The best traders.

This section is devoted to describing the success stories of famous traders and the strategies they used. Is it so difficult to succeed in trading? What is needed for this? The main secrets of profitable trading on the stock exchange.

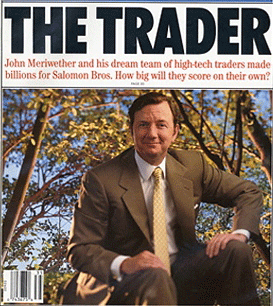

John Meriwether. Fateful Fall

John Meriwether was considered simply a master of hedging risks and building positions on a neutral positioning, making a profit from the so-called spread.

By the way, John Meriwether was one of the largest investors in Russian securities, namely debt bonds, which actually led to his collapse after the world-famous default in 1998.

He managed billions of dollars, and his team included the best mathematicians and economists, which allowed John to remain at the top of Olympus for a very long time.

Brian Hunter - Chasing the Bonus

When studying the stories of successful traders who motivate you and me to go to the end and not give up halfway, it is very important not to throw away the facts of the biggest defeats and losers traders.

Of course, for motivation you need to look up to only the best, but it is the stories of crashes that show how thin the line is between a loss-making and a profitable trader, how one mistake can turn not only your world, but the world of other people, team members, investors and even the entire financial sector.

Actually, the story of Brian Hunter is an excellent example of greed and greed, which simply led to irreparable consequences, and his mistake led to the largest ruin of a hedge fund.

To understand the nature of what happened, I suggest you read the history of what is happening more carefully.

Raymond Dalio - the life-changing side hustle

Raymond Dalio is one of the richest people in the world, ranking 60th on the Forbes list.

Raymond Dalio earned his place in the sun thanks to his largest hedge fund, Bridgewater Associates, which, in terms of profitability, having earned $500 million in 2015, overtook the fund of George Soros himself.

Currently, according to declarations, Raymond Dalio's fortune is estimated at $15.6 billion, and Bridgewater Associates' investment portfolio is $154 billion.

In the stock exchange world they call him Ray and believe me, the story of his success will surprise even the most snarky critics.

Raymond Dalio was born in 1949 in one of the historic neighborhoods of Jackson Heights in New York City. His family was far from poor, but at the same time they did not have any special income. Ray's mother was an ordinary housewife who looked after the house and children, and his father was a popular jazz musician by local standards.

Nick Leeson - the main anti-hero of the century

When studying the stories of successful people, it is very important not only to absorb the spirit of the winner, but to study the mistakes that one way or another could change the lives of these people.

one way or another could change the lives of these people.

The story of Nick Leeson is an excellent example of how banal greed and fear led to irreparable consequences, and this is not an ordinary story of a bankrupt, but a problem of a national scale, because of which many UK investors said goodbye to their savings forever.

Nick Leeson was born in 1967 in the secluded town of Watford. The seed was very ordinary and did not stand out for any financial benefits, since the main breadwinner, her father, worked as an ordinary plasterer.

Actually, it was the father who hatched plans to improve Nick’s future and wanted to make his son a builder, or more precisely an engineer.

However, from a very young age, Nick saw himself as a financier who would move large amounts of capital. The most interesting thing is that despite his dream related to finance, he found mathematics very difficult, and he regularly failed various tests.

Nicholas Darvas - the path of a recognized dancer to recognition on Walt Street

Nicholas Darvas is an excellent example of a self-taught person who was able to write his name in capital letters in the history of the stock exchange world. Nicholas Darvas is the author of five famous books that have been translated into Russian.

the stock exchange world. Nicholas Darvas is the author of five famous books that have been translated into Russian.

Anyone who has read his personal books can certainly say that there is no boring or incomprehensible terminology, and all the information on his success and achievements is an autobiography that can be read in one breath.

However, Darvas is famous not for his books, but for his amazing results in stock trading, which few can boast of. Actually, the success story of Nikolos Darvas will be close to the liking of those traders who independently strive to achieve success step by step.

Nicholas Darvas was born back in 1920 in Romania. There is very little information about Nikolos’ childhood and youth; the only thing that is known is that he graduated from the University of Economics in the city of Bucharest.

Jake Bernstein - Accidental Millionaire

There are a very large number of success stories of traders, but as practice shows, all these stories are connected with the birth of the exchange, with huge halls and crowds of exchange players, where each new innovation simply became a huge breakthrough in this area.

are connected with the birth of the exchange, with huge halls and crowds of exchange players, where each new innovation simply became a huge breakthrough in this area.

The personality of Jake Berstein already belongs to the new modern era of the development of stock trading, and in the history of his becoming a trader, probably every second person will see himself. Don't believe me? Then read to the end.

Jake Bernstein was born in Bavaria in 1946. According to Jake’s recollections, the family was very poor, had many children and, in addition, did not even have their own home, but constantly rented housing, while spending the last of their money.

At that time, everyone was actively moving to the States, because it was in the USA that prospects opened up for many. In 1968, the seed first moves to Canada, and then immediately to the USA.

Jesse Lauriston Livermore

Jesse Lauriston Livermore's success story is one of the most inspiring and motivating for new traders.

traders.

However, by studying his biography and success story, you will learn about the dark side of the trading world, namely the consequences of abusing luck, how weak players end up and how trading can affect your life, both in good and bad ways.

Jesse Lauriston Livermore was born into an ordinary family of farmers in 1877 in the town of Shrewsbury, Massachusetts.

Realizing that the same fate awaits him and that the next person in the family who will look after this farm will naturally be Jesse, thoughts about escaping from home begin to creep in from early childhood.

Edward Lampert - $15 billion in the hands of one fund

Edward Lampert is one of the best managers of our time, with an account currently worth over $15 billion. Edward Lampert has simply unique thinking and sensitivity, and his life path is in many ways compared to such an outstanding personality as Warren Buffett.

worth over $15 billion. Edward Lampert has simply unique thinking and sensitivity, and his life path is in many ways compared to such an outstanding personality as Warren Buffett.

Both investors, already at the age of 25, have reached unprecedented heights, and they approach the investment process as a business, participating in the fate and management of the company, and not from the speculative side.

Edward Lampert was born in 1962 in New York state in the small town of Roslyn.

Edward's family was provided with almost everything, since his father worked as a lawyer in New York City, and his mother was raising two children.

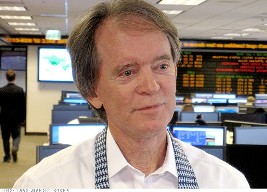

Bill Gross. From gambling to the first billion

The success story of Bill Gross perfectly demonstrates to all of humanity how, without any connections or financial capabilities, a person with his desire for success can conquer even the most unprecedented heights.

capabilities, a person with his desire for success can conquer even the most unprecedented heights.

Many analysts and journalists put Bill Gross and Warren Buffett on a par because their capital and outstanding investing abilities are written in huge letters into the history of the stock exchange world.

The only fundamental difference between these two investors is that Bill Gross is considered the king of the bond world, while Buffett is considered the king of the stock world. Both of their funds exist to this day and generate profits for their investors.

The future king of the bond market was born in 1944 in Ohio in the town of Middletown.

His family was the most ordinary and in terms of wealth was no different from other average families in the city, since his father was an ordinary manager in a steel company, and his mother was an ordinary housewife.

Victor Niederhoffer

A successful trader, and even a businessman, must simply have tremendous willpower and desire to achieve success. The story of Victor Niederhoffer is a real example from life when a man, being one of the most successful traders in the world, made fatal mistakes in management and lost, to put it mildly, everything.

success. The story of Victor Niederhoffer is a real example from life when a man, being one of the most successful traders in the world, made fatal mistakes in management and lost, to put it mildly, everything.

Having survived conviction, trials, the sale of personal property, persecution from various brokers, this man not only did not give up, but, in spite of the whole world, conquered new heights and earned a huge fortune.

The books written by this trader became simply a bible for many beginners, since all the knowledge and experience that he received were printed on the pages, and these are not the thoughts of a philosopher distant from exchange trading, but really advice and practical points from the lips of one of the most successful traders peace.

The future diamond of the stock exchange world, Victor Niederhoffer, was born in Brooklyn in 1943. The family was the most ordinary, middle class, since his father was a respected policeman, and his mother was a teacher.

Ben Warwick Trading Strategy

In the Forex market, news trading is one of the most popular methods of market forecasting. It is based on the psychological reaction of the crowd to certain macroeconomic indicators, which reflects the state of affairs in the country’s economy. However, it is not only dry numbers that influence the market, but also political statements.

It is based on the psychological reaction of the crowd to certain macroeconomic indicators, which reflects the state of affairs in the country’s economy. However, it is not only dry numbers that influence the market, but also political statements.

For example, the latest statement by the British mayor about the prospect of Britain leaving the European Union forced investors to massively dump currency on the market, which caused the pound to collapse by two percent literally in a day.

Just imagine the power of fundamental analysis if it is applied promptly and correctly.

The President of Bacon Investment Corporation, better known to the general public as Ben Warwick, is one of the active traders who developed fundamental analysis as such, and his trading strategy and developments confirmed the importance of fundamental analysis and the impact of a number of news on market participants.