SupDem supply and demand indicator

Trading on the Forex exchange is essentially no different from the market relationships that we can observe in a regular food market. So, on the Forex exchange, just like on the market, there are buyers and sellers, and the price is regulated by the balance between supply and demand.

On the Forex market, and on the stock exchange, one simple law has always operated and will continue to operate: “Sellers try to sell at a higher price, and buyers try to buy at a lower price.”

If in person you go around several counters and choose an acceptable price for a product, then on the Forex market you also try to buy an asset at a better price in order to make money on its growth.

Actually, demand always meets supply, so if you divide all exchange players into sellers and buyers, you can quite accurately determine the zones of supply and demand, namely the prices at which sellers want to sell currency and buyers want to buy it.

The SupDem indicator highlights supply and demand zones on the chart, thanks to which you can analyze the desires of players and possible price movements.

Installation

The SupDem indicator is not present by default in the MT4 trading platform, so you should first download the indicator at the end of the article and install it in the platform.

To do this, launch your MT4 trading terminal and go to the file menu, in which you should open “Data Catalog”. Having gained access to all the necessary folders, find a folder in the list called indicators and drop the SupDem indicator into it.

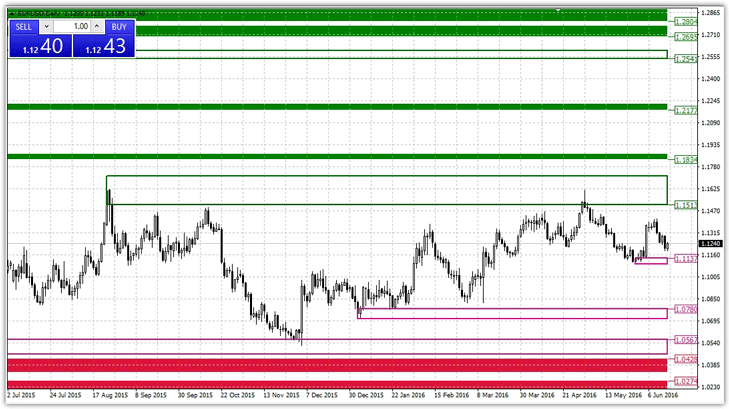

After closing the data catalog, refresh the navigator panel and the SupDem indicator will appear in the list of user instruments. To start analyzing the market, simply drag SupDem onto the hourly or higher chart of any currency pair. As a result, you will get a graph like this:

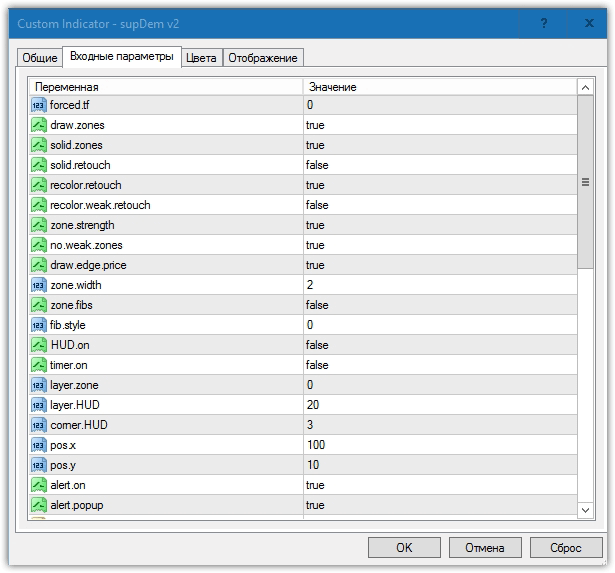

Settings indicator SupDem

The author of the indicator has laid down a rather complex algorithm for determining these zones, however, according to many programmers who have made a dozen modified versions, this tool builds its levels based on the Fractal indicator. The indicator settings are mainly graphical in nature.

Forced.tf is responsible for creating markup for a specific time frame.

The default value is 0, so the indicator builds its markings on the time frame on which the indicator is displayed. If you want the fifteen-minute marking to appear on the hourly chart, simply enter the number 15. Draw zones is responsible for displaying these zones on the chart.

If you switch from True to False, the indicator will not display supply and demand zones on the chart. Solid zones controls the display of zones on the chart.

So, by default, the zone is drawn in a certain color, and if you disable this function, the indicator will draw unfilled rectangles. The solid retouch function allows you to display worked out zones on a graph, and the recolor retouch function allows you to enable a visual display of the worked out zones and changes their color.

Thanks to the zone strength function, you can enable color changes when working out the price of weak zones, and using the no weak zones function, you can prevent the indicator from drawing these zones at all.

The zone fibs function allows the indicator to automatically plot Fibonacci levels between the supply and demand zones.

Practical application of SupDem

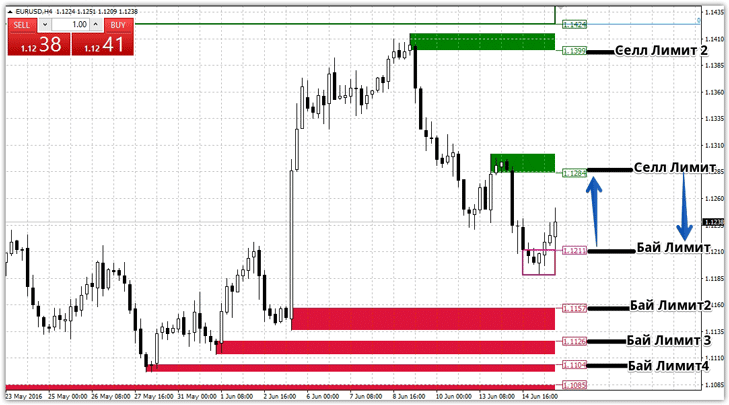

On the chart, the zones outlined in green display the place where pending orders from sellers are accumulated, namely the supply zone. The desires of buyers, namely demand, are displayed on the graph in red and purple zones. The principle of application remains the following: place a pending order Buy Limit in the red zone, and Sell Limit in the green line.

Trading comes down to the classic rebound strategy from support and resistance levels.

Since the zones are quite wide, it is recommended to place a stop order at approximately 100 points, and the target is the opposite zone. Example:

In conclusion, it is worth noting that the SupDem indicator - supply and demand copes with its task perfectly and visually displays the zones we need.

It is also worth understanding that this tool is not only a signal indicator, but can also act as a filter and protect you from transactions near strong reversal zones. Download the SupDem indicator