Which is better Swap free accounts or standard Swap

When trading on the stock exchange, you often have to leave a transaction for the next day, for which, in most cases, the broker charges a commission - Swap.

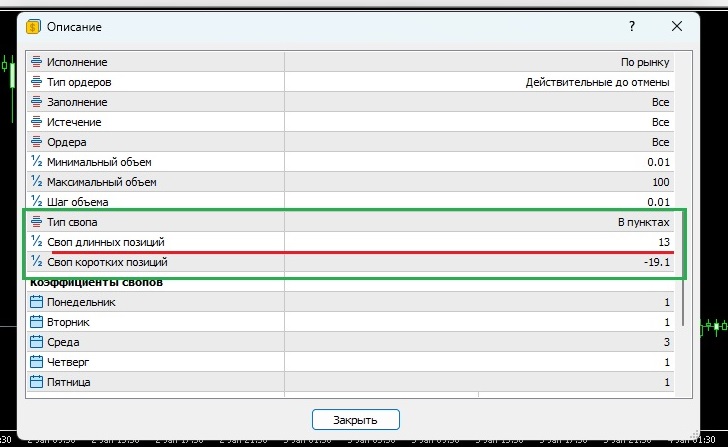

The amount of accrual depends on the discount rate for the currencies involved in the transaction and additional conditions of your broker.

It should be noted that a similar commission is also charged when trading other assets if you use contracts for difference when opening transactions.

There are many opinions on whether it is worth paying attention to this commission and how much it affects the outcome of the transaction, here is an example of calculations for cryptocurrencies - https://time-forex.com/kriptovaluty/swop-kriptovaluty

But the most important thing is that for those who do not want to pay swap, brokers offer Swap free or as they are also called “Islamic accounts”:

The main advantage of these accounts is that you are not charged a fee for rolling over your positions to the next day, but only a one-time fee when you open a trade.

But now the question arises: how profitable is it, is it worth using these types of accounts? It all depends on a number of factors that influence the choice.

When you don't need to use Swap free accounts:

For short-term transactions , it is clear that there is no point in using an Islamic account if you trade intraday, or the duration of your transactions rarely lasts more than a few days.

With a positive swap, it is no secret that the swap can be both negative and positive, so if there is a positive swap , then why lose additional profit:

If the commission is greater than the swap - for some assets the accrued commission on Swap free accounts may exceed the amount of the swap, so there is no point in using this type of account.

For example, for the AUDNZD currency pair, the swap is -0.03 points per day, while the additional commission when opening a transaction is $3 per lot.

That is, the swap for the AUDNZD pair is equal to 0.18 cents, it is easy to calculate that 300/18 = 16 days, that is, the saved swap will cover the one-time commission only if the transaction is maintained for more than 16 days.

When trading cryptocurrencies - since most brokers simply do not provide such a service on assets such as cryptocurrencies, stocks, indices, bonds and commodities.

When does it make sense to have Swap free accounts?

If you are a Muslim , in this case the use of such accounts is predetermined by religious considerations.

Long-term trades – when your trades last on average more than one month or even longer.

When opening Swap free accounts, you should be extremely careful when choosing brokers, since some brokerage companies do not charge a one-time commission, but a daily fee for using swap free accounts. That is, you opened a deal with a volume of 1 lot and for every day of its existence, you will be debited $5.