Disadvantages of trading using pending orders

Pending orders today are a fairly popular tool among most traders; they save time and allow you to open trades without being behind the screen of a trading platform.

You almost always hear about the advantages that pending orders have, but no one mentions their disadvantages.

Despite the ease of use, pending orders also have some disadvantages that affect the efficiency of trading.

There are not many of them, but they still exist, so it is advisable to take into account these features of trading using pending orders when planning new transactions.

Here are the main disadvantages of pending orders

Failure to trigger – the price may never reach the specified level. In this case, time will be lost during which it would be possible to make a profit:

In this case, time will be lost during which it would be possible to make a profit:

It often happens that the price did not reach the specified value by just a couple of points, and if you observed the situation yourself, you would most likely open a position manually.

Opening at an irrelevant price – the market situation may change and the specified price will no longer be relevant. For example, you placed a buy limit , it should trigger at the lower border of the price channel.

But instead of a rebound from the support line , it was broken, and a buy order was opened, and the price continued to fall, increasing the loss.

Opening at the wrong time - this can be considered a weekend or holiday; if an order is opened on Friday, then a triple swap . And if a gap occurs over the weekend, then the order may be closed on Monday with a loss greater than what you included in the stop loss.

True, this drawback can be eliminated if you limit the lifetime of a pending order using the “Expiration” parameter. In this case, you can limit the order lifetime to Thursday.

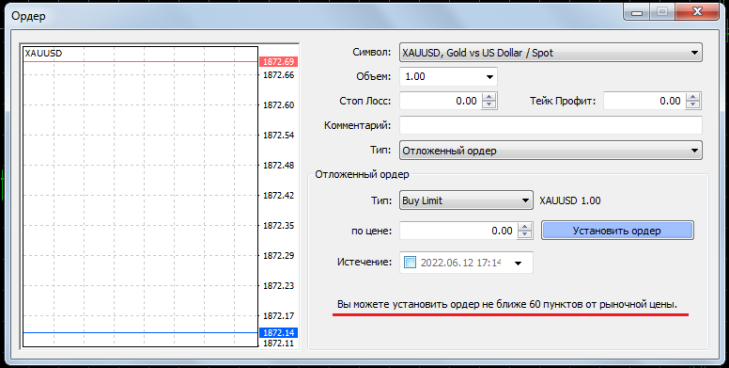

Installation restrictions - some brokers impose restrictions according to which the price in a pending order must be at a certain distance from the market, otherwise you will not open a position.

As a rule, this is 40-60 points, in some cases such a small distance plays a role.

Despite the above-mentioned disadvantages, pending orders still remain one of the most popular tools of a trader’s trading platform.