The most popular blue-chip companies and whether these securities are worth buying

Blue chips are shares of the largest, most stable, and reliable companies. They are typically included in stock indices such as the S&P 500 in the US, the DAX in Germany, or the Nikkei 225 in Japan.

That is, if you want to determine whether the shares of the company you have chosen are blue chips, it is enough to check whether these securities are included in the main stock index of the country where the company is registered.

Blue chips are characterized by the following features:

Large market capitalization . Blue-chip companies have market capitalizations in the billions or even trillions of dollars.

High liquidity . Blue-chip stocks are easy to buy and sell on the stock exchange with minimal costs.

Low risk . Blue chips are considered relatively safe investments.

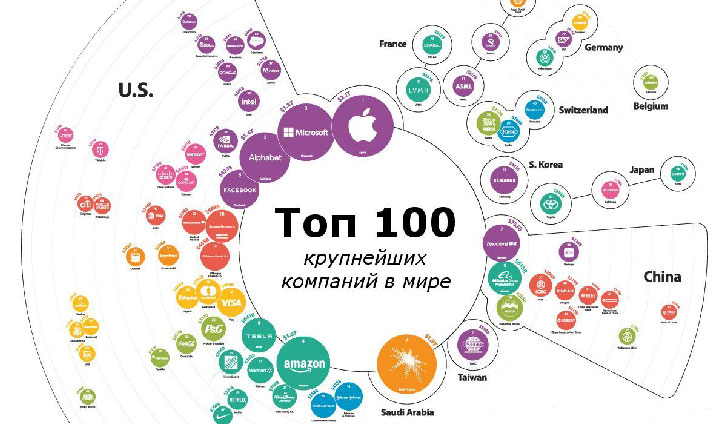

Examples of the most popular American blue chips

- **Apple Inc. (AAPL)** is an American technology company that manufactures iPhone, iPad, Mac, and other consumer electronics.

- **Microsoft Corporation (MSFT)** is one of the world leaders in software, including Windows operating systems and Office products.

- **Amazon.com, Inc. (AMZN)** is one of the world's largest online retailers with a wide range of services, including cloud computing (AWS).

- **Alphabet Inc. (GOOGL/GOOG)** is a holding company that includes Google, which provides various Internet services.

- **Berkshire Hathaway Inc. (BRK.A/BRK.B)** is a holding company controlled by Warren Buffett that owns a number of companies in various industries.

- **Johnson & Johnson (JNJ)** is a global company that manufactures medical devices, pharmaceuticals, and healthcare products.

- **JPMorgan Chase & Co. (JPM)** is one of the largest financial holding companies providing banking and financial services.

- **Visa Inc. (V)** is an international payment system and technology for electronic payments and transfers.

- **Procter & Gamble Co. (PG)** is a company that produces a wide range of consumer goods from household chemicals to cosmetics.

- **The Coca-Cola Company (KO)** is the world's largest producer of soft drinks and syrups.

- **Walmart Inc. (WMT)** is the largest retail chain of supermarkets and hypermarkets.

- **The Walt Disney Company (DIS)** is a media conglomerate that owns theme parks, film studios, television channels, and other entertainment assets.

- Nike, Inc. (NKE) is a global leader in the manufacture and sale of athletic footwear, apparel and equipment.

- **Pfizer Inc. (PFE)** is one of the largest pharmaceutical companies producing a wide range of medicines.

- **Intel Corporation (INTC)** is a manufacturer of semiconductors, including microprocessors for personal computers.

- **McDonald's Corporation (MCD)** is the world's largest fast-food restaurant chain.

- **3M Company (MMM)** is a diversified company that produces thousands of different products, from adhesive tapes to medical equipment.

- **Boeing Company (BA)** is one of the world's largest manufacturers of aviation, space and military equipment.

- **Goldman Sachs Group, Inc. (GS)** is one of the world's leading investment banks and financial conglomerates.

- **Exxon Mobil Corporation (XOM)** is an oil and gas giant engaged in the exploration, production, refining, and sale of oil and gas.

Please note that the list of blue chip stocks may change over time, and stock popularity may vary depending on market conditions, corporate events, and other factors.

These stocks are typically included in major indices such as the S&P 500 in the US and are considered relatively safe investments.

Is it worth buying American blue chips today?

There's no single answer to this question. It all depends on your goals and investment horizon.

On the one hand, American blue-chip stocks are generally considered relatively safe investments. They generate consistent profits and pay stable dividends. Therefore, they can be a good option for investors looking to preserve capital and receive regular income.

On the other hand, these securities have lost value in recent months. This is due to a number of factors related to high inflation, rising interest rates, and geopolitical instability. Therefore, American blue chips may now be a riskier investment than in the past.

In the long term, the shares of these companies will most likely rise in price, but this will happen after the 2024 US elections.

Currently, US stocks are quite volatile , making them more suitable for short-term speculation rather than long-term investment. For long-term investments, it's better to consider the Indian or Japanese stock markets.

Stock trading brokers - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka