MACD Squeeze. An interesting hybrid based on trading zones for MT5.

Standard indicators for forex are not just classics of technical analysis that every trader should take into account, but also a huge field for creating new developments.

The most interesting thing is that sometimes standard forex indicators can be transformed in simply unimaginable ways, from their appearance to the very concept of creating an indicator.

However, if in most cases the modified versions can only boast of a beautiful appearance and, as a rule, unchanged logic, then in today’s article we will look at a fundamentally new MACD.

Which in appearance is practically no different from the standard one, but carries a completely different concept.

The MACD Squeeze indicator is a technical analysis tool that belongs to the group of trend oscillators and is an upgraded version of MACD for the MT5 trading terminal.

A notable feature of MACD Squeeze, which distinguishes it from the standard version, is the search for trading zones, within which the signals of the standard instrument become more accurate.

The tool itself is universal and can be used according to the same principles as MACD, which means that the indicator can be used on all currency pairs without exception.

It is also worth noting that MACD Squeeze is perfect for all traders who trade based on technical analysis, since the tool can be both a filter for your strategy and a signal tool.

The indicator can be safely used on absolutely any time frames.

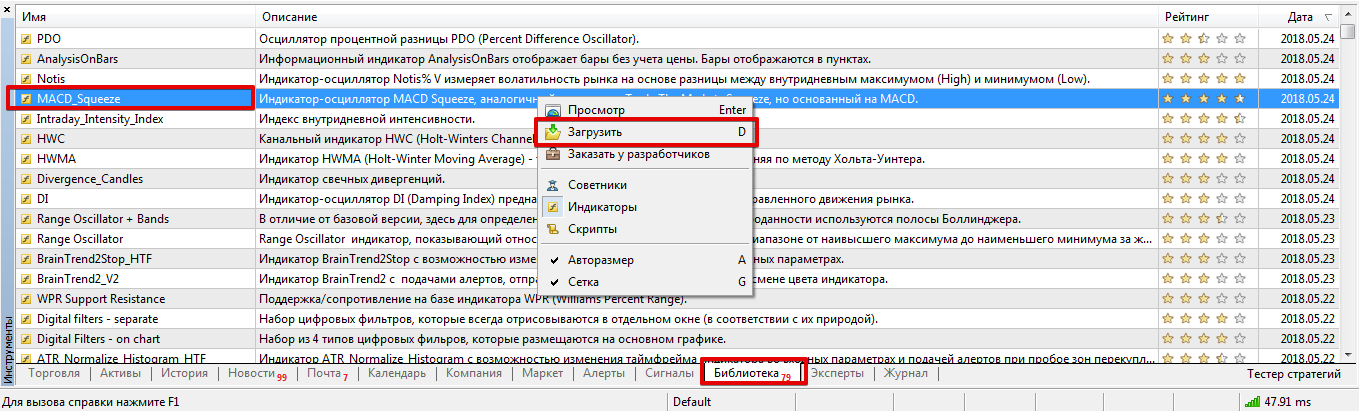

Installing MACD Squeeze in MT5

The idea of defining trading zones, within which the probability of a movement being processed becomes an order of magnitude higher, is far from new, but its implementation using the MACD indicator, and even for the MT5 trading terminal, became possible quite recently.

The indicator itself can rightfully be called a new product, since it was created in 2018. Since the tool has been hosted in the official MT5 developer library, you can not only use it for free, but also install it in two different ways.

The first installation method is to install through a library, and the second according to the standard scheme through the data directory.

If the installation through the library was unsuccessful, use the second method, namely, download the indicator file at the end of the article, and then place it in the appropriate folder of the MT5 data directory, namely in the folder called Indicators.

Regardless of how you installed the indicator, be sure to restart the trading terminal or update it in the “Navigator” panel so that the instrument appears in the list of custom indicators.

Application of the indicator.

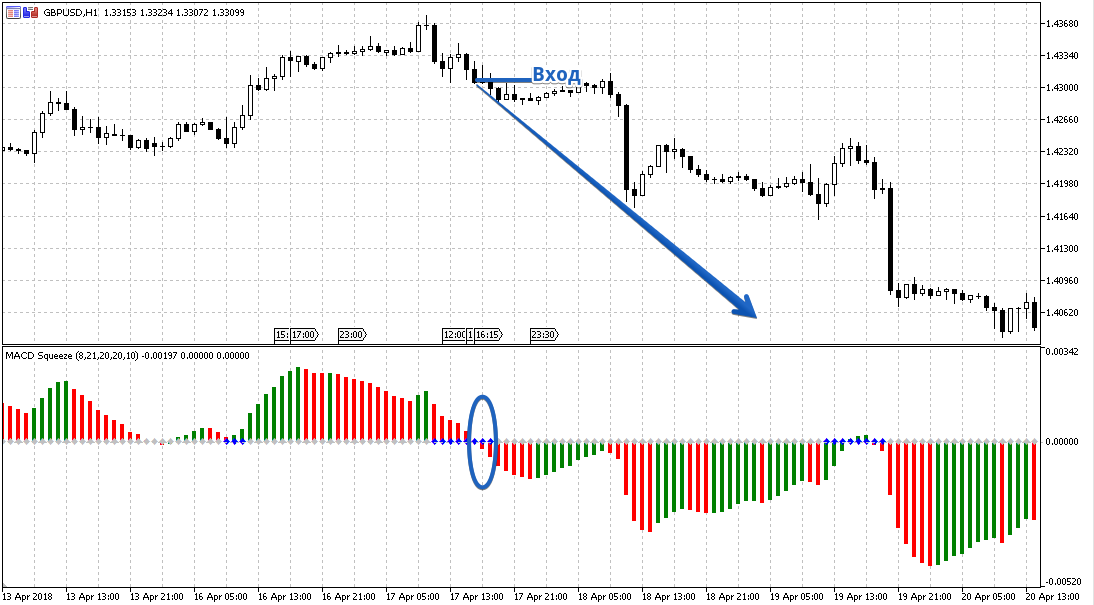

Settings After applying MACD Squeeze, you will be able to see a classic two-color histogram on your chart, which is practically no different from the standard MACD.

However, if you look in more detail, you will see diamonds of gray and blue color at the zero line.

Actually, blue diamonds indicate that an effective trading zone has been recorded in this market segment using Bollinger Bands and the Keltern Channel .

Gray diamonds indicate the absence of these zones. If we talk about methods of application, MACD Squeeze can be both a signal tool and used to filter unprofitable trades.

When using this indicator as a signal tool, a buy position should be opened only if the histogram crosses level 0 from bottom to top and there is a blue diamond.

To open a sell position, you must wait until the histogram crosses level 0 from top to bottom, as well as the simultaneous presence of a trading zone.

When using MACD Squeeze as a filter for your strategy, you need to look at the location of the histogram at the time the signal appears.

So, if the histogram is above level 0, only buy positions are considered, and if below level 0, only sell positions are considered.

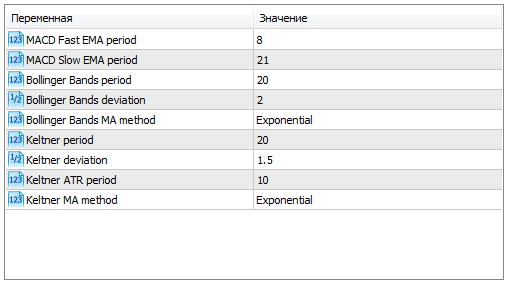

So in the variable MACD Fast EMA period and MACD Slow EMA period you can set the periods of the fast and slow moving average for calculating the MACD indicator.

The Keltner period and Keltner ATR period variables allow you to change the calculation period of the channel itself, as well as change the ATR volatility period.

The Bollinger Bands period and Bollinger Bands deviation variables allow you to change the period for calculating Bollinger Bands, as well as the size of the deviation from the average for constructing the bands.

In conclusion, it is worth noting that MACD Squeeze is an interesting mod of the standard MACD .

It allows you to filter out a huge number of false signals by introducing two channel tools into it. Download the MACD Squeeze indicator.