How does inflation affect the price of shares in the stock market?

The recent rise in world prices has caused a significant increase in inflation rates around the world, how does this fact affect the stock market and is it worth buying shares now?

In most cases, the effect of inflation on the price of shares in the stock market is negative and leads to a fall in prices.

The main reasons for the unfavorable situation with high inflation are:

Decrease in purchasing power - investors begin to spend more money on current needs, as a result, the amount of available funds that could be used for investment decreases.

Financial indicators are deteriorating - companies suffer losses due to reduced sales, people buy fewer goods, many companies are forced to reduce production volumes.

A decline in profits leads to a fall in the amount of dividends paid and makes investing in shares less attractive.

An increase in interest rates , on the one hand, causes an outflow of money from the stock market, as investors prefer to buy government securities, which become more profitable than shares.

On the other hand, loans are becoming more expensive, including borrowed funds for companies that could be used for business development.

Inflation has a negative impact on the state’s economy as a whole and causes lack of confidence in the future. Investors are beginning to move money into more stable assets, such as gold , thereby prioritizing safety over profitability.

At the same time, there is also a reverse trend: a decrease in inflation has a positive effect on confidence in the stock market and causes growth in most stocks.

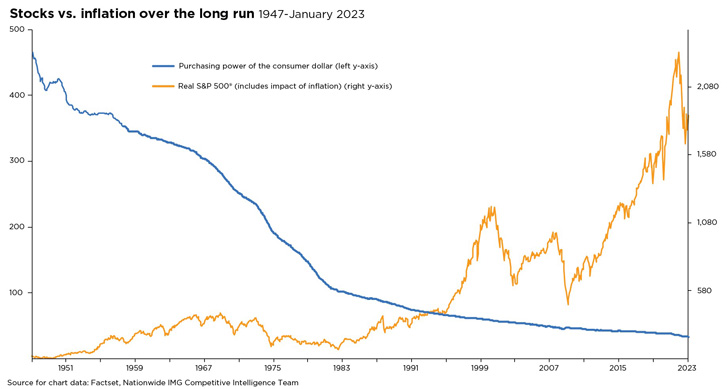

This pattern is easily confirmed by historical facts.

Examples of how inflation affects stock prices

In 2022, US inflation reached a record high of 8.6%. This caused the Fed to increase interest rates, which had a negative impact on the stock market. As a result, the S&P 500 fell 16% year over year.

In 2023, inflation in China fell to 2.1%. This led to a reduction in interest rates by the People's Bank of China, which had a positive effect on the stock market. At the end of the year, the SSE Composite Index grew by 10%.

At the end of 2023, stock indices of most European countries showed growth amid reports of weakening price growth in the eurozone, that is, a decrease in inflation.

For example, the composite index of shares of European companies Stoxx Europe 600 rose by 0.4%, the British stock exchange index FTSE 100 rose by 0.3%, and the German DAX rose by 0.6%.

All of this is to say that investors should consider the impact of inflation when making stock investment decisions.

Brokers for trading shares - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka