An example of creating an advisor in the constructor

Today, automation of the Forex trading process is not just a whim, as it was before, but a vital necessity.

Creating an advisor is the best solution to a person’s corrupted discipline, absent-mindedness and greed.

Many people avoid automating their systems because they believe that they need to know a programming language or pay a lot of money to a programmer to implement their own ideas.

In fact, traders who know the programming language have long prepared solutions for people like you and me and created special advisor designers.

Thanks to them, you can realize almost any of your ideas.

Despite the fact that there are a sufficient number of advisor designers on the network, the problems in creating them remain quite acute. Unfortunately, people who launch constructors for the first time see many different designations and signs that scare them away and do not allow them to move on.

Understanding this problem, we decided to write an article with an example of creating an advisor in Ensed Cor constructor.

Strategy

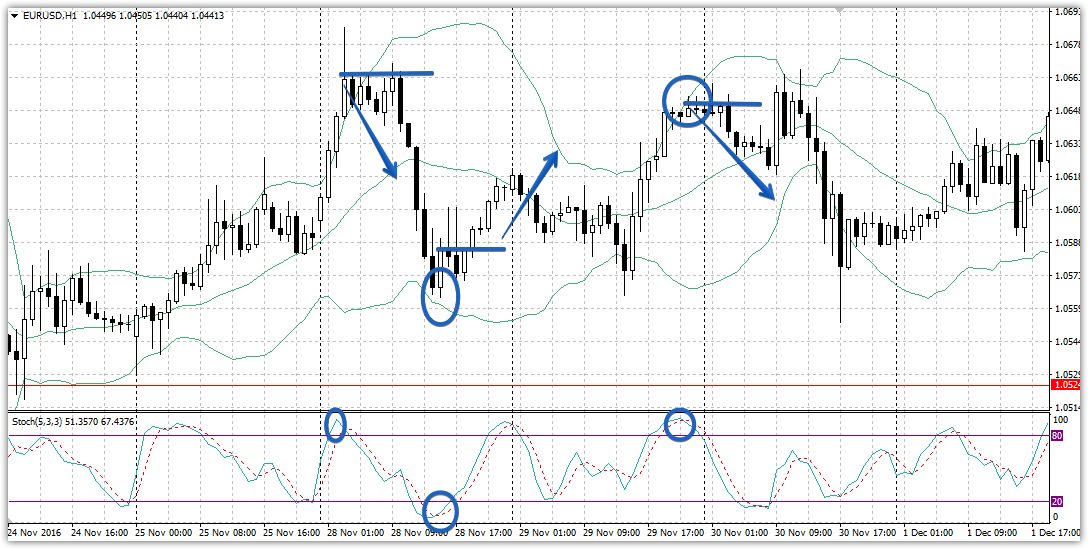

For automation, we chose a fairly simple strategy based on the Bollinger Bands and Stochastic indicator. It is no secret that Bollinger Bands form a kind of channel, from the boundaries of which traders either buy or sell.

The stochastic oscillator allows you to identify overbought and oversold zones by amplifying the signal from the bands. Actually, this strategy is far from new and is familiar to all traders.

So, we buy if the price has touched the lower bollinger band and the stochastic is in the oversold zone, and we sell if the price has touched the upper border of the bollinger band and the stochastic is in the overbought zone. You can see the strategy on the chart below:

Creating Strategy Criteria in Ensed Cor

After we have decided on the strategy, we need to look at the rules of tactics from the side of the programmer and designer. Thus, the strategy involves the interaction of price and Bollinger band, and the instructor's set contains a modest set of comparisons and variables.

So, if we look at it from the perspective of the algorithm, then entering the market to sell does not occur at the moment of touch, but if the closing price is higher (greater than) the upper bollinger band, and the stochastic line is higher than the 80 level.

Thus, to enter a sell position, we need to meet two simultaneous conditions, namely, the closing price must be above the upper band, and the stochastic line must be greater than the 80 level.

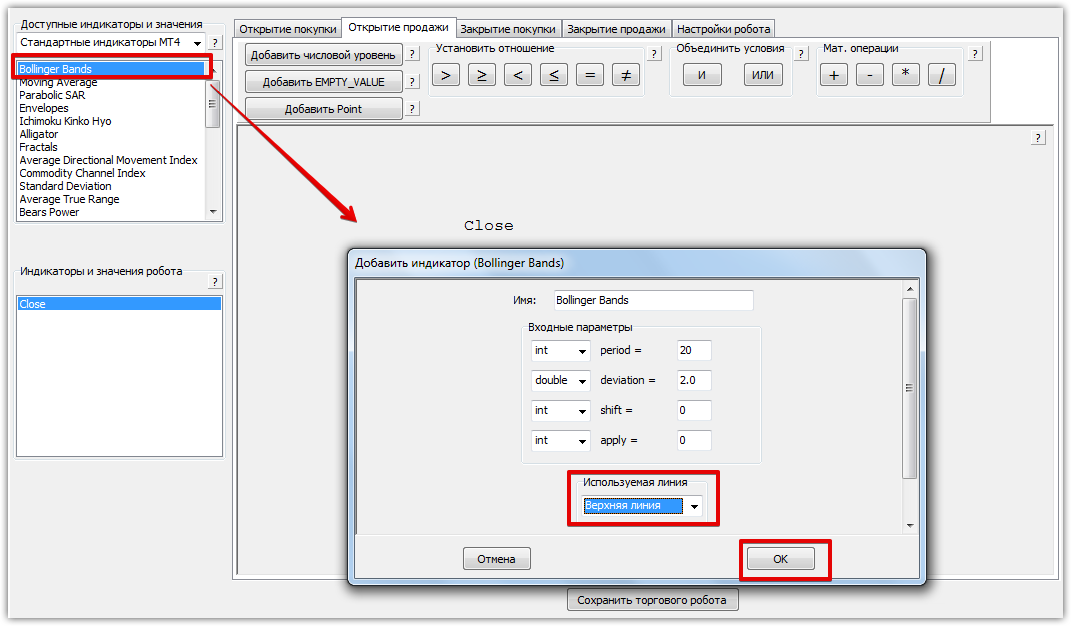

To implement the idea, in the upper left corner in the “Available indicators and values” line, drag the value “Close” and Bollinger Bands to the area where you open a sell position. When adding a Bollinger, select "Top Line" from the Line Used menu.

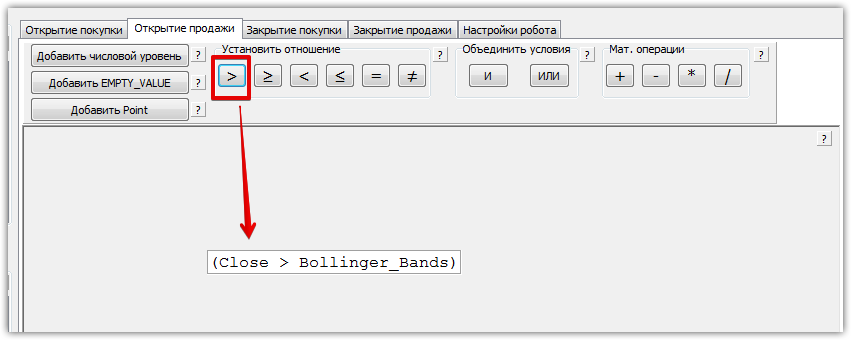

Next, highlight these two variables and indicate that the closing price is greater than the upper line of the Bollinger indicator. To do this, you need to select the greater than sign in the “establish relationship” section.

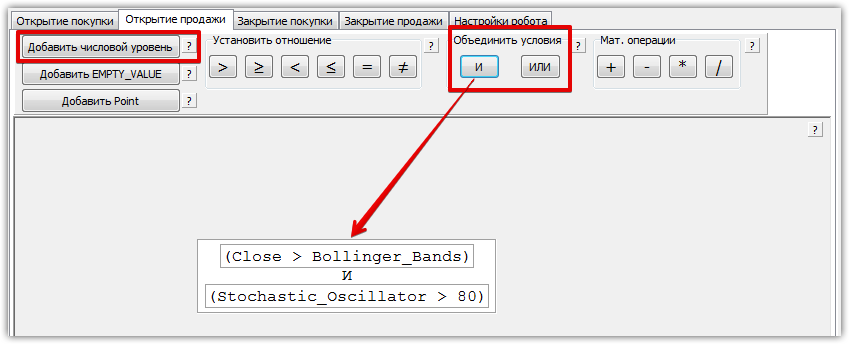

Next, we specify the second condition, namely, drag the Stochastic indicator onto the work area. Since we will be working with an overbought level, we will need to add a numerical level of 80. As in the first condition, we choose that the value of the stochastic line should be greater than the level of 80.

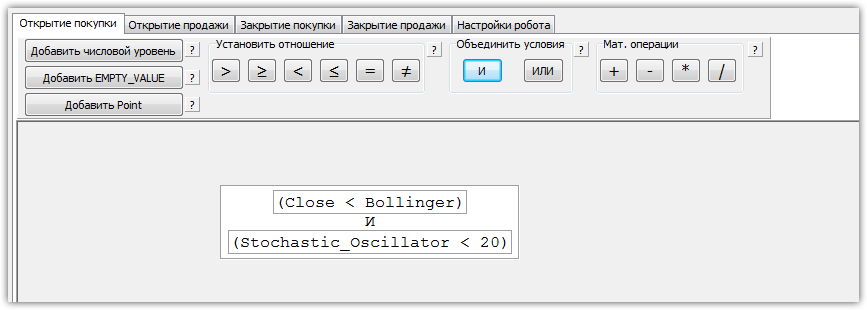

Since these conditions must be met simultaneously, it is necessary to combine the blocks by highlighting and clicking the letter “I” in the “Merge conditions” item. Example:

Next, using a similar principle, we assign conditions for buying, only in this case the lower limit of the bollinger and the oversold level of 20 are taken into account. The formula for entering the market and comparison is the opposite. Example:

Since exit from the market will occur either by profit or by stop order, we do not specify the conditions in the paragraphs “Closing a purchase”, “Closing a sale”.

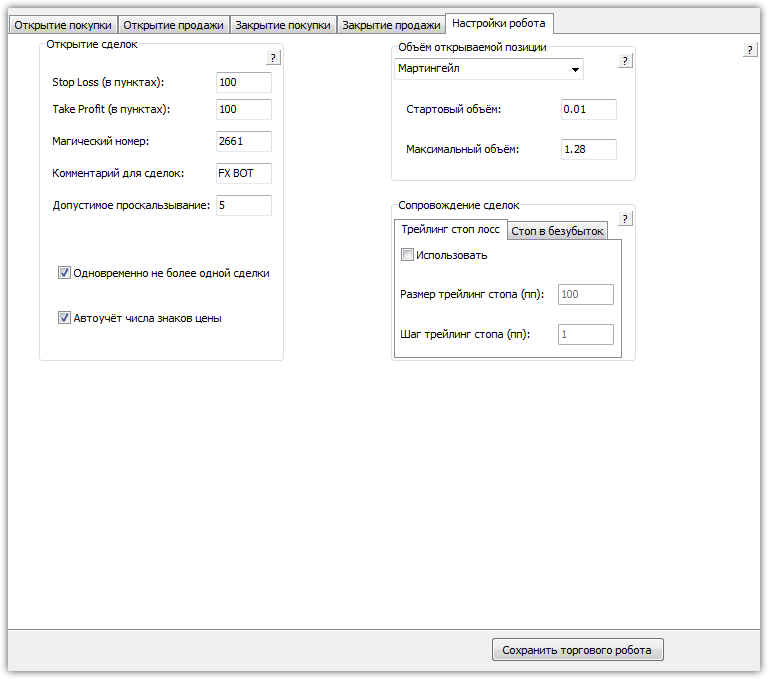

Next, go to the final item “setting up the robot” in which we select “Martingale” and set the minimum and maximum lot, profit size and stop order. After the values have been entered, all you have to do is click “save trading robot”, after which the expert will appear in the terminal.

Strategy testing

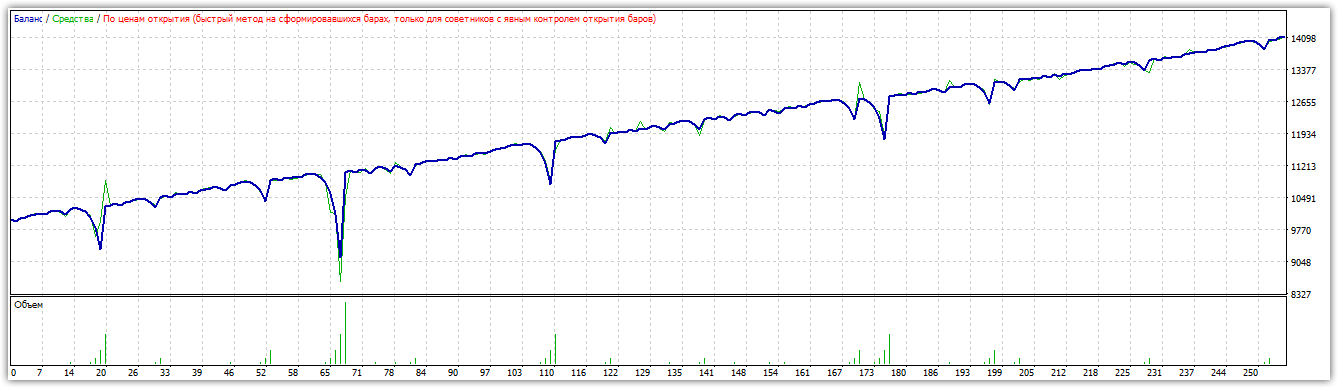

So, after creating an expert, the last stage remains - backtesting in the strategy tester. Since the Expert Advisor is created by the designer for any currency pair and time frame in Forex, we decided to test the Expert Advisor based on the underlying strategy on the Euro/Dollar currency pair on the hourly time frame for 2015. The test result is shown below:

As you can see above, the advisor was able to earn 40 percent per annum with a twenty percent drawdown, and this despite the fact that the strategy was taken out of thin air and implemented in literally 15 minutes.

Therefore, we recommend following our example and creating your own advisor in the Ensed Cor constructor. You can download the advisor at the end of the article.

Download the advisor created on Ensed Cor