Trader's trade analyzer

Analysis of completed transactions has always made it possible to reveal the strengths and weaknesses of a trader’s trading strategy. Many people do not attach importance to such analysis, but with experience you begin to understand that it is in the history of transactions that all the necessary answers are hidden, thanks to which you can avoid many mistakes in the future.

a trader’s trading strategy. Many people do not attach importance to such analysis, but with experience you begin to understand that it is in the history of transactions that all the necessary answers are hidden, thanks to which you can avoid many mistakes in the future.

Trade Analyzer is an innovative online service that has become available to all clients of the Amarkets broker.

Previously, to analyze transactions and trade in general, it was necessary to spend more than one part of time or use additional programs, which in most cases are distributed only on a paid basis.

The broker conditionally divided the service into five main blocks, namely: “Analysis by month”, “Trading account monitoring”, “Trading activity”, “Deposit loading indicator”, “Recommendations”. A particularly useful block that is worth paying attention to is “Analysis by month” due to the fact that it is the most informative.

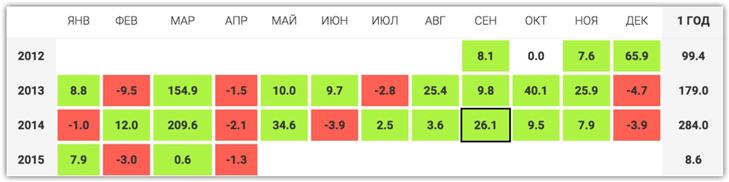

In the “Analysis by Month” section, you have access to information with the dynamics of your account development for the entire trading period by month as a percentage of profit or loss from the deposit.

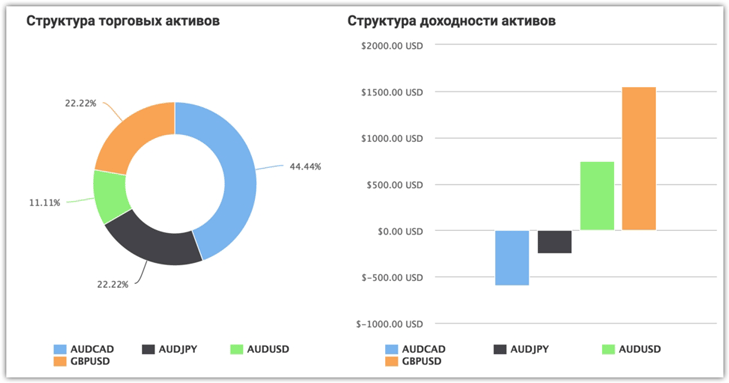

In the same section, you can familiarize yourself with the structure of trading assets, namely for which instruments you opened positions as a percentage of the total number of transactions, and see the profitability of certain instruments on the chart.

In the same section, you can familiarize yourself with the structure of trading assets, namely for which instruments you opened positions as a percentage of the total number of transactions, and see the profitability of certain instruments on the chart.

Such an analysis will allow you in a matter of seconds to discover the instrument on which you in most cases suffer losses, but because of the profits on other transactions you simply do not notice.

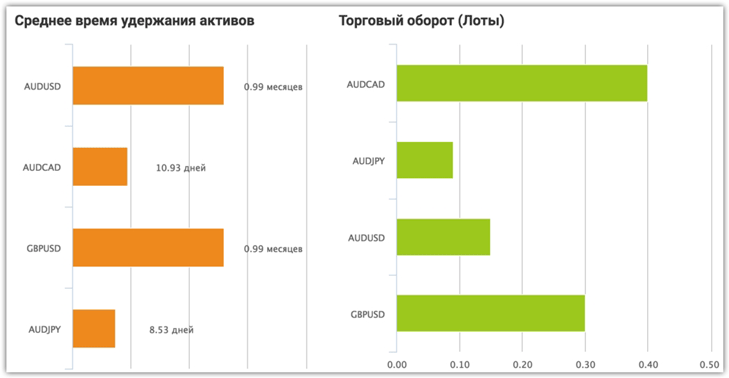

The trade analyzer displays the average holding time of an asset, namely the average time a transaction is in the market, as well as the trading turnover in lots for each instrument.

The trade analyzer displays the average holding time of an asset, namely the average time a transaction is in the market, as well as the trading turnover in lots for each instrument.

Very often, the cause of unprofitable positions is the insufficient retention of the transaction in the market and its immediate closure, and information on the average life of a particular transaction on a certain instrument will help you immediately see what you are doing wrong in relation to other profitable transactions.

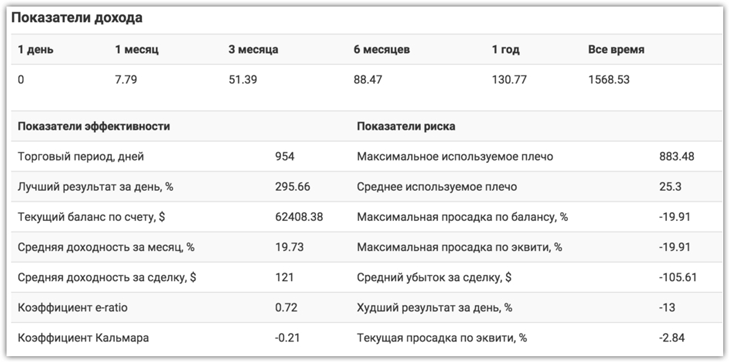

In the “Trading Account Monitoring” section you will be able to view information that reflects the effectiveness of your trading, namely risk indicators and performance indicators.

In the “Trading Account Monitoring” section you will be able to view information that reflects the effectiveness of your trading, namely risk indicators and performance indicators.

Additional indicators.

If we talk about performance indicators, you can find out the Squid Ratio, e-ratio, average profit per trade, average profit per month as a percentage, best result per day.

In relation to risks, the trade analyzer will provide information on maximum drawdown, maximum drawdown %, maximum leverage used, average leverage and much more.

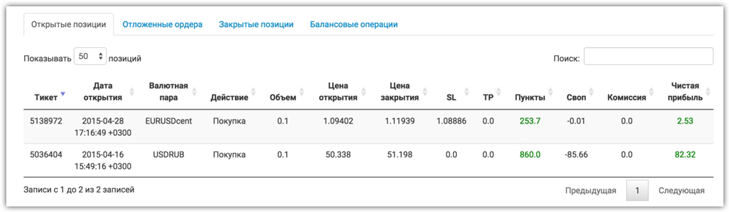

The “Trading Activity” section stores all your opened and closed trades, including pending orders, which the trade analyzer uses as initial information. This section also makes the analysis process more convenient for the trader, since you do not have to open MT4 to see information on closed transactions.

The “Trading Activity” section stores all your opened and closed trades, including pending orders, which the trade analyzer uses as initial information. This section also makes the analysis process more convenient for the trader, since you do not have to open MT4 to see information on closed transactions.

Broker Amarkets has created an excellent visual indicator, thanks to which you can see the loading of your deposit. Its main purpose is to display how risky your trading style is.

Broker Amarkets has created an excellent visual indicator, thanks to which you can see the loading of your deposit. Its main purpose is to display how risky your trading style is.

If the indicator arrow is in the red or yellow area, then you should reduce the aggressiveness of your trading (work on money management).

The fifth and final section of the Analyzer is “Recommendations”. In this section, the service provides comprehensive recommendations that relate to your leverage, drawdowns, the absence or presence of stop orders, and much more on those parameters in which the service sees a deviation from the norm.

In general, services of this kind can make it easier to work on a trader’s mistakes, and a truly honest broker is primarily interested in the success of his clients.

You will find the analyzer itself on the Amarkets page - www.amarkets.org