Fibonacci levels, practical points.

Fibonacci levels are one of the most common technical analysis tools for predicting price corrections. Actually, dozens of books have been written about Fibonacci levels, and the world-famous wave theory, one way or another, is based on these levels.

predicting price corrections. Actually, dozens of books have been written about Fibonacci levels, and the world-famous wave theory, one way or another, is based on these levels.

However, despite the popularity of the tool, opinions about it are quite contradictory.

This is actually connected with the very theory of creating the instrument, because modern economists and mathematicians simply cannot explain the patterns of movement of financial markets, and the theory of the “Golden Ratio”, which is so applicable to living and non-living nature, at first glance is not comparable with financial markets.

This number is the answer to the riddle of the “Golden Ratio”, which can be found when analyzing the construction of pyramids, the human body and many other natural factors. It is because of the mystical presence of this number that such a tool as “Fibonacci Levels” was born, which, oddly enough, works effectively on the foreign exchange market, as well as the stock exchange.

Building Fibonacci Levels

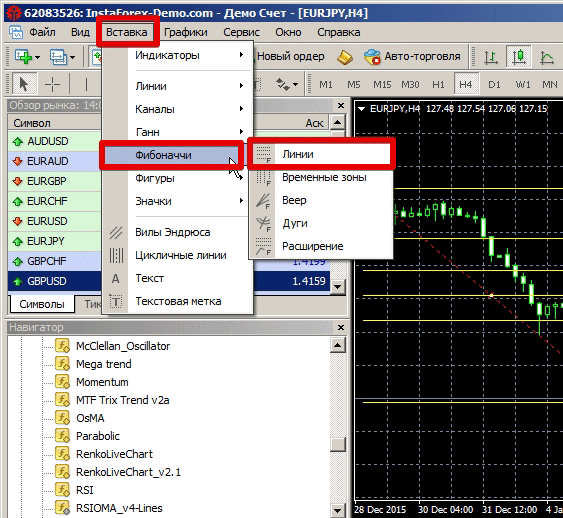

To plot these levels, there is no need to install any additional indicators in the MT4 trading platform, because this tool is built in by default.

To use it, go to the “Insert” menu, select the “Fibonacci” section and click on the “Fibonacci Lines” tool.

How to build Fibonacci levels correctly?

The most interesting thing is that despite the prevalence of the use of Fibonacci levels, it is quite difficult to find information how to build them correctly. However, despite all the fantasies, it is quite simple to build fibonacci levels correctly.

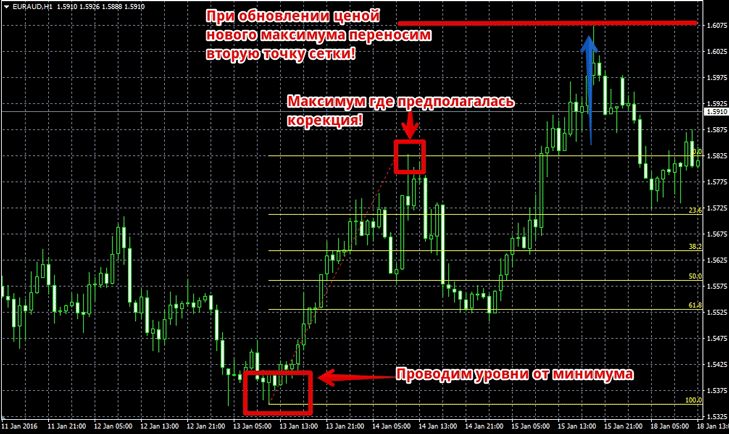

To do this, in an uptrend, you must find the minimum point (minimum) and, without releasing the mouse button, draw levels to the maximum, where you assume that a reversal or correction is occurring.

Moreover, if the price updates the maximum, you must drag the grid after it, and the minimum point does not need to be changed. In the case of a downtrend, you must highlight the maximum point and draw levels to the minimum point.

What are Fibonacci levels used for?

As we have already mentioned above, the levels of fibonacci are necessary to measure the correction of the current trend. Actually, to understand all the benefits of the tool, I propose to consider a simple situation. For example, you see a clearly rising trend on any currency pair or promotion, and you decide to buy an asset.

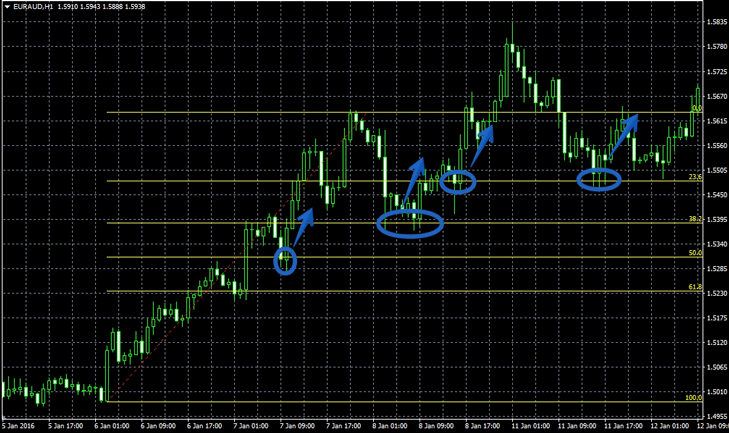

However, you understand perfectly well that there is a very high risk that you will buy this asset at a very high price, since a rollback or trend reversal may occur at any moment. Therefore, Fibonacci levels are used for a clear entry point into the market, since they show us in percentage terms how much the price has rolled back as a percentage of the main trend.

As a rule, it is considered that it is worth entering the direction of the trend if the price has touched the levels of 23.6; 38.2; 50 percent. The 50% level is considered the strongest, and if the price breaks through it, then we can say with confidence that the trend has reversed.

Non-standard application

Despite the fact that Fibonacci levels are most often used as support and resistance lines, they are often used to determine targets and good places to set stop orders.

The principle of construction itself remains unchanged, however, all subsequent levels can be considered as good points for setting profit and stop orders.

Disadvantages of using Fibonacci levels

This tool has an inherent drawback, like all graphical analysis tools, in the form of subjectivity in its construction. Each person can determine the minimum or maximum point for construction differently, especially when it comes to constructing levels on long trend sections.

It is also worth noting that the tool should in no way be used alone, because its main purpose is to measure trend correction , so Fibonacci levels should be used with another technical analysis tool.