Risks of investing in shares and options for hedging them

Many people associate long-term investments with investing money in an asset such as securities.

Most potential investors primarily focus on the size of dividends that are accrued when purchasing company shares.

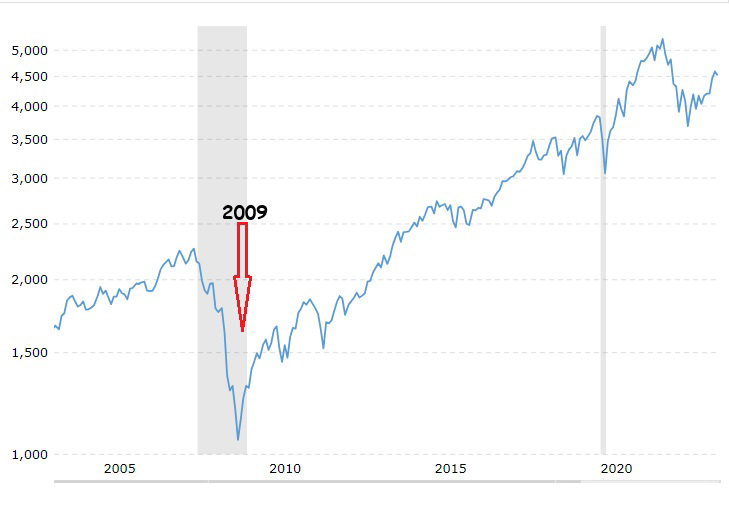

But at the same time, forgetting about the possible risks that exist in this area of investment, first of all this is a decline in stock prices.

This issue is especially relevant today, when most experts warn of a high probability of recession in the United States and other large economies. According to preliminary estimates, the probability of a recession in the United States in 2024 is estimated at 71%.

At the same time, dividends on shares very rarely exceed 5% per annum, that is, if the shares of a company in which you invested money based on dividends fall by 50%, it will take 10 years just to compensate for the losses.

Reducing the risks of investing in stocks

There are two ways to reduce the risk of loss when investing in securities - diversification and hedging.

Diversification - the essence of this technique is quite simple; when choosing securities, you should choose assets that do not have a correlation.

It’s even better to invest in shares of companies from different countries, not related economies. For example, shares of American, Japanese and Indian companies.

This approach will allow you to compensate for losses when the price of some assets falls by increasing the value of other shares.

At the same time, some investments can be made in ETF , which specialize in investments in precious metals.

Hedging is a technique in which you buy and sell the same security at the same time.

This can be done if you buy shares from a broker who pays dividends, and sell them using CFD contracts in a brokerage company where dividends are not taken into account for such trading.

For example, you buy shares of NVIDIA in the usual way and immediately sell a similar volume, but through CFD contracts.

Thanks to this, when the price of NVIDIA falls, losses are compensated by profits on a sale transaction using CFD contracts.

True, this method also has its disadvantages:

- You need to find a broker who does not take into account dividends when trading shares using CFDs. Otherwise, the dividend amount will be debited from the account upon a sale transaction.

- When calculating, take into account the amount of swap on shares so that the amount of the fee for transferring positions does not exceed the amount of dividends on the purchased shares.

Now is not the best time to invest in stocks, but if you still want to do so, choose securities of companies that have already fallen in price and may begin to rise.

Brokers for trading shares - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka