Gold price forecast for 2025 from leading analysts, what will the price of gold be in 2025?

At the end of January 2025, the price of gold was trading near $2,780 per troy ounce.

This means that over the past year (from the beginning of 2024 to January 2025), the metal has strengthened by more than 25-30% (considering that at the beginning of 2024 the price fluctuated around $2,100-2,200 per ounce).

However, during 2024, gold was unable to confidently overcome the psychological barrier of $3,000, although at some points the quotes came close to this level.

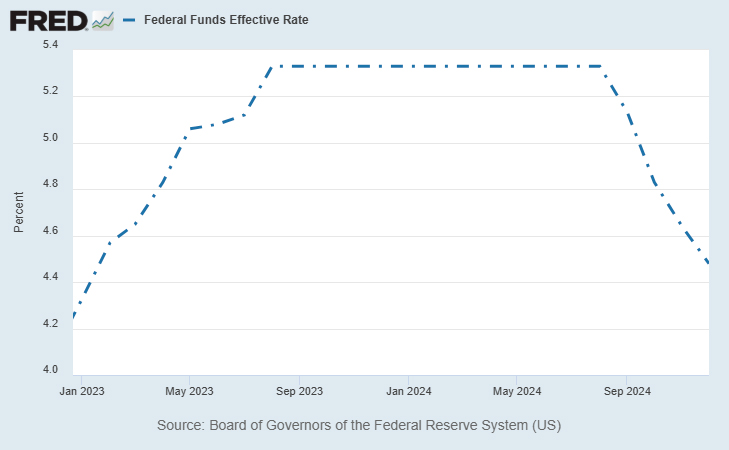

The main factors that held back the move toward historic highs were: the US Federal Reserve kept interest rates , shifting investors to bonds; the dollar periodically strengthened, hindering the rise in the price of the precious metal; stock markets rose, competing with gold; and central banks reduced their purchases.

Price forecasts from leading analytical agencies for 2025

Below is a summary table of gold price forecasts (USD per troy ounce ) from a number of major financial institutions and analytical agencies for the end of 2025. The data is based on reviews published in December 2024 – January 2025.

The values given are mid-range benchmarks; expectations may change as macroeconomic statistics are released and central bank policies change.

Key Factors Affecting the Price of Gold in 2025

Monetary policy of major central banks - If the Federal Reserve and the European Central Bank decide to cut rates in the second half of 2025, gold could receive an additional boost.

If rates remain high, gold will remain attractive as a hedge against systemic risks, but the potential for a sharp rise will be contained.

Inflation Expectations - Gold traditionally serves as a hedge against inflation. When inflation accelerates, demand for the metal increases. If inflation slows, some investors may choose alternative assets (bonds, stocks), but gold remains the primary focus as a reserve.

Geopolitical tensions - Any escalation of conflicts or global turbulence leads to increased demand for gold as a safe haven. A stable environment will allow gold to develop more smoothly, guided by monetary factors and the dollar's dynamics.

Central bank demand : If they continue their reserve accumulation policy in 2025, this will be a significant price driver. Reducing gold purchases or selling gold could exert significant pressure.

Is it worth buying gold in 2025?

In answering this question, I would immediately like to say - Gold is always worth buying, especially if you are making an investment for 5-10 years.

If you want to make money quickly, it is better to use trading through a broker .

Advantages - Gold remains one of the main tools for portfolio diversification and protection against unforeseen geopolitical and financial risks.

Risks - The possible continuation of tight monetary policy (high rates) and a strong dollar could temporarily slow gold's movement to new highs.

Taking into account forecasts from leading banks and the current price of around $2,780, gold could reach $3,000–$3,100 in 2025 under a favorable scenario.

The decision to buy depends on individual strategy, preparedness for a possible drawdown, and investment time horizon.

Thus, the gold price forecast for 2025 points to potential for further growth, but does not guarantee a surge to all-time highs without appropriate global triggers. Pay close attention to macroeconomic factors and monitor central bank policies, which largely determine the market conditions for precious metals.