Efficiency of trading on news

Around the effectiveness of trading on the news there is a lot of discussions and speculations, and I really did not really meet the efficiency or unprofitability of this approach.

I really did not really meet the efficiency or unprofitability of this approach.

As a rule, beginners show examples of how the news did not work itself out, more experienced participants argue that it should not have affected the market, while others are generally categorical about trading on news and profess only technical analysis.

Therefore, if you take the path of applying fundamental analysis in your trading, no one will give you a definite answer whether macroeconomic news affects the Forex market or not, much less whether they can be effectively applied in your trading.

On the website, in the fundamental analysis section, you can find a description of various news, as well as how they can affect a certain currency pair.

In the reviews, the main emphasis was on the number of points that the price passes, but if you have competent money management, this becomes not so important, since you can enter a position with a larger lot and a smaller stop and take a profit of the same size as if you had entered with a smaller lot. but took more points.

Therefore, in order to talk about the effectiveness of trading on news, I propose to calculate the percentage of the most popular economic indicators for the year and draw certain conclusions for ourselves.

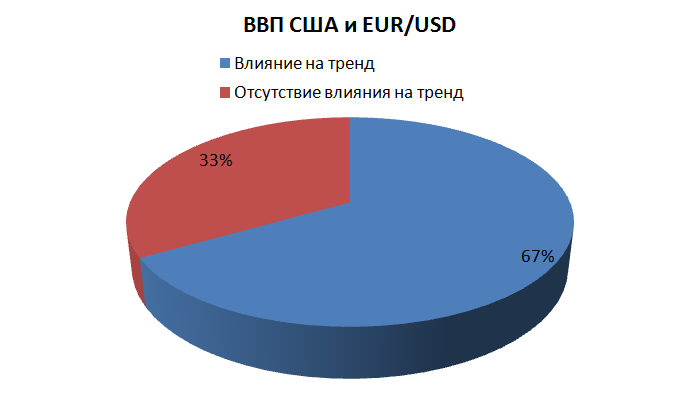

The first and most popular macroeconomic indicator that you should pay attention to when trading on the news is GDP . To calculate the effectiveness of using this indicator, we examined the Euro/Dollar currency pair and counted the number of options for the year when the price chart responded to the publication.

In order to assert that the market took into account the publication of data, we took as a constant 15 points of the distance traveled towards the indicator. The indicator is released quarterly, but every month clarifying information is published on the basis of which traders trade. Of the 12 months examined, a reaction to the news was recorded in eight cases, and a market reaction against the news was recorded in 4 cases. The percentage of the news being triggered is shown in the picture below:

The second equally popular macroeconomic indicator for the dollar, which is actively used in trading by traders trading on news, is the Consumer Price Index . Previously, we have already done a detailed review of this indicator and calculated its profitability over the past couple of months. However, in order to put together a picture of the effectiveness of the news on the Pound/Dollar currency pair, the percentage of news activation over the last year was calculated.

The second equally popular macroeconomic indicator for the dollar, which is actively used in trading by traders trading on news, is the Consumer Price Index . Previously, we have already done a detailed review of this indicator and calculated its profitability over the past couple of months. However, in order to put together a picture of the effectiveness of the news on the Pound/Dollar currency pair, the percentage of news activation over the last year was calculated.

Let me remind you that the news comes out every month and is an indicator of dollar inflation.

Out of a 12-month period, 7 times were recorded when the publication of the CPI influenced the price movement of 15 points or more, and 5 cases were recorded when the price went against the news.

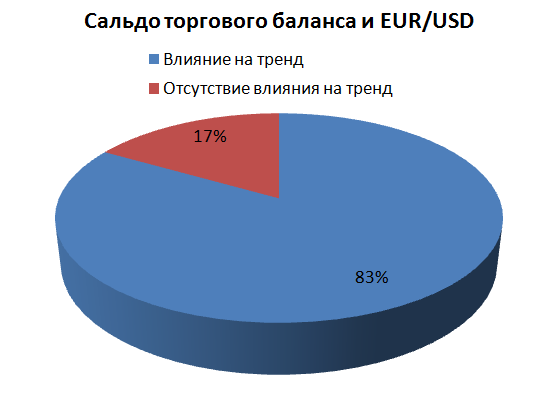

Analysis of government exports and imports has always allowed a competent investor to assess the situation in the US economy, which is why such a macroeconomic indicator as the Trade Balance is always popular among news traders. Previously, we calculated the number of points that the price passes on average after the publication of news in the last four months, but to see the effectiveness of the news, we calculated the percentage of triggered market movements over the year on the EUR/USD currency pair. This will allow you to assess the real impact of the news.

Analysis of government exports and imports has always allowed a competent investor to assess the situation in the US economy, which is why such a macroeconomic indicator as the Trade Balance is always popular among news traders. Previously, we calculated the number of points that the price passes on average after the publication of news in the last four months, but to see the effectiveness of the news, we calculated the percentage of triggered market movements over the year on the EUR/USD currency pair. This will allow you to assess the real impact of the news.

As a result of the calculation, over 12 months, 10 cases were recorded when, as a result of the publication of the Trade Balance, the price chart moved from 15 to 100 points, but in 2 cases the price simply did not react to the appearance of information. The percentage of the news being triggered is shown in the picture below:

The fourth news is familiar to almost any professional, since it is based on an analysis of the US industrial sector, which accounts for the majority of the country’s GDP. We are talking about the Manufacturing Sector Business Activity Index and its impact on the dollar exchange rate.

Previously, a review of this indicator was made and the trading results for the last four months were calculated, but in order to say affirmatively about the effectiveness of the news, the percentage of news triggered for the year on the EUR/USD currency pair was calculated. Over the 12 months analyzed, 6 cases were recorded when the price reacted to the publication of news and 6 times when it passed by, not paying attention to the published information. The percentage of the news being triggered is shown in the picture below:

Having calculated the market reaction to major news, we can confidently say that the trade balance and GDP show a high percentage of success, and for a trader 83 percent and 67 percent are high, since few strategies can give such a percentage of profitable positions. It is also worth highlighting an obvious outsider, namely the Business Activity Index, since trading based on it is reminiscent of roulette, where your chances are 50 to 50.