The cTrader trading platform is the choice of professionals

No matter what anyone says, the MT4 trading platform, which is so loved by many experienced players due to the abundance of software solutions, was created for trading on standard accounts, namely when there is an intermediary, your broker, between you and the market.

For such a scheme of work, MT4 was really the best choice, since its speed and signal processing, along with convenient functionality, is really the best solution.

However, with increasing competition in the brokerage segment, companies have to constantly improve and improve their trading conditions, which has led to the emergence of ECN accounts.

ECN accounts are characterized by a complete absence of intermediaries, namely, you work directly with market participants, so the size of the commission, the speed of order execution and trading opportunities simply reach a different level, which is something that everyone’s favorite platform can hardly provide.

The brokerage company RoboForex, being one of the leading companies in the provision of brokerage services in the Forex market, has offered a new revolutionary ECN trading platform cTrader.

The cTrader platform allows you to take a deeper look at market information, as it now has three different order books that can show the full depth of the market.

Due to the platform's focus on ECN, the speed of opening orders takes less than a second. Installation.

Appearance When downloading the platform from the RoboForex website, you need to install it.

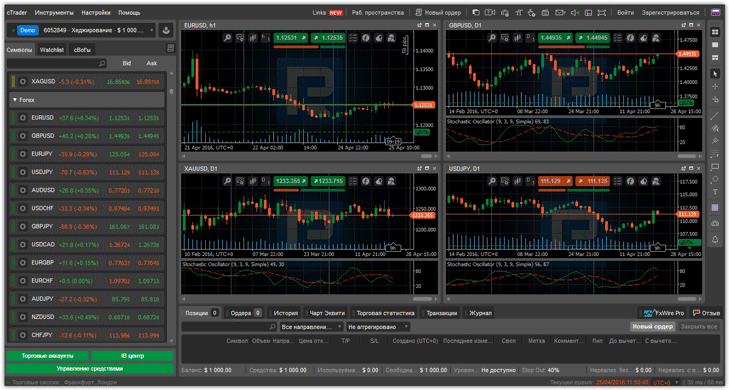

Generally speaking, installing cTrader is similar to installing any program on Windows, so no problems should arise. After the first launch, you need to enter your login and password, which you will receive in your broker’s personal account. It is worth noting that it makes no difference whether it is a real account or a demo; you do not have to do any manipulations with the settings and service. So, after the first launch you will see this appearance:

Similar to Mt4 in cTrader, three main working areas can be distinguished, namely, on the left there is a symbol area where you can select any currency pairs , in the center there is a chart area, and at the bottom there is an information area on open positions and historical data from the journal.

The first thing that immediately catches the eye of every trader is the correctly grouped symbols into their categories. So in the symbols area you can see groups such as forex, metals, indices and so on.

It is also worth noting that stocks are broken down both by sector and by country, which makes it very easy to find the right tool.

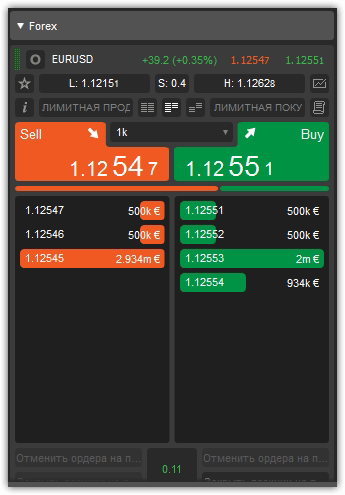

By clicking on the symbol you are interested in, you can view the market depth. By default, you can use three types of order books, which switch between each other and display real orders from banks. Technical capabilities.

Working with charts The cTrader trading platform has built-in non-standard chart periods.

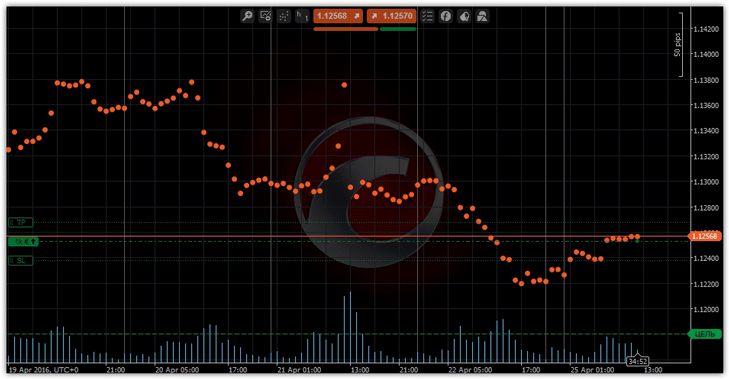

So by default you can switch to the following time frames: m1, m2, m3, m4, m5, m6, m7, m8, m9, m10, m15, m20, m30, m45, n1, n2, n3, n4, n6, n8 , n12, d1, d2, d3, w1, mn1. It is also worth noting that the platform has three types of charts by default: candlestick, bars, line, and dot. An example of a scatter plot is shown below:

Graphical analysis tools and cTrader

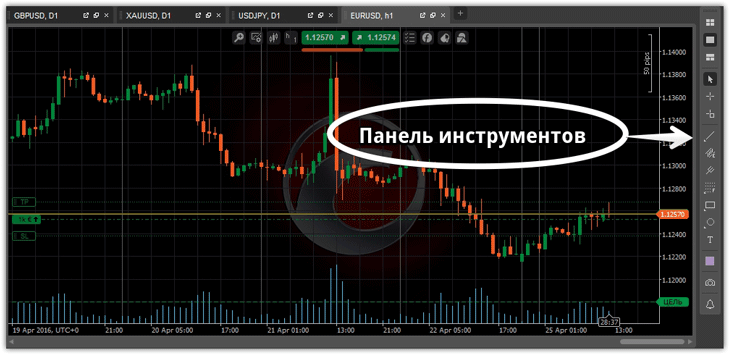

When getting acquainted with the platform, the first difficulty we encountered was finding graphical analysis tools. The developers have rather absurdly moved the toolbar to the right, which blends very much into the background. So that you don’t have any problems finding it, look at the picture below:

The principle of working with the tools is very simple, namely, we select the icon we need and carry out manipulations on the chart itself. The following graphical analysis tools are available to us: vertical line, trend line, horizontal, ray, equidistant channel, Andrews pitchfork , Fibonacci lines, Fibonacci fan, Fibonacci extensions, arrows and symbols, figures.

The platform also implements two interesting extensions, namely a sound alert for the price, as well as a screenshot of the chart at the touch of a button.

Technical analysis tools and cTrader

In terms of technical analysis, the cTrader developers have made significant progress, integrating more than 50 different technical indicators into the platform.

In order to add any indicator you are interested in to the chart, right-click on the chart and call up an additional menu where there will be an indicators item. As in MT4, the developers divided the indicators into the following categories: Trend, Oscillators, Volatility, Volume, Other, custom. In order to remove an indicator from the chart, you need to go to the “Objects” section in the same menu where you added indicators and delete the instrument you do not need.

In addition to standard indicators, you can use custom ones, which you either program yourself or download from any information resource.

Opening a position.

An invisible plus that simplifies your work. The process of opening orders is practically no different from trading in the MT4 trading platform.

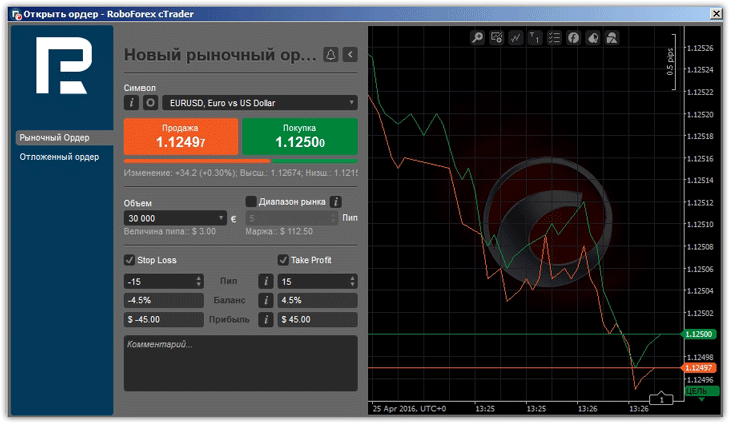

By default, you can use two methods to open positions, namely with one click in the symbol panel or by calling an additional menu. You can work with both market orders and pending ones. When you set a stop order in points, the terminal automatically displays in percentage terms how much you can lose, as well as how much you can gain for a given profit. Having opened the first position, you will be very surprised when, instead of the usual lot, you see the monetary equivalent of the volume, which is considered the norm for all professional platforms:

Working with open orders.

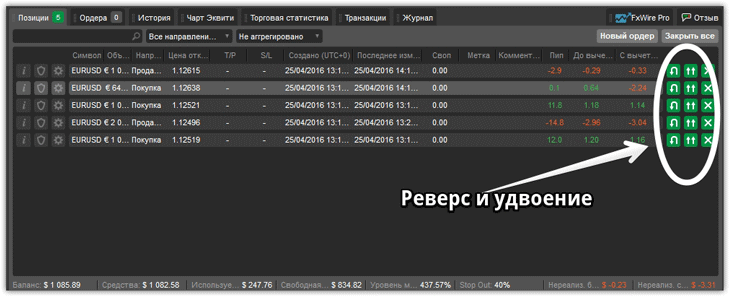

Trader statistics In the cTrader trading platform, the developers have implemented two simple, but at the same time useful functions: reverse and double a position.

For many traders, this function will seem like a small thing, but in order to implement such a function in MT4, many traders have to use various scripts. To perform an operation, you need to click on the corresponding icon in the list of transactions or directly on the chart:

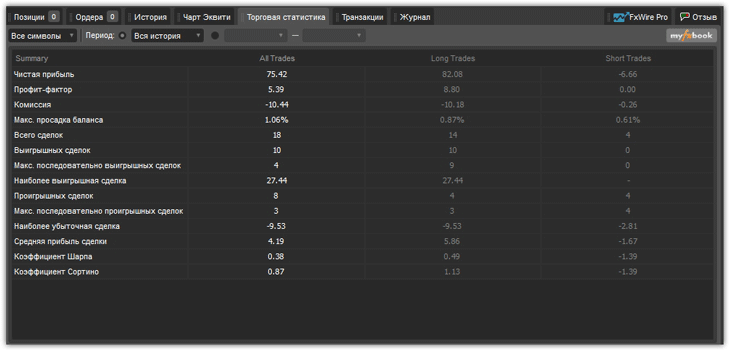

Having closed a certain number of transactions, you can get acquainted with detailed statistical information on your trading strategy.

So in the bottom panel of transactions, select the “Statistics” tab. The terminal will automatically show you the profit factor, net profit, commission, maximum balance drawdown, number of won and lost trades, Sharpe ratio , Sortino ratio and much more for a certain period.

In conclusion, it is worth noting that the developers of the cTrader trading terminal do not stand still and constantly carry out various updates, improving and supplementing the functionality of the program. Today cTrader is the best trading platform for ECN trading.

You can always download the trading platform itself from the broker RoboForex - http://www.roboforex.com/trade-conditions/ctrader/