Multi-Williams Percent Range

A trend, as a state of the market, is a fairly clear and at the same time abstract concept.

The fact is that each trader’s trend, depending on the working time frame, can be different, because it is no secret that the minute chart displays one picture, and the four-hour chart displays a completely different one.

However, the most interesting thing is that both traders can be clearly confident that within the framework of their strategy they see the correct trend or signals.

That is why there is a practice among traders of confirming signals or trend directions on a higher time frame, especially if trading occurs intraday.

Of course, constantly switching between time frames at the moment a signal appears on the main one is quite inconvenient and time-consuming, which is why you can increasingly see indicators with the Multi prefix.

The Multi-Williams Percent Range indicator is a technical analysis tool that allows you to monitor Williams Percent Range indicator data simultaneously from three time frames.

A nice feature of this particular tool is the ability to set the necessary time frames for the trader, rather than having to track the specified chart intervals by the developer.

It is worth understanding that Williams Percent Range, like other oscillator tools, can be used on all types of trading assets, be it currency pairs, stocks or CFD.

Oscillators also show high efficiency on all types of trading assets, so the tool will be useful to all traders, without exception, regardless of their trading style.

Setting the Multi-Williams Percent Range Indicator

The basic version of the Williams Percent Range was created by Larry Williams back in 1973, as a kind of analogue of the stochastic oscillator, which at that time was gaining enormous popularity among traders.

Multi-Williams Percent Range is a custom development for the MT4 trading platform, which you can use by downloading the file at the end of the article and installing it.

Installing the Multi-Williams Percent Range indicator is no different from installing any other custom indicator and follows the standard procedure, namely, you will need to dump the previously downloaded indicator file at the end of the article into the appropriate folder in the terminal data directory.

You can find more detailed instructions for installing indicators in the trading terminal by clicking on the link http://time-forex.com/praktika/ustanovka-indikatora-ili-sovetnika.

You can also install the Multi-Williams Percent Range indicator through the Market. To do this, in your trading terminal in the “Tools” panel, you need to go to the “Market” tab, then use the search to find the indicator and install it automatically.

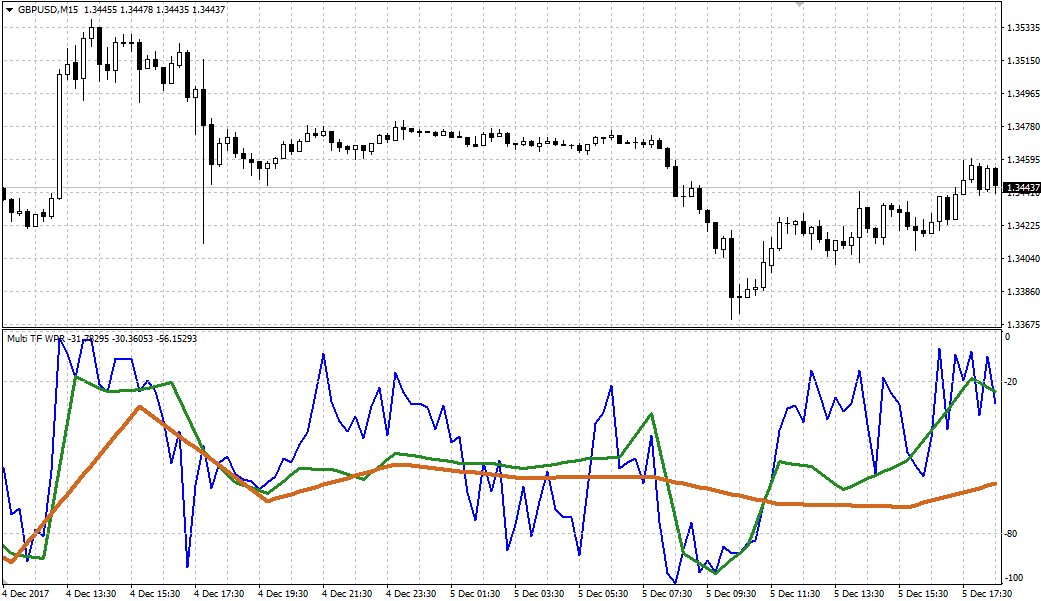

After plotting the Multi-Williams Percent Range on a graph, it will look like this:

How to use Multi-Williams Percent Range.

Settings Having plotted the instrument on the chart, you will see three lines in the additional window.

The blue line is responsible for the 15-minute chart, the green line for the hourly chart, and the yellow line for the four-hour chart. If we talk about the principle of using Multi-Williams Percent Range, it does not differ from the principles of using any other oscillator, including Williams Percent Range, except that a trader can monitor the situation simultaneously from three time frames.

The first and most popular type of signal is trading at the exit of lines from overbought and oversold zones.

So, if one of the three lines drops below the 80 level and then crosses it from bottom to top, we open a buy deal.

If the indicator line rises above 20 and crosses it from top to bottom, we open a sell position.

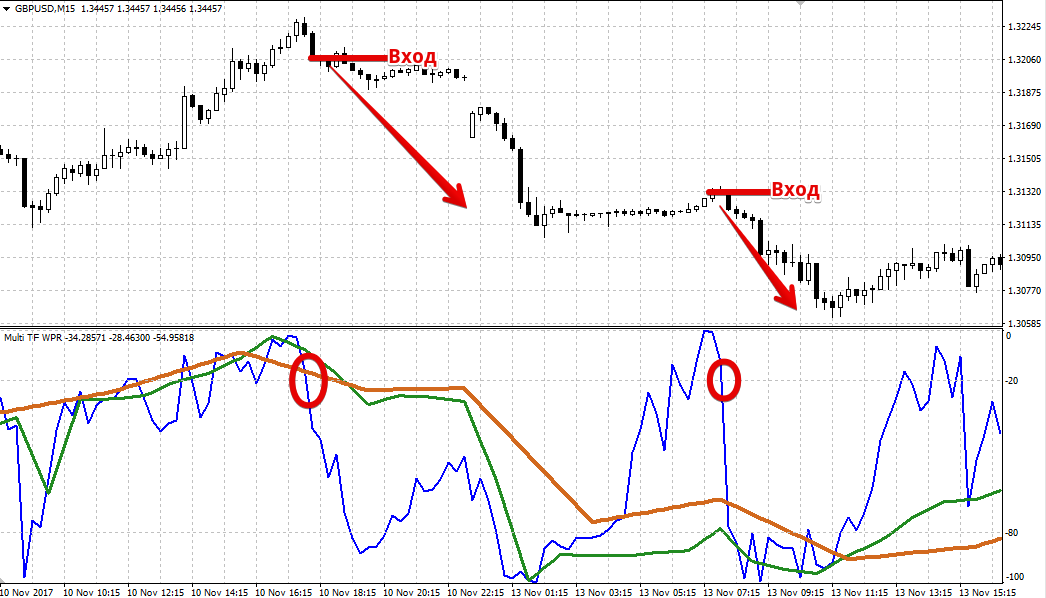

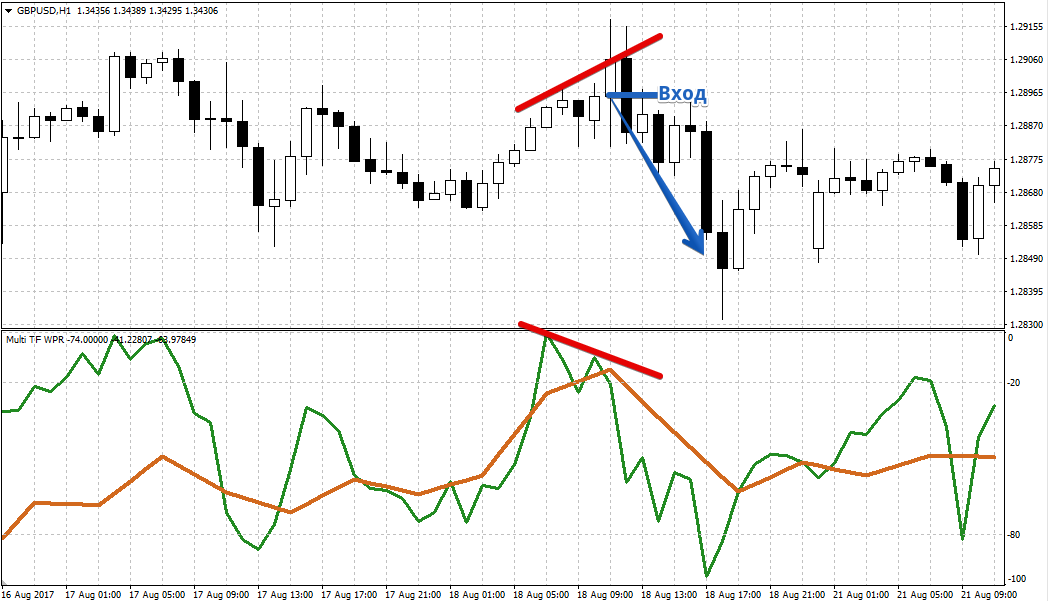

The second type of signal, which relates to leading and reversal, is called divergence.

The essence of the signal comes down to the fact that a discrepancy appears on the chart between the formation of real peaks and troughs with the formation of exactly the same price movements by the indicator line. Thus, if the price has updated the price maximum, and the indicator line of the time frame in question displays it as lower than the previous one, we open a sell position.

If the price has updated its minimum, and the chart line in question shows that this peak is higher than the previous one, we open a buy position. Example:

In the indicator settings in lines Timeframe 1, 2, 3, you can specify the time frame for each of the three lines, but the indicator period is common and is set in the Period line.

In conclusion, it is worth noting that Multi-Williams Percent Range is more convenient than the standard Williams Percent Range because it allows you to monitor market conditions in one window from three time frames simultaneously.

Download Multi-Williams Percent Range