Fork strategy for Forex

One of the most important mistakes among beginners at the stage of building strategies is going to extremes.

This is expressed in the fact that they adhere to one type of analysis and completely forget about the advantages of another, which undoubtedly leads to the fact that the strategy consists either of technical indicators alone or entirely of graphic patterns.

However, the market is not so simple and straightforward that it is so easy to predict it, so more experienced participants use several types of strategies in their trading.

Or they use strategies that are actually built on a symbiosis of technical and graphical analysis.

You can become familiar with one of these strategies as you read this article. The “Fork” strategy is a unique trading technique designed to make a profit when trading in the direction of the global trend on pullbacks.

The “Fork” strategy actually refers to graphical type tactics, so it can be used on any currency pairs and even CFDs.

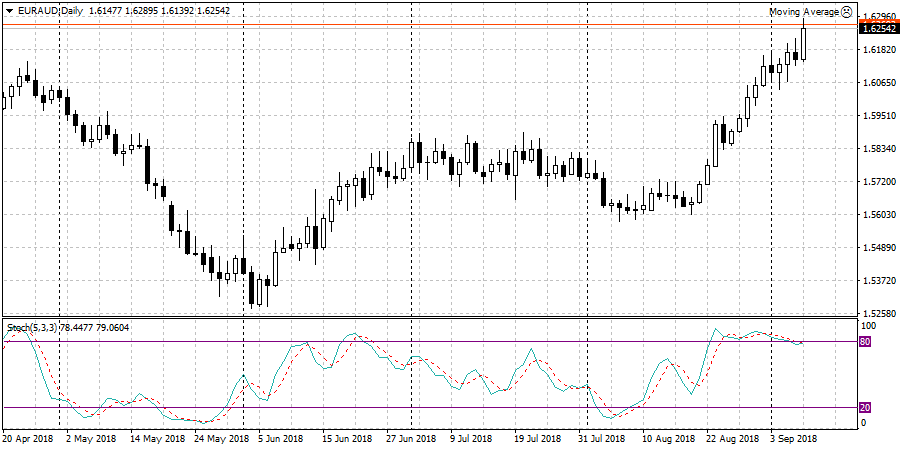

There are also no restrictions on use on certain time frames, but as practice shows, Andrews pitchforks are more effective with minimal market noise, which means that it is better to use it on the daily chart.

It is worth noting that the strategy is not recommended for use by beginners, since it requires experience in working with graphical tools.

Preliminary preparation and installation of the template

As we have already noted, the “Fork” strategy is actually based on graphical and technical analysis .

Therefore, firstly, your trading platform must have Fibonacci tools and Andrews pitchforks, and secondly, it must have a stochastic oscillator.

Both the fifth and fourth versions of the trading terminal fully meet these requirements. You can formulate a strategy either independently or using a template that you can download directly at the end of the article.

To do this, you actually need to plot only one indicator on the chart - the stochastic indicator with standard parameters.

If you use a template, you just need to place it in the Template folder, which you can access directly through the file menu in an open terminal.

After pre-installing the template, be sure to restart the platform or do a simple terminal update through the additional menu called up in the “Navigator” panel.

Then just open the daily chart and run the “Fork” strategy template on it.

Step-by-step algorithm for implementing the strategy.

Step-by-step algorithm for implementing the strategy.

Signals As we have already noted, “Fork” is a complex trading strategy that requires skills in using Andrews pitchforks and the Fibonacci grid.

Since the strategy does not require the simultaneous fulfillment of conditions, but operates on the principle of gradually building signals, we will smooth out each point one by one into a single picture.

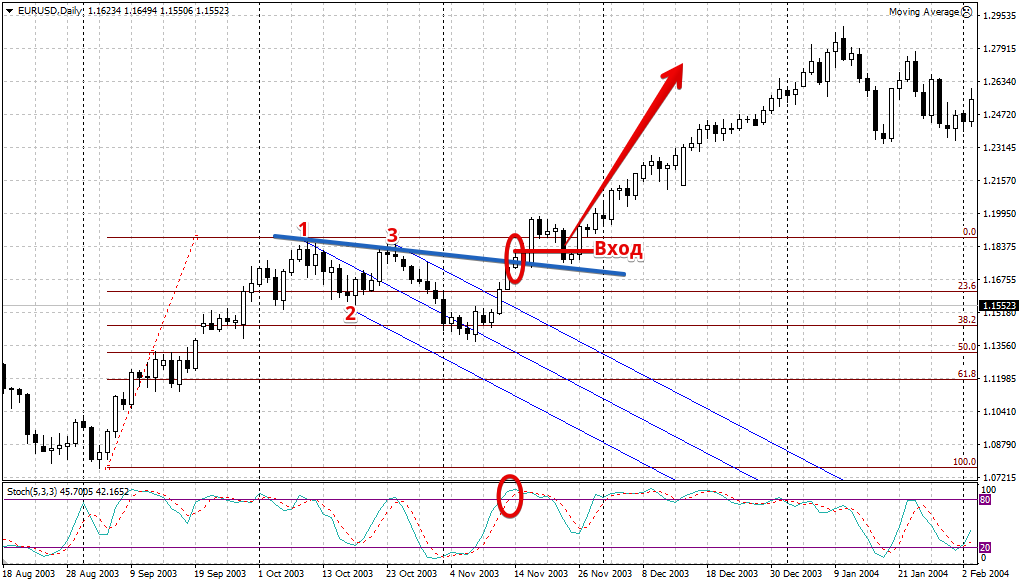

So let's get started. Conditions for opening a buy transaction:

1. In an uptrend, wait for a rollback to appear and draw a Fibonacci grid from the low of the beginning of the trend to the point where the rollback .

The key condition is the fact that the price should not roll back below the level of 61.8. 2. On the downward rollback that appears, construct an Andrews pitchfork at three points.

The first point is plotted at the local maximum, where the rollback began. The second point is placed at the local minimum, where the rollback was stopped. The third point is a local maximum, which formed after the rollback, but did not lead to a restoration of growth.

It is very important that during a further rollback the price is above the middle line of the Andrews pitchfork. 3. Draw a line through points 1 and 3 along which you built the Andrews pitchfork.

4. When the price breaks the line drawn through points 1 and 3 from bottom to top, open a buy position.

5. At the time of the breakout, the blue line of the stochastic oscillator should be above the dotted line.

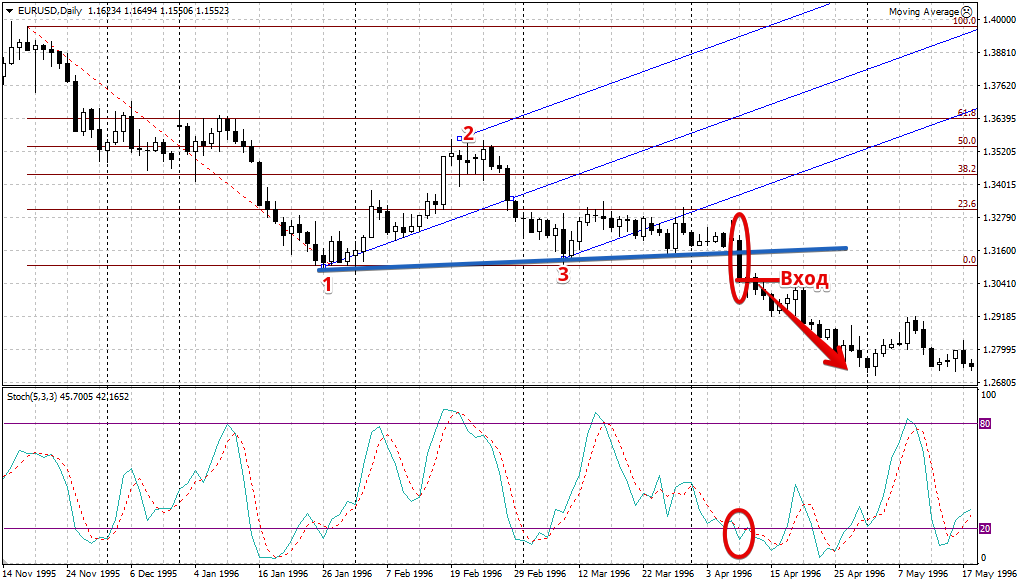

Conditions for opening a sell transaction:

Conditions for opening a sell transaction:

1. In a downtrend, wait for a pullback to appear and draw a Fibonacci grid from the high of the beginning of the trend to the point where the rollback begins.

The key condition is the fact that the price should not roll back above the level of 61.8. 2. On the upward rollback that appears, construct an Andrews pitchfork at three points.

The first point is drawn at the local minimum, where the rollback began. The second point is placed at the local maximum, where the rollback was stopped.

The third point is a local minimum, which formed after the rollback, but did not lead to a restoration of growth. It is very important that during a further rollback the price is below the middle line of the Andrews pitchfork.

3. Draw a line through points 1 and 3 along which you built the Andrews pitchfork.

4. When the price breaks the line drawn through points 1 and 3 from top to bottom, open a sell position.

5. At the time of the breakout, the blue line of the stochastic oscillator should be below the dotted line.

In conclusion, it is worth noting that the Fork strategy may seem difficult only at first glance.

In conclusion, it is worth noting that the Fork strategy may seem difficult only at first glance.

In fact, if you understand the rules for constructing graphic elements, using it in practice is much easier than you might imagine.

Download a ready-made template for the fork strategy

.