cAlgo program

Automation of trading operations is a real way to solve the problem of human factor intervention in the trading process.

Thus, an ideally profitable strategy tested on historical data turns out to be far from the indicators that we get in real trading.

Do you think it’s all about the broker, strategy tester, order execution speed, and the like? No, dear ones, it’s up to us!

cAlgo program is a special application that adds and improves ECN functionality cTrader trading platform allowing the use of various automatic algorithms, and in simpler terms, robots.

Many traders at the initial stage considered cTrader’s big drawback to be the inability to create automatic trading strategies and indicators, but with the help of the cAlgo application, the developers eliminated this drawback.

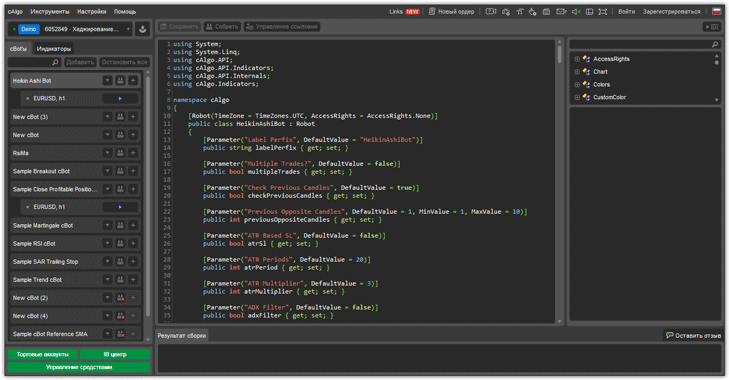

This application has its own editor, in which a trader, having studied programming, can write complex algorithms in C#.

Installing cAlgo

The familiar MT4 advisors in the cTrader trading platform are usually called cBots, but the ability to edit, test, and optimize them is possible only in the cAlgo program.By default, this application is not installed, although it is an integral and indispensable part for cTrader. So where can you get this app? First, you need to launch the cTrader trading platform and in the left main tab with symbols, switch to the cBots tab.

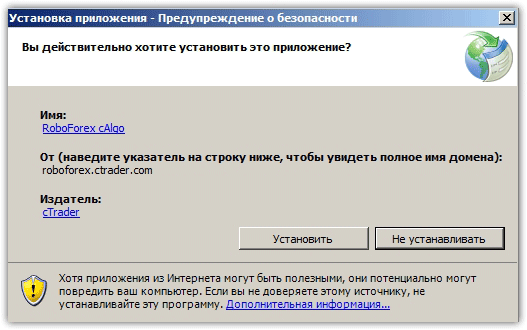

A list of standard advisors will appear in front of you. Hover your mouse over one of them and right-click to bring up an additional menu in which you need to click on the “Open in cAlgo” item. A window will appear in front of you in which the trading terminal will offer to install cAlgo.

Actually you will get the following working environment:

Testing

Working with the editor will not raise questions only for the programmer, and for the average user, the more important functions in cAlgo are the ability to test and optimize ready-made developments for this platform.

Working with the editor will not raise questions only for the programmer, and for the average user, the more important functions in cAlgo are the ability to test and optimize ready-made developments for this platform.In order to see the tester, first we need to exit the editor, namely, go to the chart area where the adviser directly works.

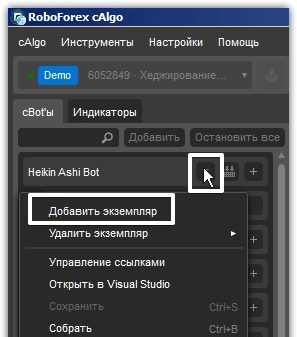

To do this, select the advisor we like and click on the arrow on its name, where in the additional menu you need to click on “Add instance”.

Afterwards you will see a chart where your advisor will start working automatically. It is very important that you need to disable the advisor at the top of the chart, since its profitability is far from question.

Directly above the graph there are three tabs, namely currency pair, Backtesting, Optimization.

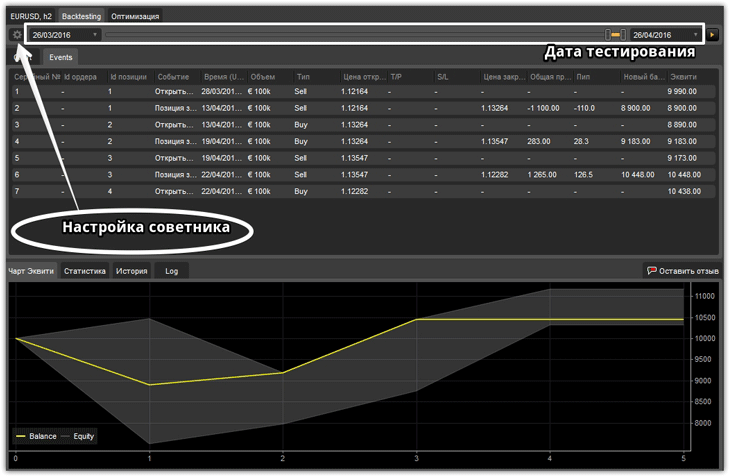

In order to conduct testing, open the Backtesting tab. In the window that appears, you will see a slider with which you can specify the date for testing, and by clicking on the icon to the left of the slider you have the opportunity to change the test settings.

After launch, you will see certain trades, as well as an equity chart:

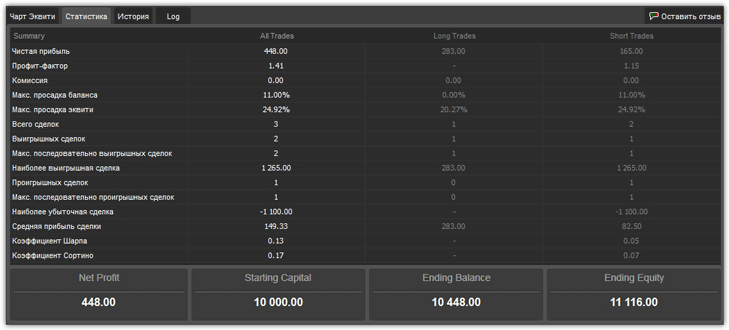

By switching the tab in the tester to statistics, you can get acquainted with more detailed information on the behavior of the adviser on the selected historical period. These indicators include: profit factor, net profit, maximum balance drawdown, maximum equity drawdown, Sortino coefficient, Sharpe ratio and other indicators:

Optimization

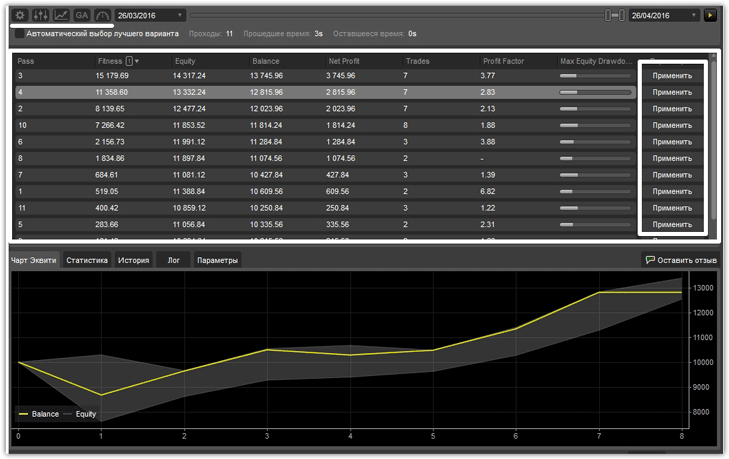

In order to optimize the advisor after testing, you need to switch to the “Optimization” tab at the top of the tester slider. Just like in the tester, you need to select the testing period using the slider. The cAlgo program offers two optimization options, namely a genetic algorithm (such as in standard MT4) and a grid algorithm.

Which option to choose is up to you. Also in the left corner there are icons by clicking on which you can change the EA testing parameters, set optimization criteria, and also limit the load on the computer processor so that it, in turn, does not slow down as happens when optimizing complex algorithms.

After you run the optimization, cAlgo will offer you options for settings, next to which there will be an “apply” button for their approval.

So, having made a detailed review of the cAlgo program, we can say with confidence that the process of testing and optimizing advisors takes much less time and effort than in trading MT4 platform.

It is also worth noting that thanks to the C# programming language, you can create very complex algorithms, and the number of people programming in this language is an order of magnitude greater than in MQL, which greatly simplifies the search for a programmer on the freelance exchange and reduces the cost of the order.