

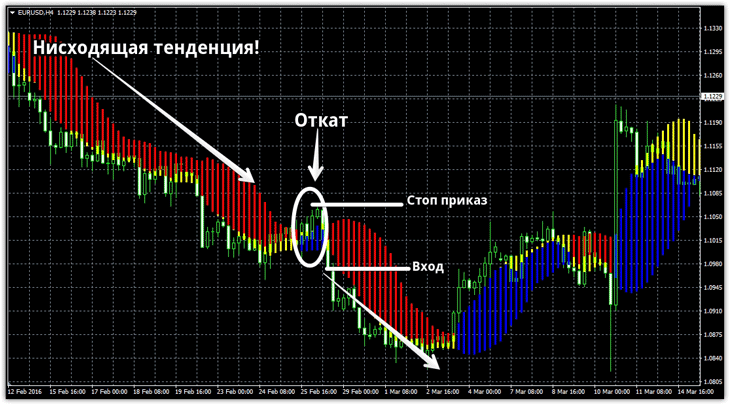

An example of using an aggressive style is shown below: The second method, which is intended for conservative traders, is based on the market’s ability to rollback and then follow the main trend.

The essence of this strategy is to identify the main trend, which is displayed in red for a downward market and blue for an upward one.

Then we wait for a rollback and the appearance of bars of the opposite color. After the indicator displays the color of the main trend after a rollback, the market is entered. In order to understand the technique of this approach, look at the picture below:

In conclusion, I would like to note that both options for entering the market can be safely used, however, it is necessary to take into account that the aggressive option involves greater risk, but the profit also increases significantly.

The conservative approach of trading on pullbacks has an order of magnitude lower profitability, however, the transactions are more accurate and the signals are stronger.

It should also be added that Forex Profit Boost can act as a trading strategy, but it would be useful to use it in conjunction with some kind of oscillator. Download Forex Profit Boost Indicator