Make your trading more effective with a trade analyzer

Many traders change trading strategies, indicators and programs day after day after a loss on Forex.

For some, this search for a truly working algorithm even takes years.

However, as practice shows, not one of those traders who puts their next trading strategy into a black box every day has conducted a full analysis of their own trading. In fact, every professional knows that the devil, as always, lies in the details, which few people are aware of.

Thus, the same Forex strategy can show completely different results on different currency pairs and even at different times of the day.

Naturally, in order to learn about the strengths and weaknesses of a strategy, it is necessary to conduct many hours of painstaking analysis.

Trade analyzer from Amarkets

As already noted, analyzing a trader’s trade is a rather painstaking process that requires endurance and mathematical skills from the trader.

Understanding the need for self-analysis for a trader, broker Amarkets for its own clients, it launched a special service “Trade Analyzer”, which in a matter of minutes can introduce you to the basic characteristics of your trading, as well as help identify the shortcomings of your tactics.

Moreover, unlike similar programs and services, Trade Analyzer provides clear recommendations for eliminating certain shortcomings in your trading.

The trade analyzer is available to all traders without exception who have accounts with the Amarkets broker. In order to launch the analyzer, just click on the “Trade Analyzer” button opposite your chosen trading account in your personal account.

Trade analyzer interface

After the first launch of the analyzer, you will be able to see five tabs in front of you, namely “Analysis by month”, “Trading account monitoring”, “Trading activity”, “Deposit loading indicator”, “Recommendations”.

So, let's take a closer look at each tab and the information it contains.

1. Analysis by month

In this tab, you can select a time period and get data on your trading for each month, day of the year as a percentage.

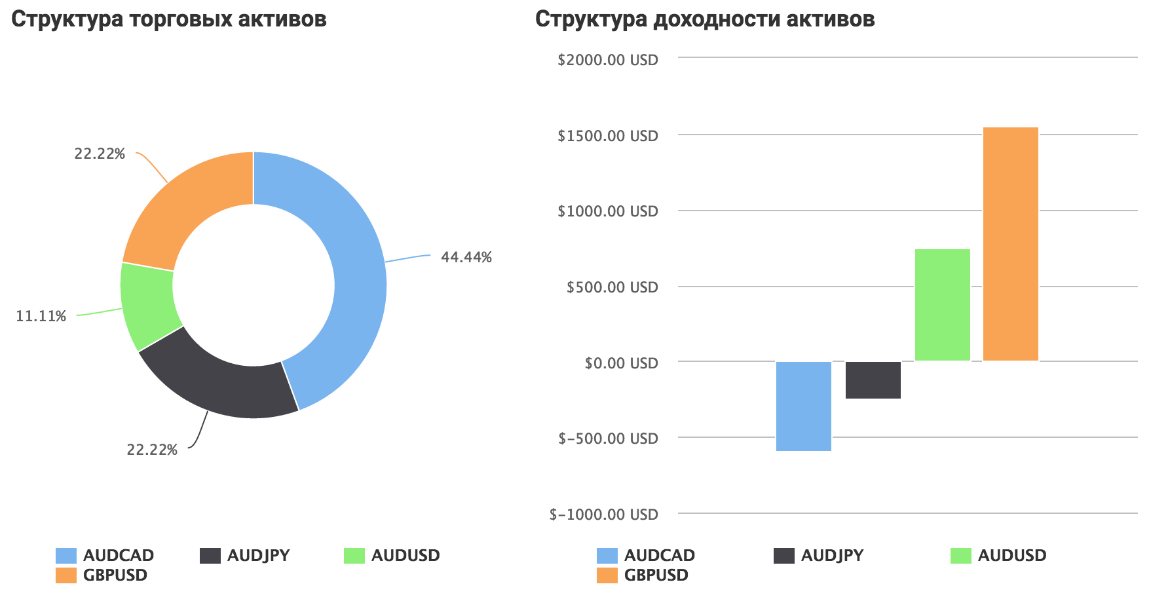

Also in this tab you can see the structure of your trading assets that you use in trading, as well as the profitability or loss of a particular currency pair.

In addition, you can see information about how long on average you hold a position as well as your trading turnover.

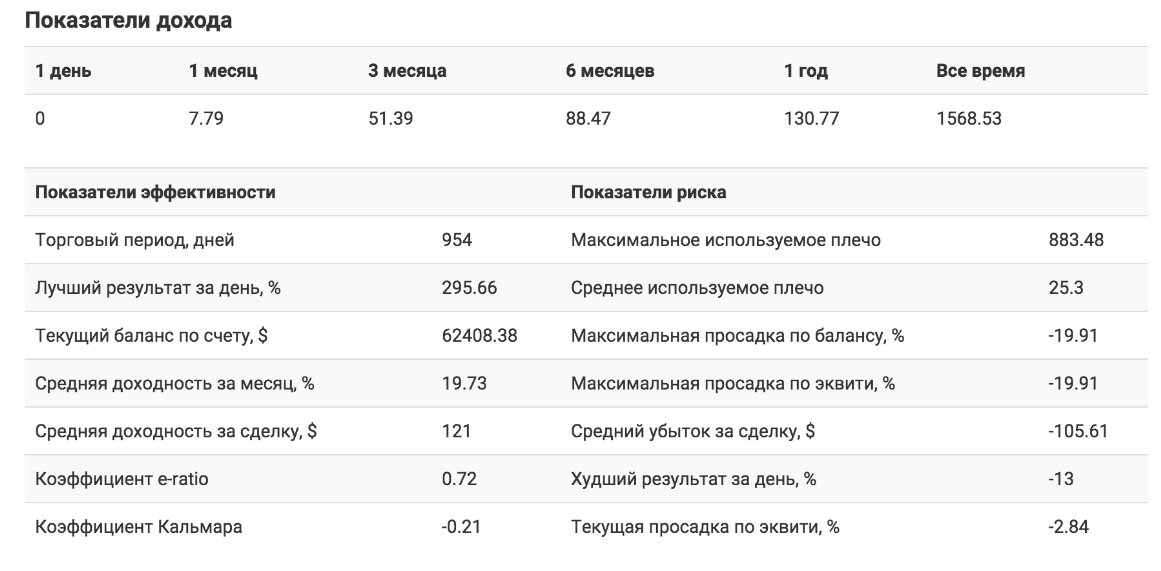

2 Monitoring your trading account

In this tab you can get data on the leverage you use, data on profitability and drawdown, and also see a graph of the growth of your funds as a percentage.

In addition to the basic data, in the table the analyzer displays information about the best and worst deal, the average profitability of the deal, both as a percentage and in the deposit currency, the recovery coefficient and the Kalmar coefficient, the maximum drawdown in equity and balance, as well as the current drawdown .

3 Trading activity

In this tab you can get acquainted with the list of your open current orders, pending orders, closed positions, as well as balance transactions (replenishment and withdrawal).

It is worth noting that all the information is laid out in the form of a table, inside which you can see the opening and closing price of a particular transaction.

Its direction and placement of stops and profits, the result of the transaction in points and deposit currency, as well as the value of the swap , commission and net profit from the operation.

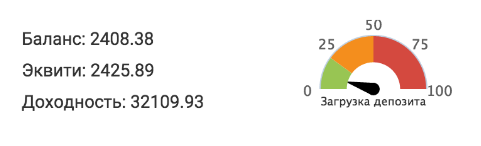

4 Deposit loading indicator

The deposit loading indicator is designed symbolically in the form of a speedometer, which is divided into zones.

So, thanks to this simple tool, you can see how aggressively you are trading, and the further the speedometer needle is from the green sector, the greater the drawdown you allow and the more aggressive your trading.

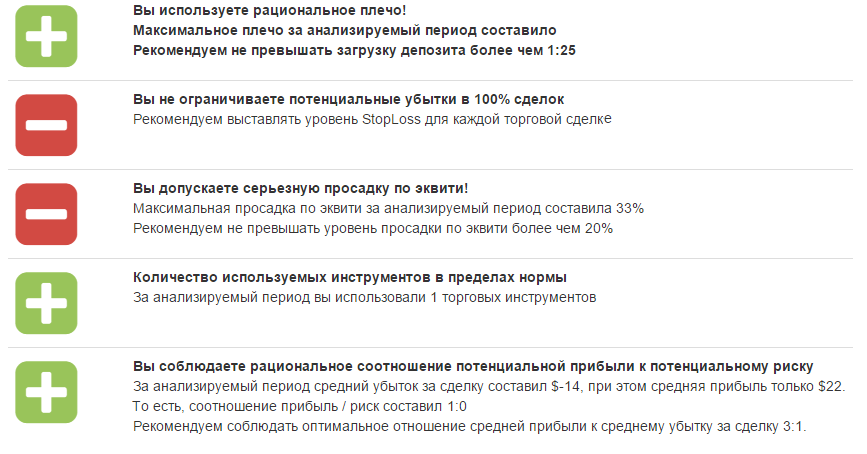

5 Recommendations

As already noted, the Trade Analyzer not only provides information, but also gives practical advice, highlighting those critical points that may affect the performance of your trading.

It is worth noting that this tab provides only superficial data; you must draw deeper conclusions yourself based on the data obtained from the tabs discussed above.

In conclusion, it is worth noting that thanks to the built-in trade analyzer in your Amarkets personal account, the process of analyzing your own trading is simplified to the point of impossibility, and thanks to the data obtained, you can easily make your trading more effective than it was before.

More details about this tool can be found on the page https://www.amarkets.org/laboratory/trade/