Is Volkswagen stock worth buying?

In recent years, Volkswagen shares have become something of a safe haven for investors. Consistent annual growth and relatively healthy dividends, reaching $2.50 per share, made investing in this asset so attractive that few major funds could resist holding a certain amount of the stock in their portfolios.

and relatively healthy dividends, reaching $2.50 per share, made investing in this asset so attractive that few major funds could resist holding a certain amount of the stock in their portfolios.

The German automobile concern has firmly established itself in the international automobile market thanks to the quality of its products and the relatively reasonable prices for cars of this class, so that various Japanese and American brands did not provide much competition.

Unfortunately, this idyll for investors did not last very long, and the recent decline and devaluation of shares by 50 percent became simply shock therapy.

You're probably wondering why this happened. If you haven't been following my news feed, I suggest you refresh your memory.

The stock's decline was caused by a simple violation of the law, or more accurately, a major, worldwide fraud. Volkswagen actively promoted its cars in the US market, claiming that diesel engines would reduce fuel costs, maintain maneuverability, and produce no more air pollution than conventional gasoline engines.

Such aggressive brand promotion and the claimed powertrain specifications simply couldn't ensure such low emissions. Therefore, American environmentalists decided to test the emissions of two of the most well-known brands, namely the Passat and the Jeta.

As it turns out, engineers installed special software that, when the car is parked, activates the filter and keeps readings within normal limits. However, when driving, emissions exceed the standard by 40 times.

This revelation led to US authorities suing the company for $18 billion, despite Volkswagen's average annual profit being $9.5 billion. The mere thought of the company having to operate without a profit for two years halved its stock market value.

Is Volkswagen stock worth buying?

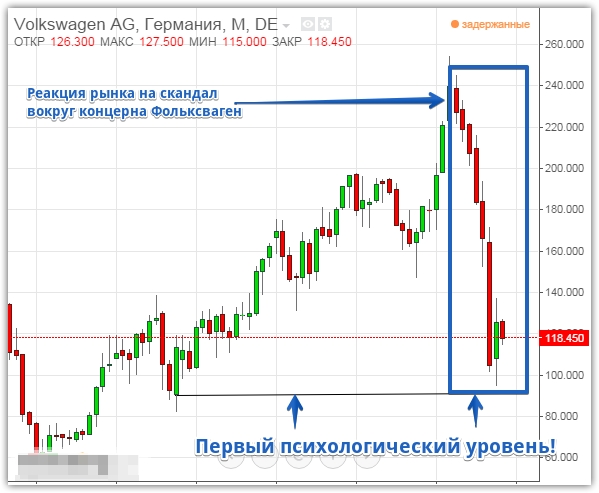

The sharp decline in stock prices has made them more accessible than ever. While the price of one share was recently $240, it's currently at $118. It's also worth noting that a psychological level has formed on the chart, from which the price has already bounced and slowed:

Despite the sharp decline in the share price, investing in Volkswagen remains a relatively profitable proposition. Let's assume that the US court's ruling forces Volkswagen to pay an $18 billion fine, and the share price declines further. However, it's important to remember that, with this stock price decline, market participants have already psychologically priced in the fact that Volkswagen will pay the fine.

Many fear the concern will collapse, but for such a large company, 18 billion is two years of work. It's also worth remembering that any reputable company has a safety net, and the penalties will be restructured over time, so the company won't have to pay such a huge sum in one lump sum. Therefore, the fear that the concern will close after all the lawsuits should be dismissed immediately.

It's also important to remember that Volkswagen pays a very large sum to the German budget, so the fine could be mitigated, and the scandal itself could be abated thanks to political support. Furthermore, it's worth noting that Volkswagen has the best legal representation worldwide, which could significantly reduce the penalties. Therefore, it's safe to say that the time has come to buy shares, despite all the risks involved.

What if the decline continues?

Of course, the US trial is only the first step in the scandal, as a US victory could trigger a string of lawsuits from European countries. Even South Korea has started talking about inspecting vehicles after the scandal. Therefore, if such a protracted case begins, it's necessary to hedge the risks .

You can do this by selling a Volkswagen CFD derivative in the same amount as you would if you bought the shares. This way, you'll limit your risks and, if the price declines further, you'll only profit from dividends. However, it's important to remember that when trading CFDs, it's important to choose a reputable broker with minimal commissions.