Wolfe Wave Indicator

Wave theory is considered one of the most complex techniques of graphical analysis. However, the popularity of Eliot's works gave rise to new concepts and approaches to the analysis of waves, one of them being Wolfe's wave theory.

However, the popularity of Eliot's works gave rise to new concepts and approaches to the analysis of waves, one of them being Wolfe's wave theory.

When analyzing waves, Wolf applied the famous rule of physics “For every action there is a reaction,” believing that the price, like a pendulum, swings in different directions.

Applying this rule, he formed his own concept of wave formation and offered the whole world his pattern, which consisted of five legs and showed a clear place of reversal and target.

Actually, if graphical analysis and the main patterns of trend continuation and reversal are very subjective, then the Wolfe pattern has clear rules for constructing and working with it.

Independent pattern building

In order to use additional means for detecting Wulf waves, you must first of all learn to find them yourself, which will allow you to discard incorrect constructions made by technical indicators .

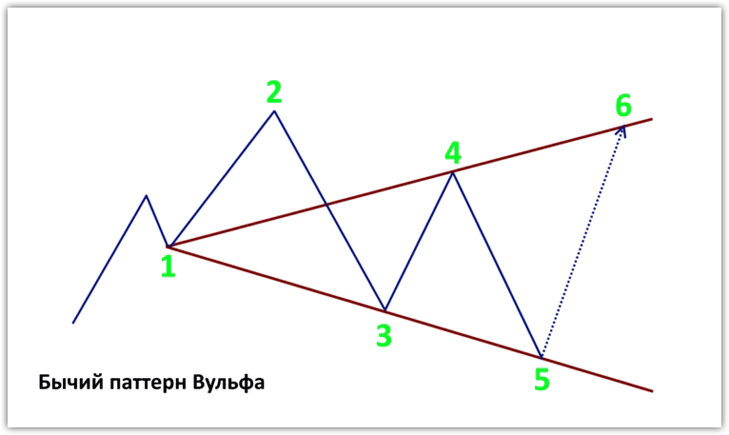

Bullish Wolfe Pattern

The bullish pattern is built on five points, with the sixth being the direct target, and the fifth being the entry point. You must clearly understand that the pattern is a reversal, so the first point is below the second, and the third is below the first, the fourth is below the second, but above the thirds, and the fifth is below 3.

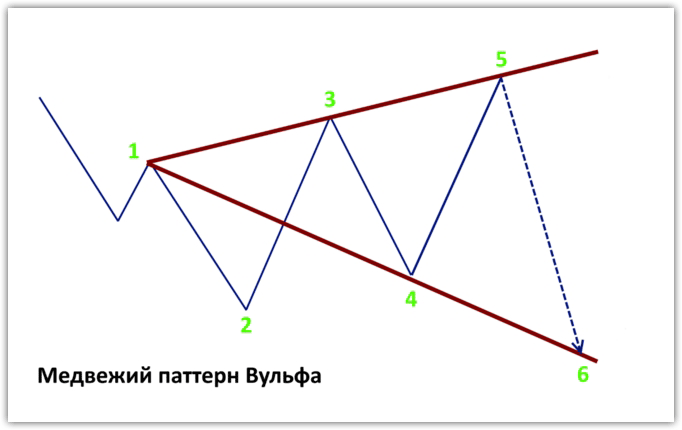

Bearish Wolfe pattern

This pattern is built in a radically opposite way, namely, point 2 is under point 1, point 3 is above the first point, the fourth point, in turn, is above point 2, but below point 3, and point 5 is above point 3.

The line that connects points 1 and 4 is our goal, since point 6 will be located on it. See the example below:

Wolfe wave indicator

As you already understand, even schematically Wolfe waves look quite complicated, and on a chart, for a beginner, finding these patterns is not at all difficult. That is why Wolfe indicators are very popular, which produce markings independently without any intervention from the trader.

The Wolff indicator 40 wolfwave uses an indicator such as ZigZag for construction, thanks to which it searches for extreme points on the basis of which the waves themselves are built. The Wolfe indicator can be used on any currency pair and chart, since this pattern of price behavior is characteristic of all assets on any time frame.

Installation

This tool was designed for trading on the Mt4 trading platform, so to use the indicator you must first install it. To do this, place the Wolfe indicator downloaded at the end of the article in a folder called indicators, which you can access through the data directory in the file menu. After installation, we update the “navigator” panel, after which the indicator will appear in the list of tools.

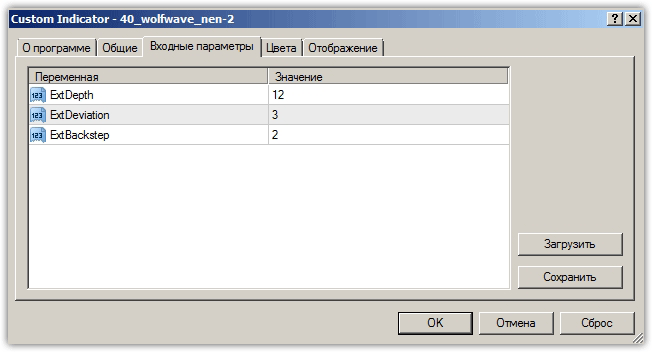

Wulf indicator settings

Wulf indicator settings

In the Wulf indicator settings, you can find only three parameters that are completely identical to the settings of the ZigZag indicator . The ExtBackstep line indicates the value of the ZigZag indicator. The ExtDepth line specifies the depth of the ZigZag indicator, and the ExtDeviation line specifies the deviation of the ZigZag indicator. Actually, these are all the settings that affect the search for waves.

Signals

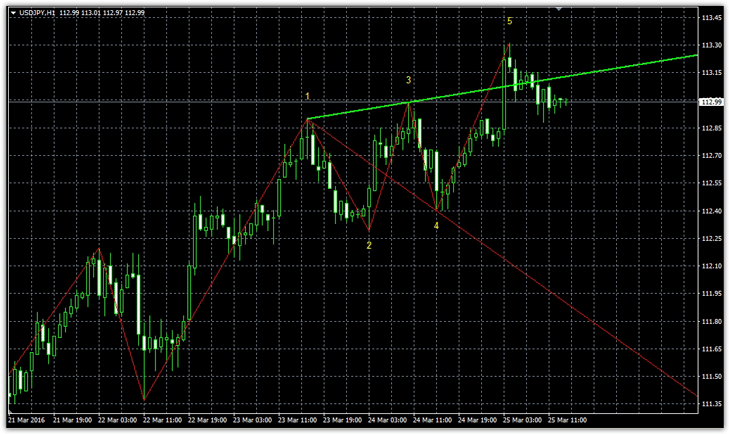

The Wolfe indicator independently marks waves on the chart and numbers them, and in addition to defining them, it draws a signal line between point 1-3-5, as well as a target line between point 1 and 4.

Buy signal:

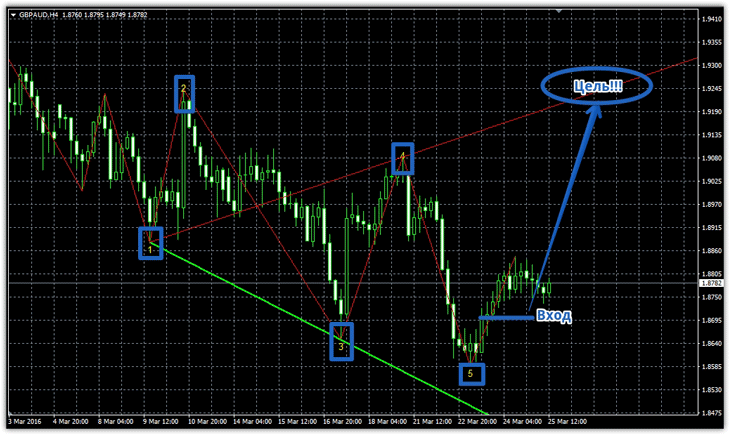

1) The indicator detects a bullish Wolfe pattern.

2) We wait for the price to push upward from point five and enter the position.

The position is entered using a closed bar, and our profit should be on the line drawn between points 1 and 4. Example below:

Sell signal:

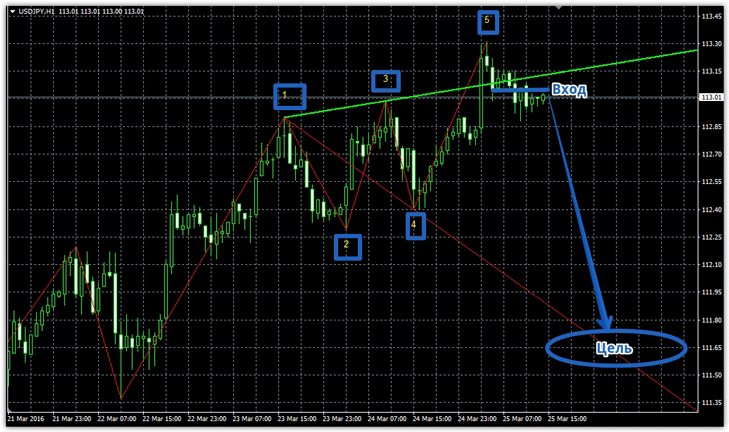

1) The indicator detects a bearish Wolfe pattern.

2) We wait for the price to push down from point five and enter the position.

The position is entered using a closed bar, and our profit should be on the line drawn between points 1 and 4. Example below:

In conclusion, I would like to note that not a single Wolfe indicator is capable of displaying a perfect pattern, as it is written directly in the textbook.

In conclusion, I would like to note that not a single Wolfe indicator is capable of displaying a perfect pattern, as it is written directly in the textbook.

However, you must clearly understand that dry theory is far from practice, and the pattern itself in the real market looks more distorted. Download the Wolfe Wave indicator .