Piping strategies for profitable trading on M1, indicators and signals

Pipsovka as a trading style is the most profitable, however, at the same time the most labor-intensive. Trading in a chaotic market, where market noise makes up 90 percent of the time, requires a trader with nerves of steel and special skills.

It is in pip trading that you as a trader have no time to hesitate, since every second of delay takes away a couple of points of profit, which, as a rule, at best does not exceed 10-15 pips per trade, or even less.

Naturally, in order for pips strategies to bring stable profits, you will need to be systematic, namely, use special trading tactics that are designed specifically for pips on the minute chart.

The strategy for pipsing on M1, which we want to offer you, is a universal tool that is designed for trading almost any currency pair on the Forex market.

The trading tactics themselves are based on standard technical indicators , so you can apply them regardless of which terminal you are working with.

Preparing a strategy for pipsing on m1

Initially, open the minute chart on which you plan to trade, but be warned that pipsing requires a minimum spread on the currency pair (brokers' spread size).

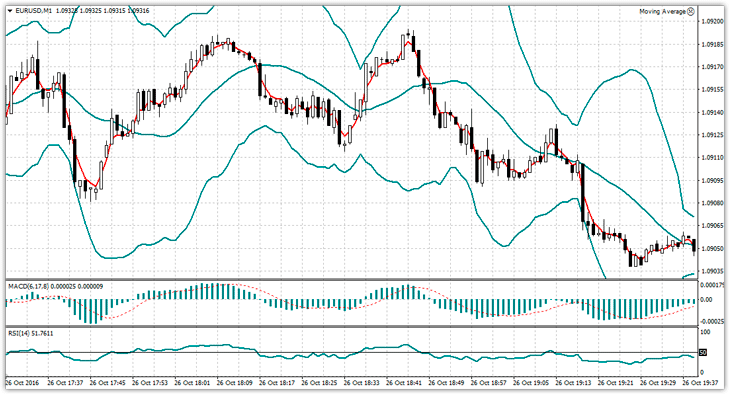

Next, plot Bollinger bands with a period of 20 with an offset of 3, as well as an exponential moving average with a period of 3. Also plot RSI with a period of 14 on the chart and mark the level of 50 and MACD with parameters 6, 17, 8.

If you are trading on the Forex market via MT4, then we have prepared for you a special template, after launching which all indicators will appear on the chart automatically.

Go to the end of the article and download the template. Then install it directly into the MT4 trading terminal. To do this, you will need to enter the data directory, which you can access directly in the platform by opening the file menu. After the terminal system folders appear, find a folder called Template and drop the template into it.

For the trading terminal to see the changes, restart it. After the restart, use the mouse to call up an additional menu on the chart and select “Strategy for pips on m1” from the list of templates. If you did everything correctly, you will get a graph like this:

Indicators for the strategy and trading signals

As you may have noticed, the strategy pips on m1 consists of four indicators, namely RSI , MACD, Bollinger Band, EMA.

Of these, the exponential moving average and Bollinger bands are signal indicators, while the MACD and RSI oscillators act as a trend filter. It is worth noting that the settings for all tools are non-standard, so we do not recommend changing anything. The entire trading process is carried out purely on a minute chart, and entry into the market must be directly based on a closed candle.

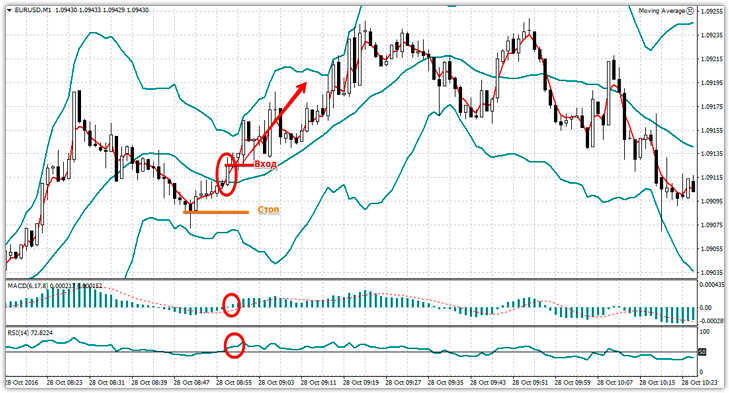

It is very important not to neglect this rule, since the minute chart is very dynamic and the signal may disappear if you enter inside the candle. So, straight to the signals. Buy signal:

- The red line of the 3-period moving average (EMA) crosses the center line of the Bollinger Band from bottom to top.

- At the moment of intersection, the MACD indicator should indicate an upward trend, namely, its histogram should be above level 0.

- RSI crosses 50 from bottom to top or is above it.

After the candle closes, we enter a position provided that the risk does not exceed 10 points. The stop order should be placed near the local minimum, and the profit is either equal to the stop order or placed at the border of the Bollinger Bands. Example:

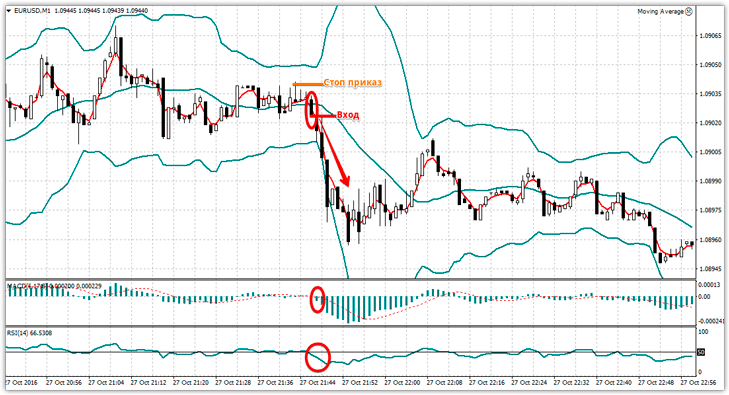

Sell signal:

1) The red line of the 3-period moving average (EMA) crosses the center line of the Bollinger Band from top to bottom.

2) At the moment of crossing, the MACD indicator should indicate a downward trend, namely, its histogram should be below level 0.

3) RSI crosses the 50 mark from top to bottom or be below it.

The stop order must be placed strictly at the local maximum, and the profit should be equal to the stop or at the border of the Bollinger channel.

It is very important to ignore the signal if your stop order size is more than ten points! Example:

Since this trading tactic often produces signals within a Forex trading session , we recommend trading only with a static lot, since delays in calculations can significantly affect the effectiveness of the transaction.

In conclusion, I would like to note that pipsing on this strategy requires the trader to constantly be present at the monitor, and trading should be carried out during active trading sessions (European and American).

Also pay attention to the size of the spread, since for the tactic to be effective, its value must be minimal. To do this, we recommend using it on ECN accounts .

Download the template – pipsovka strategy .