Cryptocurrency swap, and is it worth paying attention to?

When trading on the stock exchange, a certain commission called a swap is paid for transferring a transaction to the next day.

Swop - in simple terms, a swap is the difference between the interest rates on a deposit in one currency and a loan in another.

That is, it is understood that when making a transaction on the eur/usd currency pair, you borrow one currency at interest, and you own the other and for this you receive a reward in the form of interest on the deposit.

The amount of interest itself is set depending on the discount rates of national banks for a particular currency. More information about swap - https://time-forex.com/praktika/svop-fx

Is there a swap for cryptocurrencies?

If with regular currencies the size of the commission for rolling over positions to the next day depends on the discount rate of national banks, then what about cryptocurrencies? Do I need to pay a swap when rolling over a cryptocurrency transaction to the next day?

Surprisingly necessary if you trade cryptocurrency through a trading platform using CFD contracts .

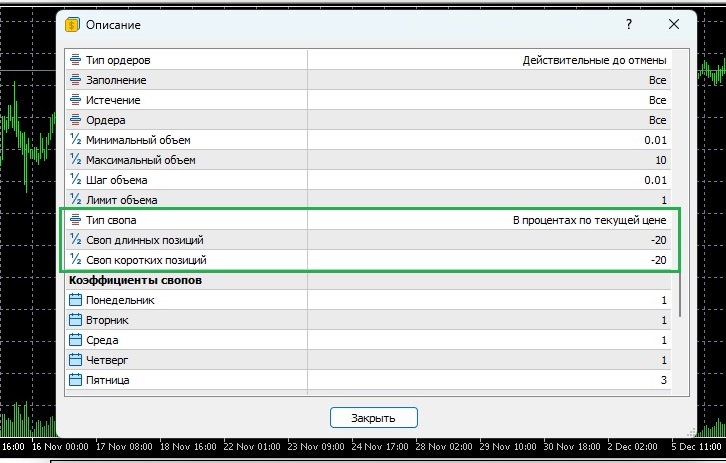

At the same time, you can see the size of the swap for cryptocurrencies both on the broker’s website and in the trading platform itself by opening the specification for the selected asset:

On average, the fee for transferring a transaction is about 20% per annum, which is approximately 0.055% per day; on Friday, a triple swap is traditionally charged.

How much does a cryptocurrency swap affect the outcome of a transaction?

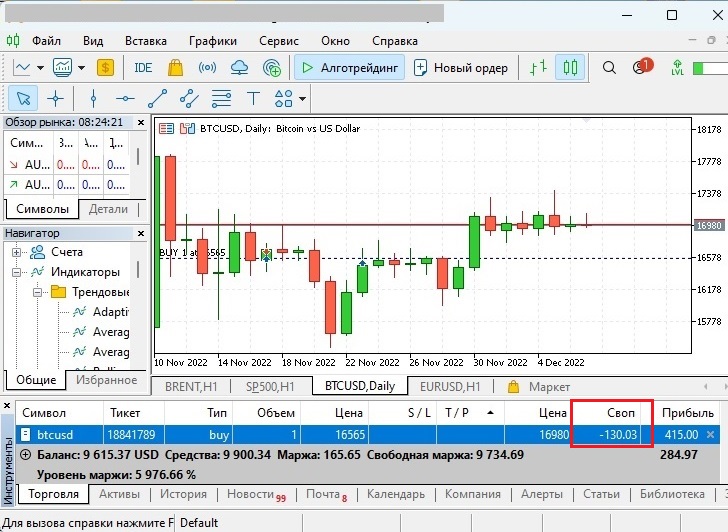

The easiest way to understand the power of influence of a swap on the financial result of a long-term transaction is by using a specific example:

For 13 days of the existence of an order for BTC/USD with a volume of 1 lot, the commission for transferring positions was 130 US dollars, that is, 10 dollars per day.

If we take into account the fact that Bitcoin can easily rise or fall in price by several hundred or even thousands of dollars in a day, then we can say that the swap has virtually no effect on the financial result of the transaction when trading cryptocurrency pairs.

With this in mind, you can use both short-term and long-term trading strategies in your trading, although I myself prefer intraday trading.

Brokers for cryptocurrency trading - https://time-forex.com/kriptovaluty/brokery-kriptovalut