How much can you earn on a positive swap, Carry trade strategy

When trading on Forex, there is such a thing as a swap; brokers charge a fee for transferring open positions on the exchange to the next day.

This commission is quite specific, its essence lies in the difference in discount rates between currencies in a currency pair, for this reason the swap value can be either positive or negative.

This aspect was described in more detail on our website in an article located at - https://time-forex.com/praktika/svop-fx

If there is a positive option for a swap, it means that there are people who want to make money on it; at one time, an entire strategy called Carry trade was even developed.

Many novice traders are attracted by the simplicity of this trading option, because to make money, you just need to select a currency pair and open a trade according to the trend. But is the amount of earnings that can be earned on a positive swap really that big?

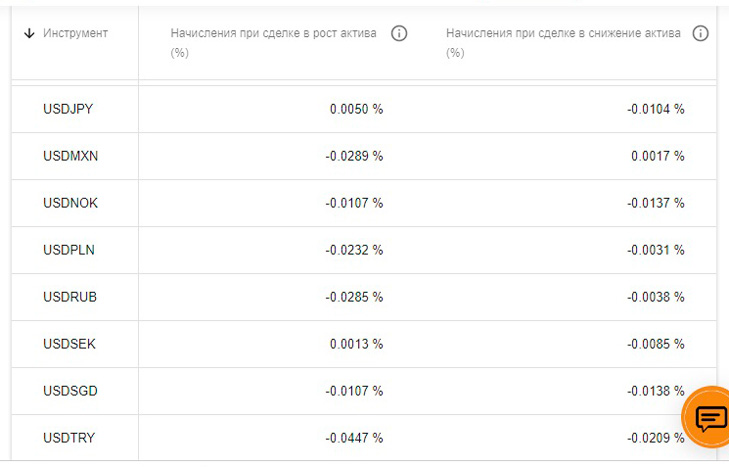

We choose the most profitable currency pair, in our case it will be USDJPY, a positive swap on it in the amount of 0.0050% is charged if you buy the US dollar for the Japanese yen.

That is, when opening a buy deal on the USDJPY currency pair with a volume of one lot, when transferring to the next day, we are credited with 100,000*0.005/100=5 dollars. If the deal lasts a month, then you will already receive $150.

To make it more clear, let’s convert 0.005% into annual profit, this is 365 * 0.005 = 1.82% per annum, this amount does not make much of an impression. But here we should remember about leverage; even leverage of 1:10 will already allow you to increase the amount of interest in relation to equity capital to 18% per annum.

Theoretically, you can look for an even more profitable currency pair, but given the size of the existing discount rates, you are unlikely to be able to find a pair for Carry trade that will bring more than 4-5% per annum. If you use a leverage of 1:10, then it is already 40-50% percent per annum.

After all, you trade through brokers, and they have their own arithmetic when calculating discount rates, so the indicator of probable profitability is noticeably reduced.

As for the size of leverage, it is quite risky to use a value of more than 1:10, since the strategy involves long-term transactions and the position needs to withstand possible trend corrections .

As a result, we can say that the Carry trade strategy can only be considered as a source of additional profit, but it is clearly not worth expecting that it will allow you to earn a lot. Since you will not be able to maintain the trade for a whole year, the trend will most likely change and you will need to close the position.