Trading strategy "Sniper"

The Sniper trading strategy is considered one of the most popular purchasing trading strategies in recent years in the Russian-speaking segment.

This tactic was invented by a certain Pavel Dmitriev, who positions himself as an established trader; according to him, this type of exchange trading is effective even when used by a novice trader.

In general, the strategy did not exist even a year before it was actively taught at various brokerage courses, and the tactics became the basis of many trading strategies.

The Sniper trading strategy is an indicator-free trading tactic that is based on working with basic support and resistance levels, as well as various price levels.

Many who paid for the training course said that under the tasty and obvious names of various price levels there is a base from a textbook on technical analysis, so if you are an experienced market participant and have repeatedly worked with the levels in this strategy, you will not see anything complicated.

The strategy is usually used on a five-minute chart, as well as on an hourly chart to search for a global trend. The choice of currency pairs depends entirely on the trader, since the levels work on any asset.

Signals

The Sniper trading strategy consists of a number of signal blocks that are completely independent of each other and give certain market entry signals. The strategy uses the following levels: High and low of the previous day, impulse levels, total impulse levels, bank levels, levels of sharp trend changes, consolidation zones.

As a rule, all signals boil down to entering the market on a rebound from the above levels, however, there are also signals for a breakout. So, let's go through the levels and signals in detail.

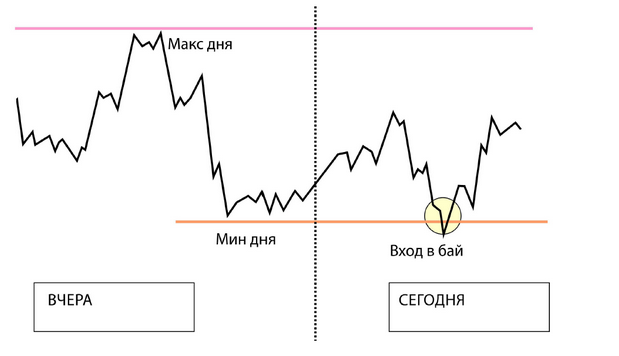

Minimum and maximum of the day

The previous day's low and high levels are the strongest support and resistance levels because they are psychological points. As a rule, a price reversal occurs near these levels, because no one has canceled the old rule, namely, buy at a lower price and sell at a higher price.

To trade, highlight these levels as horizontal levels on the daily chart and immediately switch to the five-minute chart. Your task is to look for positions not for a breakout of these levels, but for a rebound.

We enter a buy position when the price touches the low of the previous day, and a sell position if the price touches the high of the previous day.

When entering a position, stops should not be higher than 25 points. Impulse levels

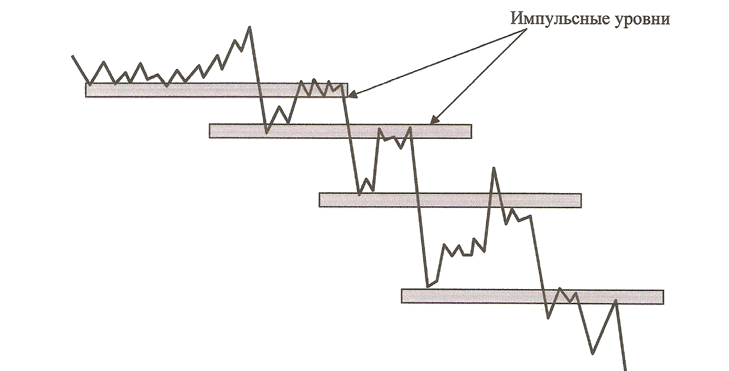

An impulse level differs from a regular support and resistance level in that a retest occurs at it and a further breakdown of this level occurs, with the value consolidating with the help of price impulse.

By price impulse, the author of the strategy means a breakout movement of at least 6 points. To say that an Impulse level has formed in front of you, the following conditions must be met:

1) The price has broken through the level.

2) After the price has pushed off, a breakdown of this level occurs with an impulse.

3) After the breakdown, a return to the level occurs.

These levels build a kind of ladder for any trend movement, and an example can be seen below:

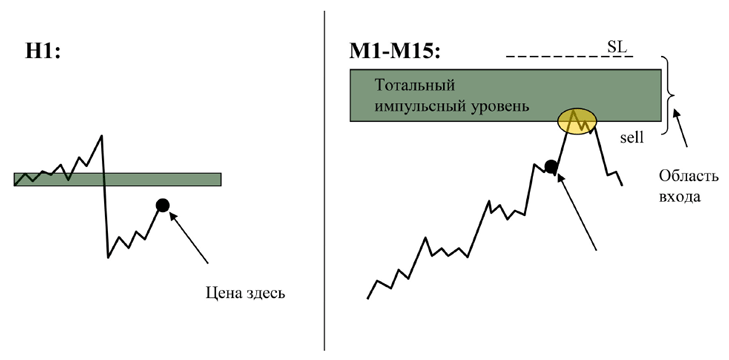

Total impulse levels

Total impulse levels are levels in history near which reversals or strong breakouts occurred.

These levels are found on an hourly or four-hour chart, and as a rule, at local minimums and maximums.

Trading near these levels occurs after the fact, namely, if you observe the market reaction close to it, you open the appropriate transactions (as a rule, trading is carried out for a breakout).

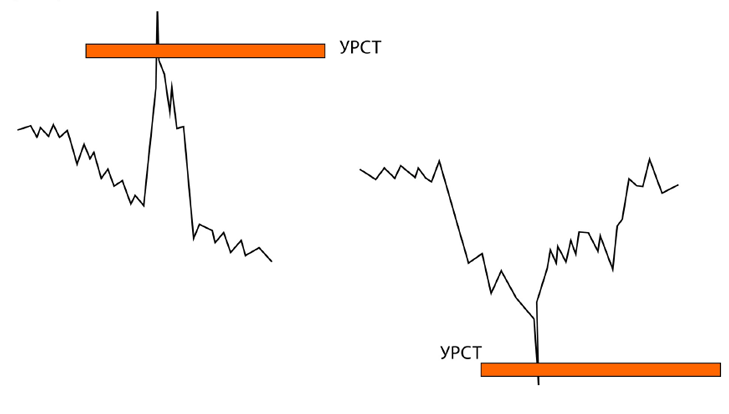

Levels of a sharp change in trend

Levels of a sharp change in trend are an extremely rare phenomenon in the market, but a reaction almost always appears near it.

This level is formed after the price makes a sharp sudden jump of 100 or more points and a return occurs. On the chart you see this situation in the form of a candle with a huge shadow, which is also often called a hairpin. The level is drawn at the tip of the shadow of this hairpin, and the market reaction should be expected if the price approaches this zone.

After the price has completed its rebound from this level, it is removed from the chart, since it is considered completed. Example:

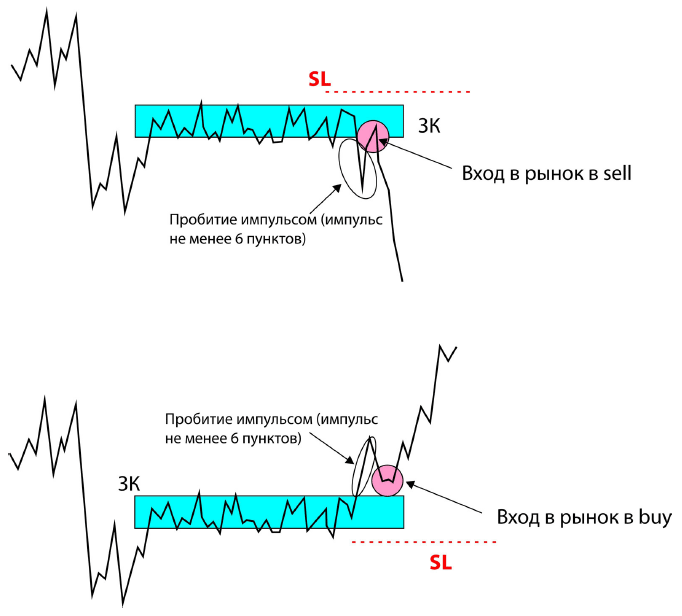

Consolidation zones

It is no secret that the market almost always consolidates its strength before making a strong market impulse.

For example, behind a trend you can always see a compressed sideways movement, followed by a new continuous impulse. The consolidation zone is characterized by a compressed sideways price range, the size of which does not exceed 18 points.

Entry into the market occurs in the direction of the breakdown of one of the boundaries after a retest of this level. Example:

Safe as a way to preserve profits

The author of the Sniper strategy noticed a trend that in 85 percent of cases the price moves towards a profit of 15 points, after which it often returns to the starting point.

To increase the efficiency of entering the market and reduce the number of returns, the author recommends moving the stop order to the point +15 points.

This approach is moving the stop order to a no loss, but not with a zero value as in the classic version, but with a positive value of +15 points. In conclusion, I would like to note that all the considered patterns and levels of the Sniper trading strategy are based on simple laws of technical and graphical analysis, so there is simply no doubt about its performance.