5 steps to the market, the Wyckoff method, part five

The Wyckoff Method refers to a 5-step process of entering the market, selecting potential stocks, and opening trades.

Read the first part of the article on the method on the page - Basics of the Wyckoff method

Step 1: Identify a trend

The trend identification includes the determination of the current trend and forecasting the future direction of price by analyzing the structure of the market and the ratio of demand and supply.

Assessment of the future trend will help you decide whether to enter the market at the moment, and in which direction to make a deal?

Step 2: Select trending stocks

These are stocks that have a higher percentage gain when the market recovers, and often continue to grow even during a general market correction .

Step 3: Select stocks that have a “Reason” justifying their rise in price to your price.

The Wyckoff method determines target prices based on the length of the accumulation/distribution period (when the market moves sideways).

According to the law of cause and effect, the amount of P&F (on a tic-tac-toe chart) that moves sideways within a trading range is the "multiplier" and the next level of price movement is the "result" for both short and long trades .

Therefore, if you are a long-term investor, you should choose stocks that are in the accumulation or re-accumulation phase for quite a long time, this will give a chance that the asset will reach the expected price.

Step 4: Determine the possibility of price movement

This step aims to assess whether the price is ready to break out of the TR trading range to move up after accumulation or down after distribution:

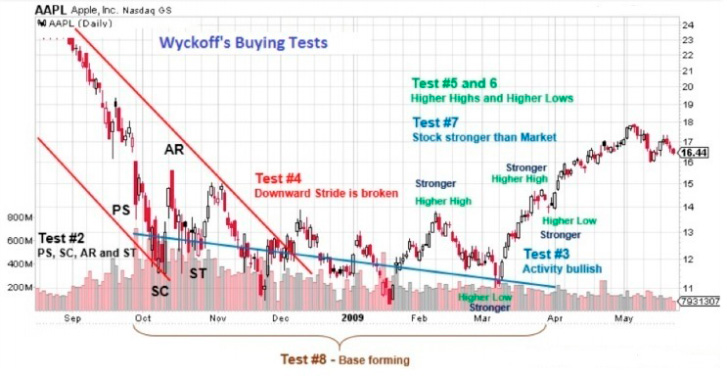

To determine the likely price movement, Wyckoff proposed 9 tests (signals) for buying and selling. These tests are specific recommendations that help determine when a TP is about to end and a new trend (bullish or bearish) begins.

These 9 tests include price completion events that occur on the accumulation/distribution chart as described above, namely:

9 test to buy in the accumulation phase: (including conditions and charts used)

• Bearish target met, P&F chart.

• Form PS, SC and ST, Bar and P&F Chart.

• Bullish activity appears: trading volume increases during the recovery stage and decreases during the correction stage), Histogram.

• Broken downtrend trend line, bar or P&F chart.

• Price forms a higher low, bar and/or P&F chart.

• Price forms a higher high, bar and/or P&F chart.

• Stocks are outperforming the market (moving higher on recovery and performing better than the market index), histogram.

• Base formation (horizontal price line), which means the accumulation period is long enough to create a future breakout, bar and/or P&F chart.

• Estimate 3x profit potential with stop loss, histogram and P&F chart.

Example of 9 tests for buying Apple shares in the accumulation phase:

The 9 sales tests in the distribution phase are performed in reverse order.

The 9 sales tests in the distribution phase are performed in reverse order.

Step 5: Determine when to enter the market

Wyckoff believes that the market should only be entered when the factors of individual stocks coincide ¾ or more with the overall market trend.

If so, your trade will be more successful due to the strength of the market as a whole. In addition, the specific principles of the Wyckoff tests, as well as the manifestation of price behavior in the TR trading range, will help investors determine reasonable entry, stop loss and take profit points .

Summary

Although the rules and principles of the Wyckoff method are quite simple, applying them in practice is quite difficult.

Within the framework of this article, only the main elements that make up the Wyckoff method were disclosed, but this information is quite enough to understand the essence of the method and apply it when choosing promising stocks.

The first part of this article is located at - https://time-forex.com/tehanaliz/metod-wyckoff