Listing of cryptocurrencies, is it worth investing in new assets?

Almost every day new digital assets are created in the world; the cost of creating your own cryptocurrency today is only a couple of tens of thousands of dollars.

But the newly created coin is, so to speak, money for internal use; the real value of such an asset is in doubt.

In order to determine how much a coin is actually worth and increase its popularity, a listing of the cryptocurrency is necessary.

Cryptocurrency listing is the listing of an asset on a digital exchange, after which this coin will begin to be bought and sold in accordance with market laws.

Typically, the listing procedure consists of several stages - first, a description of a new asset appears on the trading platform, then the asset is added to the list of those available for trading. It is the start date of trading that will be the beginning of the listing of the cryptocurrency.

Earnings from cryptocurrency listing

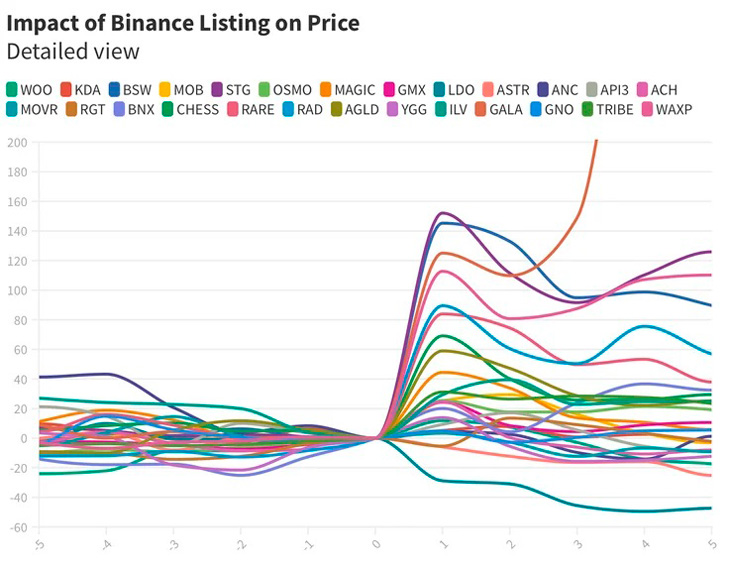

According to many investors, listing cryptocurrencies is an excellent chance to make money by increasing the liquidity of a new cryptocurrency. It is generally accepted that after the start of trading, coins usually increase in price, and such an increase can be hundreds of percent.

In order to earn money, you need to monitor announcements of the appearance of new cryptocurrencies in the list of available assets on one of the popular crypto exchanges, for example, the same Binance .

Once operations with the selected coin have become available, it is purchased and all that remains is to wait for the price to increase.

But the main question that most investors ask is how guaranteed are earnings from listing a cryptocurrency? Does the price of a new asset always increase after the start of trading?

Surprisingly, yes, according to a study by one of the analysts, most new cryptocurrencies grow in the first days after listing:

Subsequently, price growth slows down, and some assets even begin to actively fall in price. Moreover, the number of coins whose price began to fall immediately after the start of trading is much less than those that rose in price after entering the exchange.

And this is understandable, because the listing strategy is quite popular, and many investors begin to actively buy new coins immediately after they appear on the exchange. Afterwards, interest wanes, and players get rid of dubious assets.

I myself do not use a similar strategy due to the high risk of bankruptcy of crypto exchanges, as a result of which one will not only not earn money, but even lose all the money in the account.

In my opinion, it is less risky to make transactions through regular brokerage companies - https://time-forex.com/kriptovaluty/brokery-kriptovalut